The NZD/USD pair, also known as the kiwi, has remained above the previous highs near 0.6470 as the anti-dollar mood remains intact.

NZD macro updates eyed

During the Asian session, the New Zealand ANZ activity outlook for January improved notably, rising from -25.6 to -15.8 but still remaining in negative territory. Furthermore, the ANZ business confidence also rose markedly, hitting -52 from -70.2 in December.

Earlier this week, in the December quarter, annual inflation in New Zealand reached 7.2%, exceeding market forecasts of a 7.1% increase but falling short of the Reserve Bank of New Zealand’s prediction of 7.5%.

You may also read: Hindenburg shorts Adani Group, firm of the third richest man on planet

Nonetheless, this strengthened prospects for less aggressive interest rate increases in the coming months. After a record 0.75% increase in November, there is an expectation for a modest 0.5% increase in February.

The upcoming New Zealand labor market statistics for the fourth quarter (due out the following week) will be used to track pay growth. Analysts at ANZ Bank believe that the RBNZ will have a little more room to slow the pace of Official Cash Rate (OCR) rises if these wage spirals moderate, as the central bank determines an acceptable level for the OCR at which the MPC can “watch, worry, and wait” comfortably. As a result, they anticipate a 0.5% increase in February and a top of 5.25%.

A barrage of US data

Before the weekend, market players will eagerly monitor the Personal Consumption Expenditures (PCE) Price Index data from the United States.

According to estimates from Reuters, the markets foresee the core PCE inflation, which excludes volatile food and energy costs, to increase by 0.3% on a monthly basis and to decrease to 4.4% from 4.7% in November.

Likewise, the CPI inflation data released earlier this month decreased to 5.7% from 6% in December. Accordingly, a low PCE inflation estimate shouldn’t be a major shock. In addition, after the CPI report, the markets have priced in a less vigorous Federal Reserve policy tightening, currently only 2x 25 bps of tightening at the central bank’s next two meetings.

In addition to Pending Home Sales and the University of Michigan’s Consumer Sentiment Index (final) for January, the US economic agenda will also include Personal Spending and Personal Income numbers for December.

Lastly, the US Bureau of Economic Analysis announced Thursday that the economy expanded at an annual pace of 2.9% in the fourth quarter. Although this result was smaller than the 3.2% growth reported in the previous quarter, it exceeded the market’s forecast of 2.6% growth.

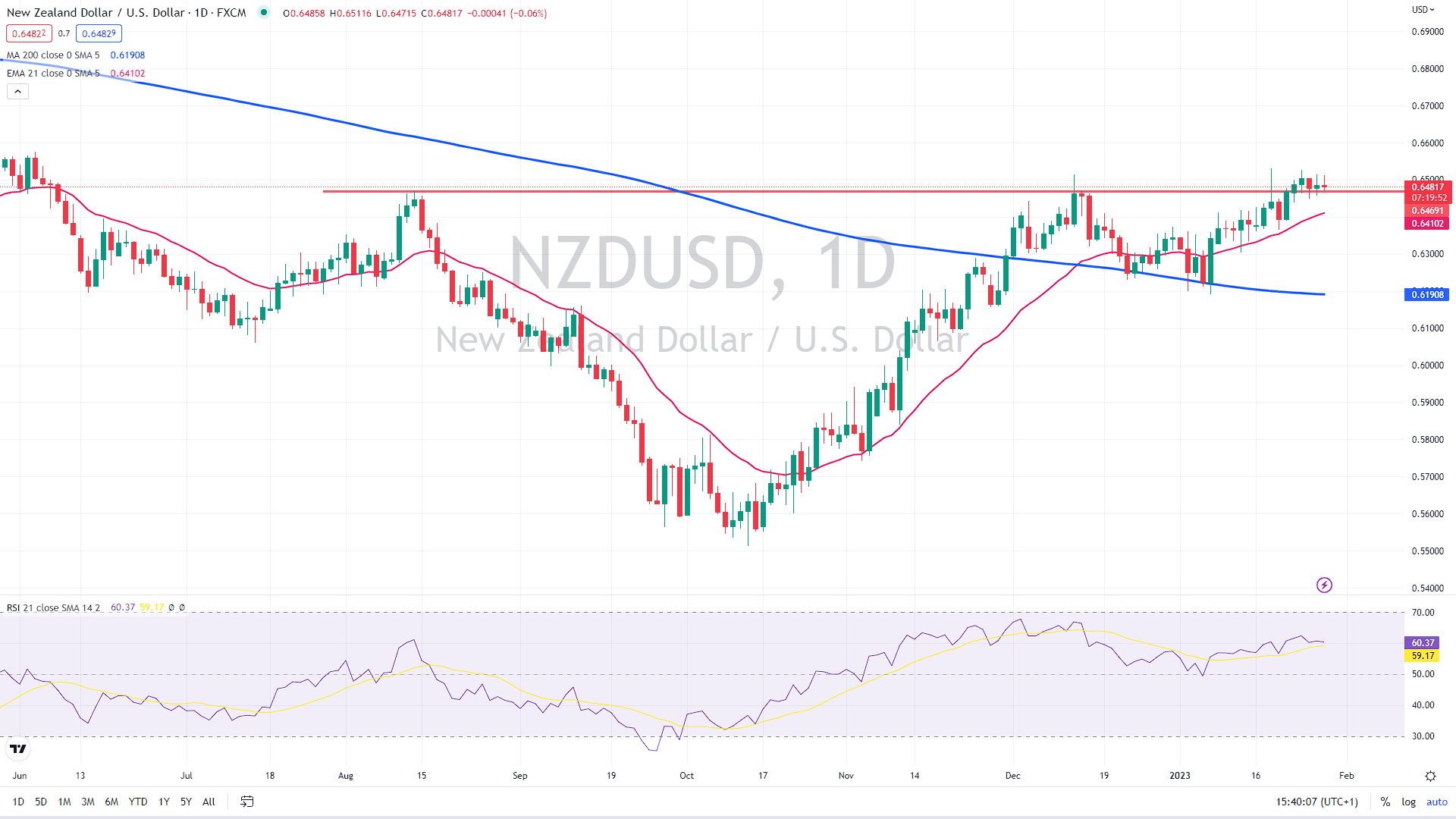

NZD/USD daily chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.