Fears of a recession drive down the stock market

Tuesday saw a decline in stock prices on Wall Street as signs of a slowing economy increased concerns that the Fed’s efforts to control inflation may trigger a severe slowdown.

All three of the main stock indices were down, as data revealed that manufacturing orders fell for a second consecutive month and that job openings in the United States fell to their lowest level in almost two years in February. This is possibly indicating a cooling of the labor market. Data from Monday also suggested that American manufacturing output was declining.

Also interesting: How to invest $100,000? Read this before you do so

S&P 500, down 0.56%. The Dow Jones turned out lower by 0.65%, while the Nasdaq dropped 0.47%. The tech-heavy Nasdaq and the S&P 500 have risen by almost 7% and 16%, correspondingly, so far in 2023.

Jaime Dimon, CEO of JPMorgan Chase & Co, cautioned shareholders in a letter that the US financial crisis is still going on. He also expressed that its effects will last for years. Bank stocks suffered after this statement. Bank of America and Wells Fargo & Co both saw declines of more than 2%.

The US dollar keeps falling

Trader’s expectations that the Fed would pause its tightening cycle, pushed the EUR/USD above the 1.0900 level for the second day in a row. Recently, speculators have increased the likelihood of a Fed halt at the May meeting from 43% to 57%. Investors expect two rate drops by the end of the year, with a 43% possibility of a 25 bps rate increase.

As a result of the widespread US dollar weakening, the EUR/USD increased from 1.0886 to 1.0973, its daily high, and also its highest level since February, before settling at close to 1.0947.

More to read: Hacker returns $200 million after stealing it from Euler Finance

The US dollar Index, which measures the value of a group of six different currencies against the greenback, declined 0.41% to 101.628. The Sterling increased in value against the dollar to a new 10-month high.

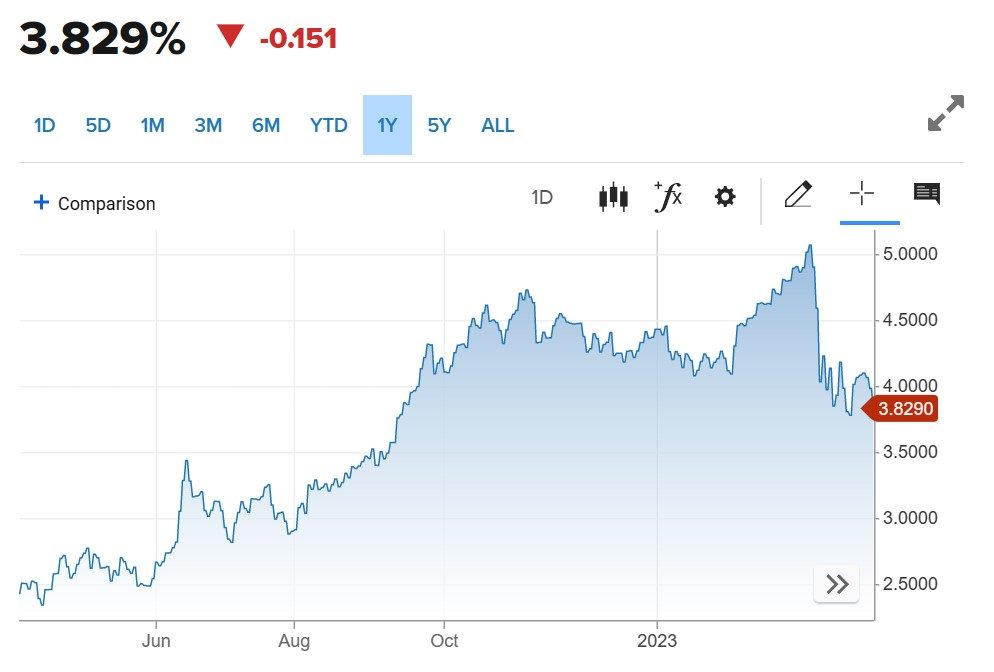

The two-year Treasury yield, which often reflects forecasts for interest rates, fell 12 bps to 3.86%. Two-year rates fell by roughly 74 basis points in March, the most since January 2008. The Reserve Bank of Australia (RBA), as anticipated, kept its cash rate constant at 3.6%, ending a run of 10 consecutive increases, and the Aussie was last down 0.6%. The dollar also decreased by 0.6% to 131.635 against the Japanese yen.

US 2-year treasury yield chart, source: CNBC

Oil holding on to huge gains

Just one day after OPEC+ declared its second output reduction in four months, recession fears placed pressure on crude. The buyers, however, insisted that the crudes not finish in the red.

WTI ended the session at $80.71, up 0.4%. WTI increased 6.3% on Monday as the US oil standard increased 25% since reaching 15-month lows of $64.12 on March 20th.

Following a daily top of $86.44, Brent oil ended the day at $84.94, an increase of just one cent. On Monday, Brent saw a 6.5% increase.

Following a session high of $2,043.25, gold for June delivery closed at $2,038.20 per ounce, up $37.80 or 1.9%. Thus, gold upheld its promise of being a safe haven. Silver’s May contract solidified its price above $25 with a 4.7% gain, closing at $25.157.

Comments

Post has no comment yet.