The Meta stock jumped slightly ahead of the US opening bell on Friday. However, it still remains in a violent bearish trend as investors remain unimpressed by the Meta’s fundamental transition from a social media platform to a virtual reality company.

J.P. Morgans lifts its outlook

J.P. Morgan upgraded Facebook’s parent company Meta Platforms on the belief that expenses are getting under control, income should begin to increase, and the present value is attractive.

Analysts led by Doug Anmuth upgraded the stock’s recommendation from Neutral to Overweight and raised the target price by $35 to $115. After investing billions in unprofitable virtual reality platforms, the company’s stock has declined by almost 65% this year, far more than the S&P 500 and the technology-heavy Nasdaq.

Here are the five factors that contributed to Anmuth’s Meta upgrade:

1) Improved management oversight of overall spending and capital expenditures.

2) Lessening the effect of Apple iOS privacy changes on sales.

3) The firm will be able to compete with TikTok more successfully.

4) The monetization of reels may gain traction and become “at least” neutral to sales by the end of 2023.

5) The stock’s valuation is “compelling” following the sharp 2022 decline.

“Heading into 2023, we believe some of these top and bottom line pressures will ease, and most importantly, Meta is showing encouraging signs of increasing cost discipline, we believe with more to come,” Anmuth said.

Cost cutting and layoffs in 2023

In the first significant round of layoffs under CEO Mark Zuckerberg, Meta announced in November that it would lay off around 11,000 employees, or 12.5% of its worldwide workforce.

The group expects hiring to slow “dramatically” in the coming months, according to Meta CFO Dave Wehner, who told investors on October 26 that the group’s overall headcount — estimated at 87,000 — will remain “roughly flat next year relative to current levels… with new hiring investment only in our highest priorities.”

You may also like: Donald Trump sold out his NFT collection worth $4.5 million

The move occurred just weeks after Facebook confirmed plans to “powerfully” increase financing in Reality Labs, the division that will house the company’s metaverse plans. Reality Labs has absorbed more than $9.4 billion in losses during the first nine months of the year, as the social media conglomerate continues to transition away from its Facebook roots.

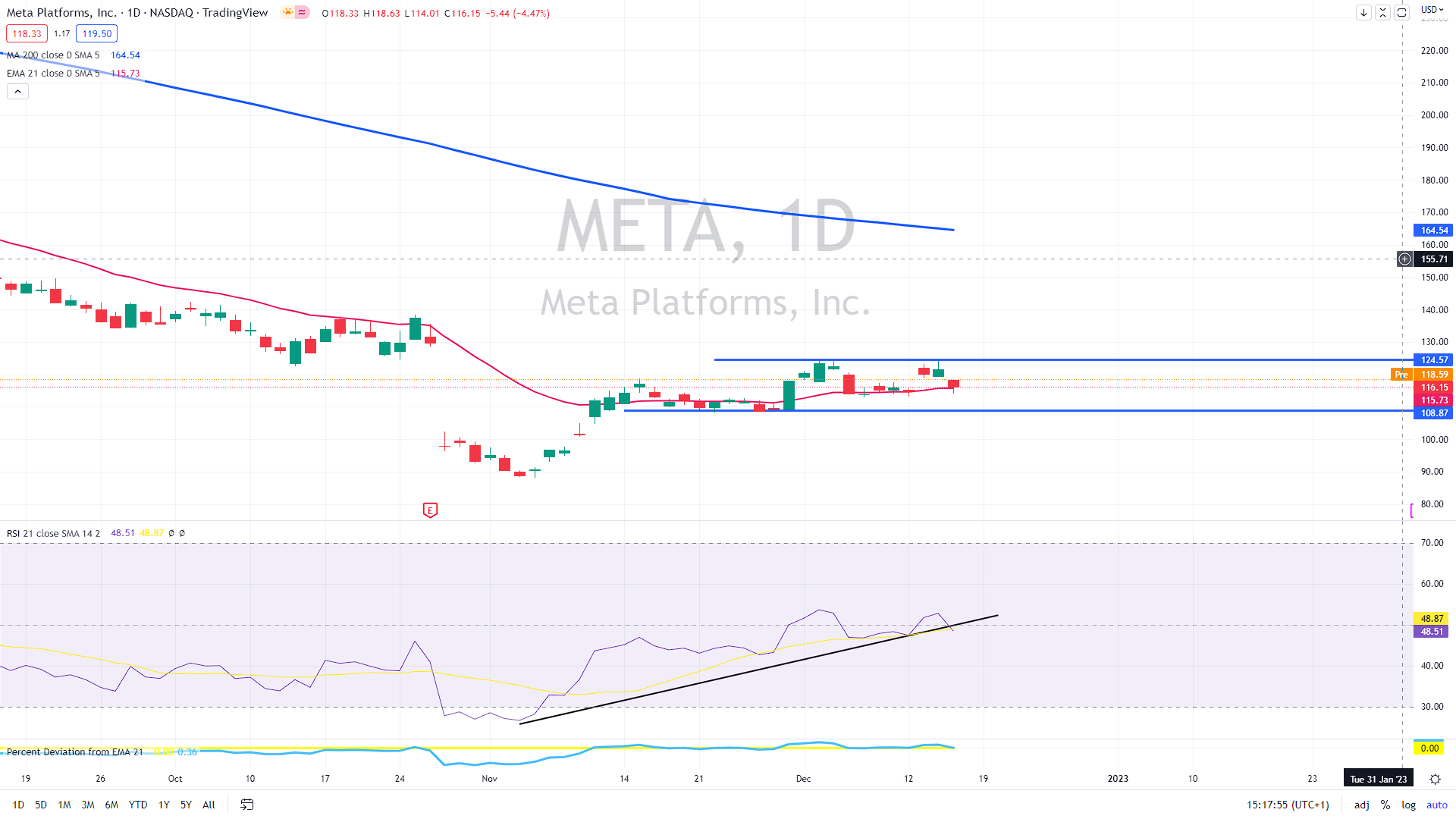

The next resistance could be at previous swing highs of $125, but the ongoing negative sentiment in the markets could drag the stock price further down, targeting the $108 support.

Meta daily chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.