Lebanon, a 6-million-people country in Western Asia, has just devalued its national currency by 90%. For people having their whole portfolio or retirement in Lebanese pounds (LBP) this could be fatal.

The exchange rate is officially changed

Wednesday marked the first time in 25 years that Lebanon has devalued its official exchange rate. The 90% devaluation left the local currency significantly undervalued. Lebanon is known for being corrupted, recklessly spending, and mismanaged by the country’s government.

Also read: Wage increases are the highest in decades – is the economy in danger?

As a result, the country’s currency, the pound (also called the lira), went into deep trouble in 2019 and the country’s poverty rate continued to rise. After decades of being linked at 1,507 pounds to the dollar, the currency has been depegged.

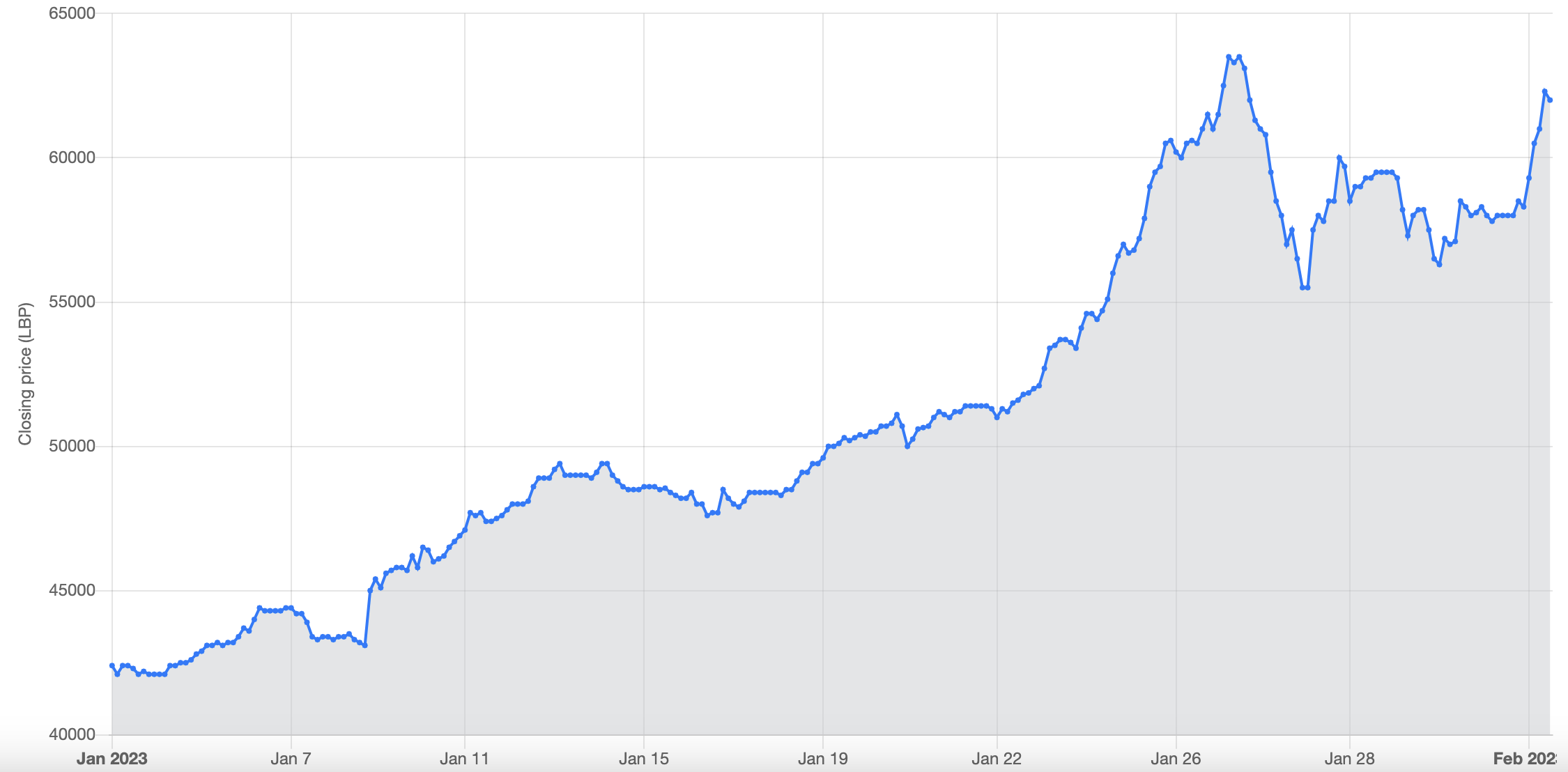

Now the central bank certified the new official rate of 15,000. You won’t see it on forex websites like xe.com, yet, but it’s a reality. The Lebanese central bank explained this shift is necessary due to an array of rates. The rate was allegedly 38,000 or even 60,000 on the parallel market.

This drastic devaluation should unify several exchange rates. Citizens have also been limited to withdrawals from ATMs, which is a common problem in other countries like Nigeria as well. This caused Bitcoin to rise 60% in price against Nigerian local currency.

Bitcoin and other cryptocurrencies could also save Lebanese inhabitants from losing any more money. This direct devaluation of the Lebanese national currency will allegedly also lead to a reduction in the equity of banks too. While the “official peg” is 15,000, it is running above 60,000 as we speak.

Lebanese pound (LBP) chart, source: lbprate.com

Lebanon is in big trouble

The country hasn’t done anything about its monetary policy since 2019, which led to this event. Lebanon clearly failed to hold its peg which got the country into one of the largest financial crises ever seen.

Read more: Usain Bolt lost $12 million to a scam – do not repeat his mistake

Ordinary citizens see their wealth being eaten by inflation and taxes, leading to increased poverty. Several other developing countries are struggling due to high inflation. These countries, including Turkey, Nigeria, Venezuela could potentially end up in a similar catastrophe.

Comments

Post has no comment yet.