The New Zealand dollar, known as the Kiwi, surged Wednesday as the central bank delivered another rate increase.

RBNZ continues in monetary policy tightening

The Reserve Bank of New Zealand unexpectedly lifted its policy rate from 4.75%to 5.25%. That was the eleventh consecutive rate increase since the cycle began in October 2021.

The RBNZ maintained its assessment that a rate rise of this magnitude is necessary to bring inflation to the 1-3% target range over the medium term. At this meeting, the committee considered 25 and 50 basis point hikes. As a result, inflation is still viewed as excessively high and persistent, although employment has reached its maximum sustainable level.

You may also like: Markets turned red with recession fears getting stronger

The fourth quarter’s economic growth was weaker than anticipated, but economic capacity constraints are loosening. Nonetheless, demand continues to outpace supply, creating considerably inflationary pressure. Moreover, although the economy is predicted to stagnate in 2023, activity will continue to be supported by reconstruction efforts following recent weather catastrophes, with resource demand expected to contribute more than anticipated to inflation.

Together with an increase in deposit rates, the Committee finds that maintaining the existing level of lending rates for consumers and enterprises is required to attain the inflation objective.

As a result, the 2-year government yield increased by 12 basis points to 4.7%. Nonetheless, markets expect a greater than 50% possibility for a final rate increase this summer. In February, this was the RBNZ’s basic scenario.

While the hawkish RBNZ steps can be connected to the NZD/USD pair’s recent rally, it is essential not to overlook the broad-based US dollar decline when noting the positive factors for the pair.

Another interesting topic: Financial sector stumbles, investors eye Dimon and El-Erian comments

US JOLTS Job Openings sank to the lowest levels since May 2021, flashing a 9.931 million figure for February compared to the 10.4 million projected and 10.563 million revised before. This was a huge negative for the US dollar. In the same spirit, US Factory Orders for February came in at -0.7% monthly compared to -0.5% predicted and -2.0% negative revision to the prior month.

Fed done with rate hikes soon

President of the Federal Reserve Bank of Cleveland, Loretta Mester, stated on Tuesday that the central bank is expected to execute more rate hikes, with the Fed funds rate climbing over 5%.

Dont miss: Hacker returns $200 million after stealing it from Euler Finance

In March, the Fed raised interest rates by a quarter percentage point to a range between 4.75% and 5%. This might suggest that there will be just one more increase of 25 basis points before a pause.

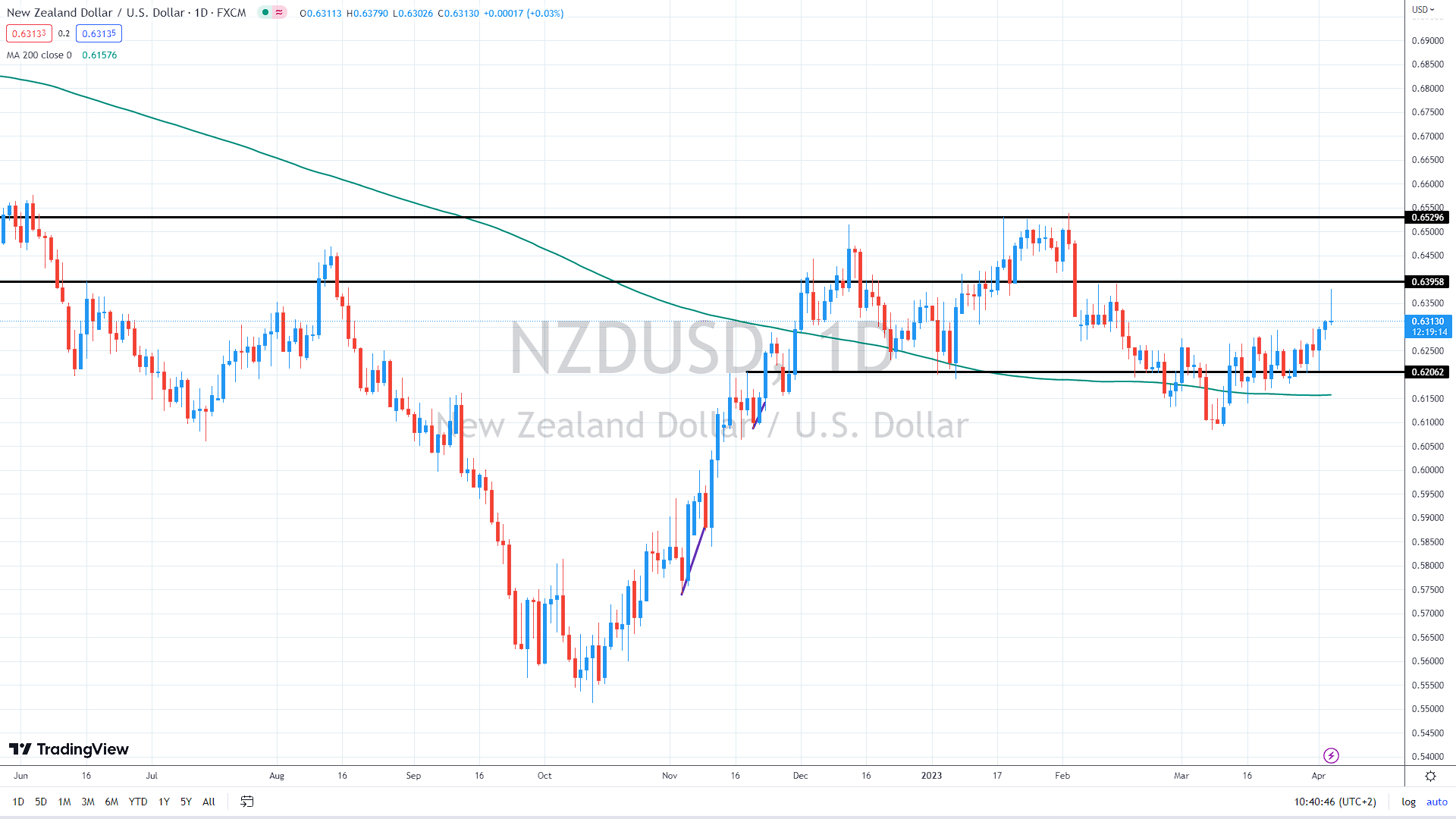

The next resistance is expected near 0.64, and if the NZD jumps above it, it could quickly rise to the previous cycle highs near 0.6530. On the downside, the support is near 0.62, followed by the 200-day moving average (the green line) near 0.6150.

NZD/USD daily chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.