Scams are a serious problem everywhere. It’s essential to be cautious at all times, especially when it comes to investing money. With the rise of the internet, scams have become increasingly common. It can be challenging to differentiate between legitimate opportunities and fraudulent schemes.

After all, even Bernie Madoff or FTX’s Sam-Bankman Fried once looked like legitimate businessmen. You may never be fully sure about your decision, so, in this article, we will discuss how to spot a scam by paying attention to red flags.

Guaranteed profit

One of the most common red flags in a scam is the promise of guaranteed profit. This is the most obvious one! No legitimate investment opportunity can guarantee a profit, and any claim otherwise should be viewed with skepticism.

If a company is making promises of high returns with little or no risk, it’s most likely a scam. They want the investors to believe this fairytale, so acting with logic is the key, not acting based on emotions. Many people fall prey to these types of schemes because they are attracted to the idea of making a quick buck without putting in any effort.

Also read: These 5 celebrities lost millions to scams

In most cases, this ends with a fiasco. Nevertheless, it’s essential to remember that there are no shortcuts to wealth. Legitimate investments come with risks, and any company that guarantees profit is likely hiding something.

No team behind the project revealed

Another red flag to look out for is a lack of transparency about the team behind the project. Any legitimate investment opportunity should have a team of experienced professionals with a track record of success. If a company is not forthcoming about who is behind the project, it’s a major red flag.

⚠️ The arrival of #Ordinals (Bitcoin & Litecoin NFTs) attracts a lot of scammers.

For example, one cryptocurrency called "Ordinal Chain" has been recently listed on CoinMarketCap.

1/5 🧵 Why is it a scam ? 99% chance we're right.

— Investro.com (@investrocom) February 21, 2023

This is very common in the crypto market. Some meme tokens or other kinds of cryptocurrency projects may look good, but there is no team shown on the website, which is why there is a 99% chance that it’s a scam. Be aware of this.

Investors should be able to research the backgrounds of the team members, including their education, experience, and credentials. If a company refuses to provide this information or if the team members have questionable backgrounds, it’s best to steer clear.

Pressure to invest immediately

Sales pressure, source: simpsonsecurity.com

Scammers often use high-pressure sales tactics to get investors to part with their money quickly. If a company is pushing for an immediate investment without appropriate time to do the due diligence, it’s a major red flag. Legitimate investment opportunities should allow investors to take their time to review the materials and make informed decisions.

Scammers may try to create a sense of urgency by telling investors that they will miss out on a great opportunity if they don’t act quickly. They may also use fear tactics, such as warning investors that the opportunity will not be available for long.

However, it’s important to remember that legitimate investments will still be available after reviewing the materials. For instance, investors who want to invest in stocks or stock indices should feel free to have several weeks to do their own research. Don’t fall for the fear of missing out (FOMO).

Unsolicited investment offers

Be wary of unsolicited investment offers, especially those that come via email or social media. Most people know they are outright scams, but some might be smarter than one thinks. Scammers often use these channels to reach out to potential victims, offering them an opportunity to make a quick profit.

It could even be a “Nigerian Prince” writing an email, directly to the victim, to loan him just $20,000, and he will return a fortune back. Yes, some people fall for these kinds of fraudulent schemes. However, legitimate investment opportunities are rarely advertised through these channels.

Upon receiving an unsolicited investment offer, investors should always do the research before investing any money. Check the company’s website and social media profiles to see if they are legitimate. Investors can also search for reviews or complaints online to see if other investors have had any issues.

Lack of regulation or licensing

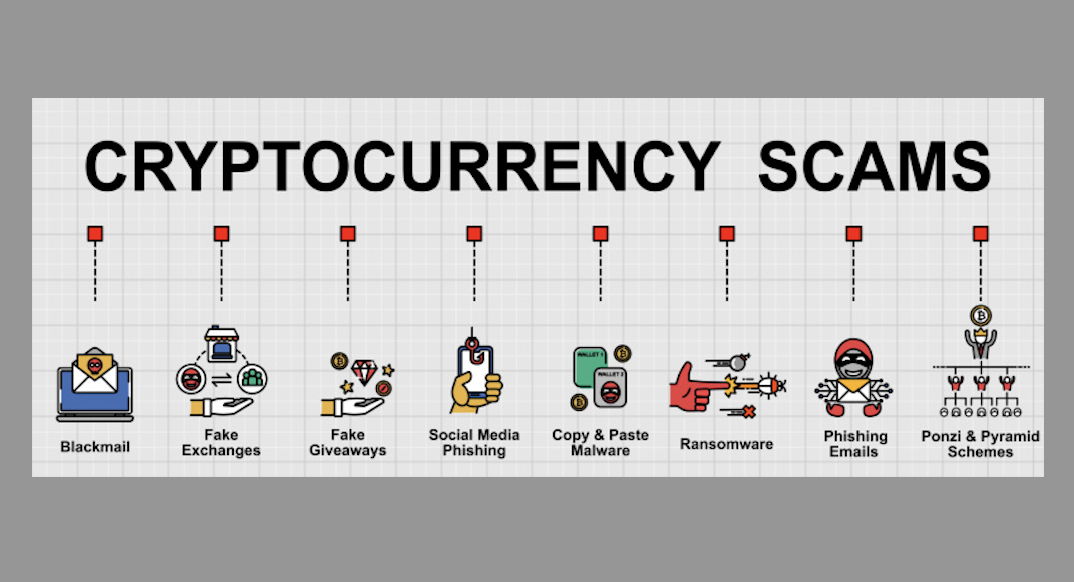

Common scams in the crypto space, source: shutterstock.com

Legitimate investment opportunities are typically regulated and licensed by government agencies. Scammers often operate outside of these regulations, which means they are not held to the same standards as legitimate investment opportunities.

If a company is not regulated or licensed, it’s a major red flag. This is why scams in the crypto space are so widespread. There is a lack of regulation. Scammers use this to launch tens of tokens, if not hundreds, on a daily basis. They are mostly a simple copy-paste of Binance Smart Chain code to create tokens, advertise their fake project, and then simply dump their holdings.

Read more: What is the difference between trading and investing?

Investors should research the regulatory requirements for the type of investment they are considering and verify that the company meets those requirements. If a company is not registered with the appropriate regulatory agencies, it’s best to stay away.

Requests for personal information

Scammers often use requests for personal information as a way to steal identities or commit other types of fraud. If a company is asking for personal information, such as Social Security number, bank account information, or other sensitive data, it’s a major red flag.

Legitimate investment opportunities should not require to provide sensitive information upfront. If the investor is asked this information, they should verify that it is legitimate before sharing any personal data. Never feel rushed to do any financial decision that is supposed to be long-term investment.

Bottom line

Scams can happen to anyone. It’s essential to be cautious and vigilant when investing money. By recognizing the red flags mentioned above, one can protect themselves from fraudulent schemes and make informed investment decisions.

Remember, if an investment opportunity sounds too good to be true, it probably is. Legitimate investments are risky, with no guarantees of profit. Always do the due diligence before investing any money and take the time to research the company along with the team behind the project.

If you do fall victim to a scam, report it to the appropriate authorities immediately. The faster you act, the more likely you are to recover your funds, while also preventing others from falling prey to the same scam. Stay safe and always trust your instincts when it comes to investing your money.

Comments

Post has no comment yet.