Housing prices increased due to higher demand for larger homes sparked by the pandemic and extremely low interest rates. However, now that central banks have begun hiking interest rates to combat inflation, the housing market might be in trouble.

The lack of resale home inventory and rising loan rates make it more difficult for purchasers to make a move, which is hurting the real estate market. Moreover, bankruptcies of mortgage lenders might be additional elements aggravating an already unstable market.

Housing market indicators show steep declines

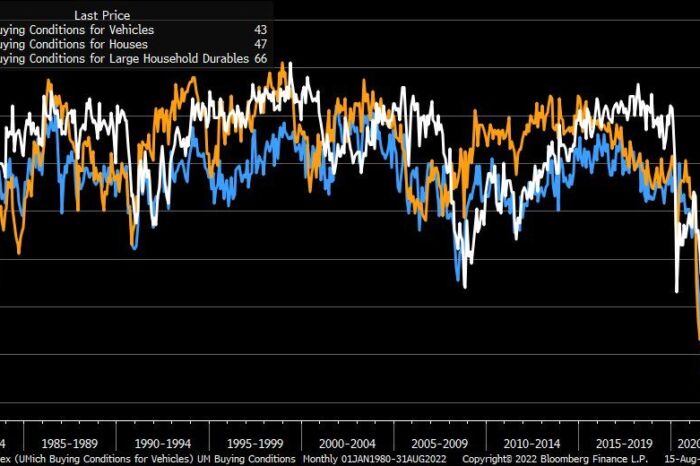

While the EU and US unemployment rates are low, other indicators show the economy is already slowing down. For example, the confidence of consumers to buy vehicles, houses and large household durables is hitting 40-year lows, which leads to a significant cooldown in the housing market.

The average price of a single-family home in the US with a mortgage guaranteed by Fannie Mae and Freddie Mac increased by just 0.1% from the previous month in June 2022. However, this indicator shows a substantial decline when looking just a few months back. Regarding Q2, home prices increased 4% from the first quarter of 2022 and 17.7% from a year earlier.

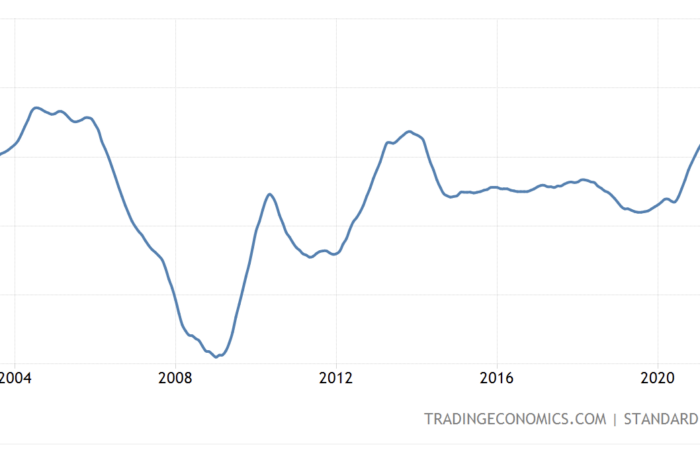

The S&P CoreLogic Case-Shiller home price index, which tracks changes in residential real estate prices across 20 US metropolitan areas, rose 18.6% year over year in June 2022. This was the smallest gain in six months and far less than estimates of 19.5%. This price index reached levels higher than before the 2008 crisis, and it is already falling.

Read more: US restricts chip exports to China

As Fed raises interest rates and the macroeconomic environment remains challenging, mortgage financing has become more expensive, increasing the possibility that home prices will continue to decline.

The lowest interest rates in decades allowed the creation of tons of mortgage companies. However, many mortgage firms may go broke now that rates move back up. This was the situation in 2008, and there is a risk it might be happening again soon. For example, the mortgage rate for a 15-year loan in the US one year ago was 2.17%, which rose to 4.85% this week. This number is expected to grow even more, if Fed keeps a hawkish stance.

The housing market might drag the economy into recession, and the American economy is fundamentally dependent on real estate. According to the NAHB, housing activity actually contributes 15% to 18% of the nation’s GDP each year. So naturally, the rest of the economy suffers when this industry has a slowdown. Every recession since the end of World War II has been caused by a fall in home construction and purchases.

The US is not the only country experiencing trouble in its housing market. The nation’s largest developer by sales, Country Garden Holdings, reported first-half earnings fell 96%, the most since its 2007 Hong Kong IPO, due to China’s real estate crisis possibly spreading worldwide.

You may also read: Crypto exchange founder arrested for $100m fraud

Rents have risen in 25 of the EU’s 27 countries since 2010, but the increase has not been so sharp. Rent increases across Europe will only exacerbate the strain that inflation, energy crisis, and other factors have already put on family finances. For example, the price of electricity in Germany recently hit 1,000 € but already fell by more than 50% in just a few days.

Conclusion

While high inflation and interest rates may be the start of a recession, the falling housing market could trigger even more significant market turbulence. Moreover, until central banks do not tame inflation to stable levels, they won’t stop hiking interest rates, and as a result, it will only prolong the ongoing crisis.

Comments

Post has no comment yet.