The importance of Money management

Money management (MM) is one of the most important settings in trading or investing. The portfolio is profitable not only from successful trades, but from the system of how these trades are managed. Because trading and investing can never be 100%, they also bring losses. And this ratio between wins and losses needs to be set. The interesting fact is that in almost every book related to trading and investing, the MM section is at the end. Beginners in trading and investing see the profitability of trades right in the middle of the book and do not think about risks. For example consecutive losses, which happen daily.

Read more about: If Celsius fails, whole market will follow

The table you have to know

It is good to ask yourself how big positions you open. What is your % target? 1,2 or 10%? And what is your % target for your loss? Do you have any stop-loss? One of the biggest mistakes people do in markets is not setting a stop-loss (highest acceptable loss for your trade).

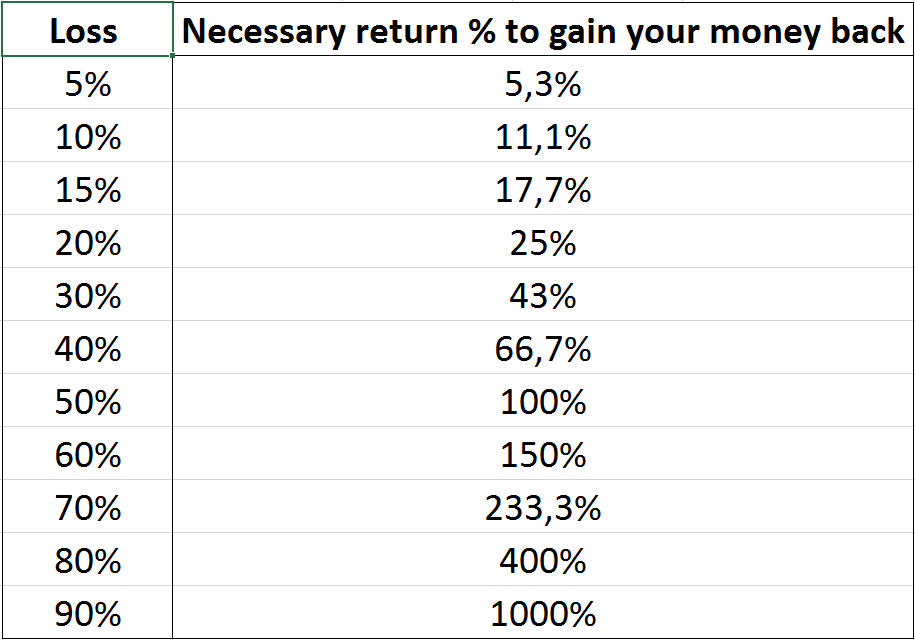

The human psychology does not like losses and another big mistake is telling yourself that “the market has to turn back”. Well, it does not have to. Or it will turn back but much later and at a lower level. In the moment of the reversal, it will be without you because your account is wiped out, mostly because of your bad MM. Here is the table which shows how profitable the trader needs to be to erase previous losses.

The problem of losses. Source: Author´s analysis

This table shows the importance of setting MM for a portfolio and trades. It is very easy to reach a loss of -20% or -30% because people believe that it has to turn back to green numbers. But, what if it does not? Are we able to achieve 43% profitability to gain what we lost? Well, it is quite hard to be this profitable. If it was easy, all of us are multimillionaires. But this is only one of many parts of successful MM.

Comments

Post has no comment yet.