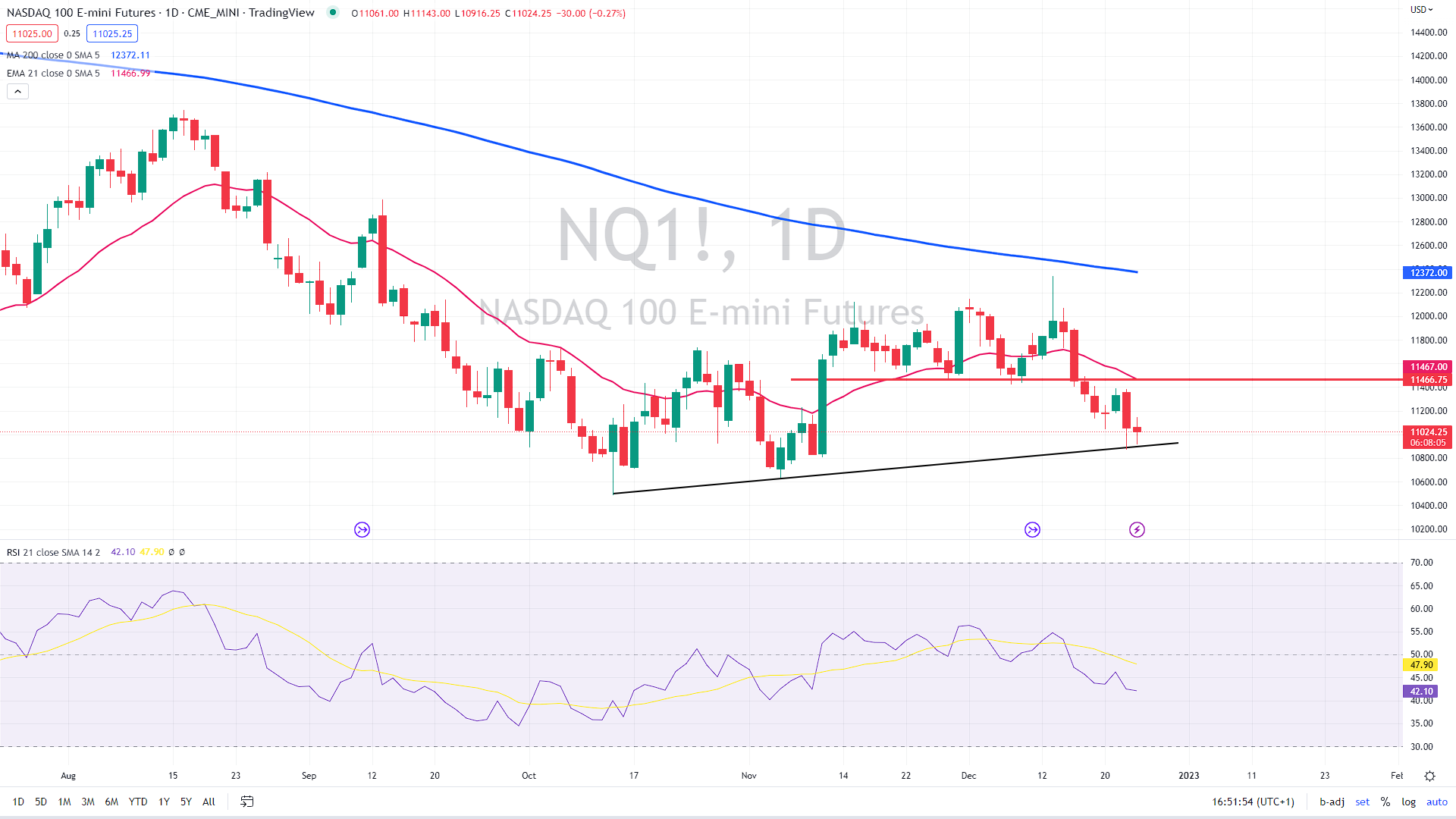

The tech-heavy Nasdaq 100 index has defended a significant trend line support (so far), erasing today’s 1% losses and trying to turn positive during the US session.

US durable goods disappoint

In preliminary November data released today, US Durable Goods Orders fell 2.1% month-over-month (significantly worse than the 1.0% decrease anticipated). This represents the worst MoM decline since the COVID lockdowns and the poorest YoY increase since February 2021.

Non-defense aircraft and parts decreased by 36.4%, and defense aircraft and parts decreased by 8.6%. The exports of non-defense capital goods, excluding airplanes, directly factored into GDP estimates, decreased by 0.1%.

You may also read: Holidays are coming – when are markets open?

Increasing economic unpredictability and quick Fed rate rises are reflected in dwindling CAPEX plans, indicating an impending recession.

Inflation remains hot

In addition, the Fed’s preferred inflation gauge, Core PCE Deflator, was somewhat hotter than anticipated in November (+4.7% YoY vs. +4.4% predicted); the monthly basis remained unchanged at +0.2% following an upward revision for October.

This is lower than the 4.8% predicted by the FOMC in its December predictions.

Simply said, for the FOMC’s estimate to be realized, December’s PCE would need to increase substantially (which most analysts see as highly unlikely).

In other words, the Fed will be pushed to acknowledge that inflation is decreasing more quickly than anticipated, which is inherently dovish given their “higher for longer” story.

“The Federal Reserve’s preferred measure of inflation continues to go down, which is good news for their most important objective, but unfortunately for the market, it is happening at the same time as consumers continue to reduce their spending,” Independent Advisor Alliance Chief Investment Officer Chris Zaccarelli said in a note.

Moreover, according to the University of Michigan, the 1-year inflation outlook fell from 4.6% flash to 4.4% final (from 4.9% in November)… the lowest level since June 2021.

Another interesting topic: FedEx defends gains after encouraging earnings report

Lastly, Friday’s report from the US Census Bureau and the Department of Housing and Urban Development revealed that sales of new single-family homes increased by 5.8% in November to a seasonally adjusted annual rate of 640,000.

This number followed October’s growth of 8.2% and was far better than the market’s projection of a 4.7% decline.

As previously mentioned, the key support, for now, is near $10,880, and if not held, the short-term outlook could change to bearish during the rest of the year, negating the Santa Claus rally.

On the other hand, the resistance is at previous lows near $11,450, and the index must climb above it to cancel the current bearish momentum.

Nasdaq futures daily chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.