Bank of England – necessary move which led to capitulation

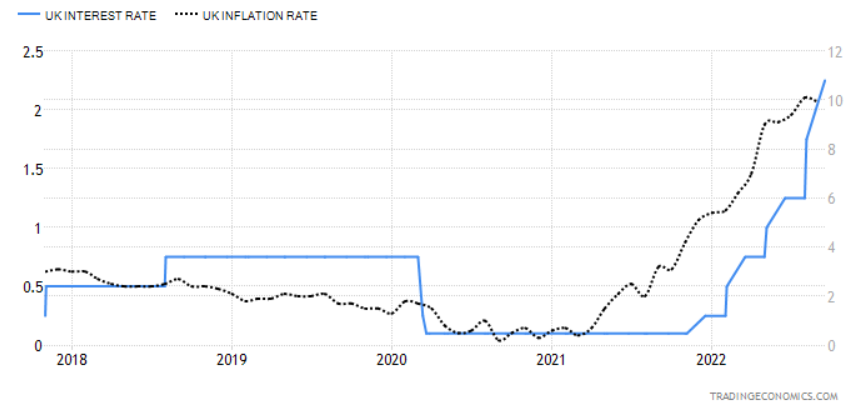

With a brief story, we would like to explain what happened in the UK. Firstly, in a very clear manner, we need to say that the BoE was really hawkish in terms of hiking rates to fight inflation. But the pace of the hike was quite excessive and fast enough with a target to reduce the demand side of inflation. At the last meeting in September, the BoE hiked the main rate to 2.25%.

Read also: OPEC has significantly increased its oil production

The issue is that while the central bank played on a very hawkish note, the UK fiscal side did everything the other way. Yes, it is also understandable because they wanted to ease the pressures on households via tax cuts. But that was a clear message for the market, that it would be another fiscal stimulus, which could lead to higher inflation and a higher reaction from the central bank.

Interest rates and CPI YoY (in %) in UK, Source: Tradingeconomics

The yields reacted very aggressively to such a political move, and the bond market priced in further rate hikes to follow. Then BOE needed to step in. The outcome of a story below is fully described by the great @RobertPeston. This text of BoE is paraphrased by that author:

“The price drop triggered a liquidity problem for £1.5 trillion in liability-driven investment funds, of which £1 trillion was invested in gilts and other bonds. When they acquire gilts, they often use them as collateral to obtain cash (in the repo market), then use the cash to buy more gilts, then pledge the gilts again and buy more gilts, and so on.”

When the value of the collateral declines, as it did with the slump in gilt prices, the funds must find cash to repay their loans (or liabilities) or pledge new collateral. Pressure requiring them to sell additional gilts and other assets might jeopardize their solvency and the solvency of other institutions investing in gilts (and other assets).

It caused market chaos. Liability-driven investment funds (LDIs) were held by final salary pension systems to match their responsibilities to millions of retirees with future income from these assets. The immediate concern was that these pension funds would go bankrupt because their obligations to LDIs would exceed their assets. The Bank of England needed to step in urgently. The reason for buying these gilts is to raise their price, giving LDIs time to sell assets so that the re-pricing doesn’t cause a market massacre. It has worked.

GB20Y, Source: Tradingview

The pension regulator assesses a pension scheme’s liabilities by discounting the future cash value of pensioner payments (which are connected to gilt yields). When the gilt yield increases, the present value of such liabilities falls. The Great Paradox Lack of capital or liquidity could cause the crash of pension funds at the end of the day. Pension funds should be stronger after being bailed out by the Bank of England with public money. Fiscal policymakers are still responsible for an unnecessary disaster.

Read our previous bullish thesis: Weekly macro report – It’s time to be a contrarian

Without the fiscal stimulus of policymakers, the Bank of England wouldn’t have had to step in with £65bn. The issue is that a state needs to manage the energy crisis and needs to spend plenty of money to do that. The main impact could be seen on gilts (bonds) with longer maturities, and the Bank of England has stated that they will purchase maturities of 20 years or more. The reaction was massive – from more than 5% to 4%.

The ECB may follow the suit

The Bank of England provided market participants with a clear indication of what can happen if monetary policymakers are too aggressive on the one hand (in the case of speed), with a combination of fiscal easing on the other. The UK currently has a 95.9% debt to GDP ratio (2021). As in the case of lack of liquidity in the market, it makes no sense to create another and deeper deficit. The reason why we are saying this is that the situation in EA (Europe) is similar, if not more complicated.

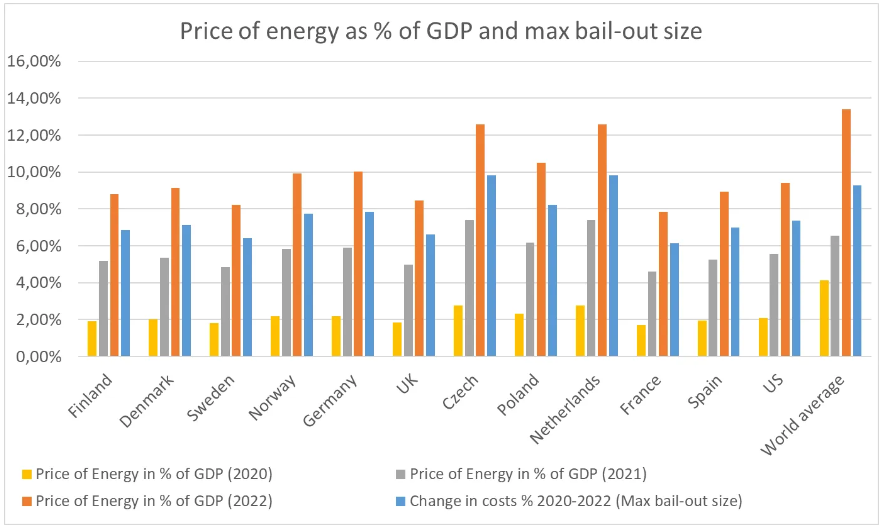

The Europeans are just a little bit more lucky, because the ECB did not act so aggressively, yet. And also, bear in mind that despite the end of QE, the ECB still reinvested matured securities in that way, meaning that they let mature German bunds and bought Italian bonds to slightly impact the spread (to lower it). Look at the great chart by @AndreasSteno, which reveals the price of energy as a percentage of GDP. The issue is that, in our view, such prices will cause budget deficits in many countries, which need to be somehow financed. The bond market faced solid drawdowns, as the front-end of the yield curve priced in additional rate hikes by the ECB.

Price of energy as % of GDP and max bail-out size, Source: Andreas Steno Larsen

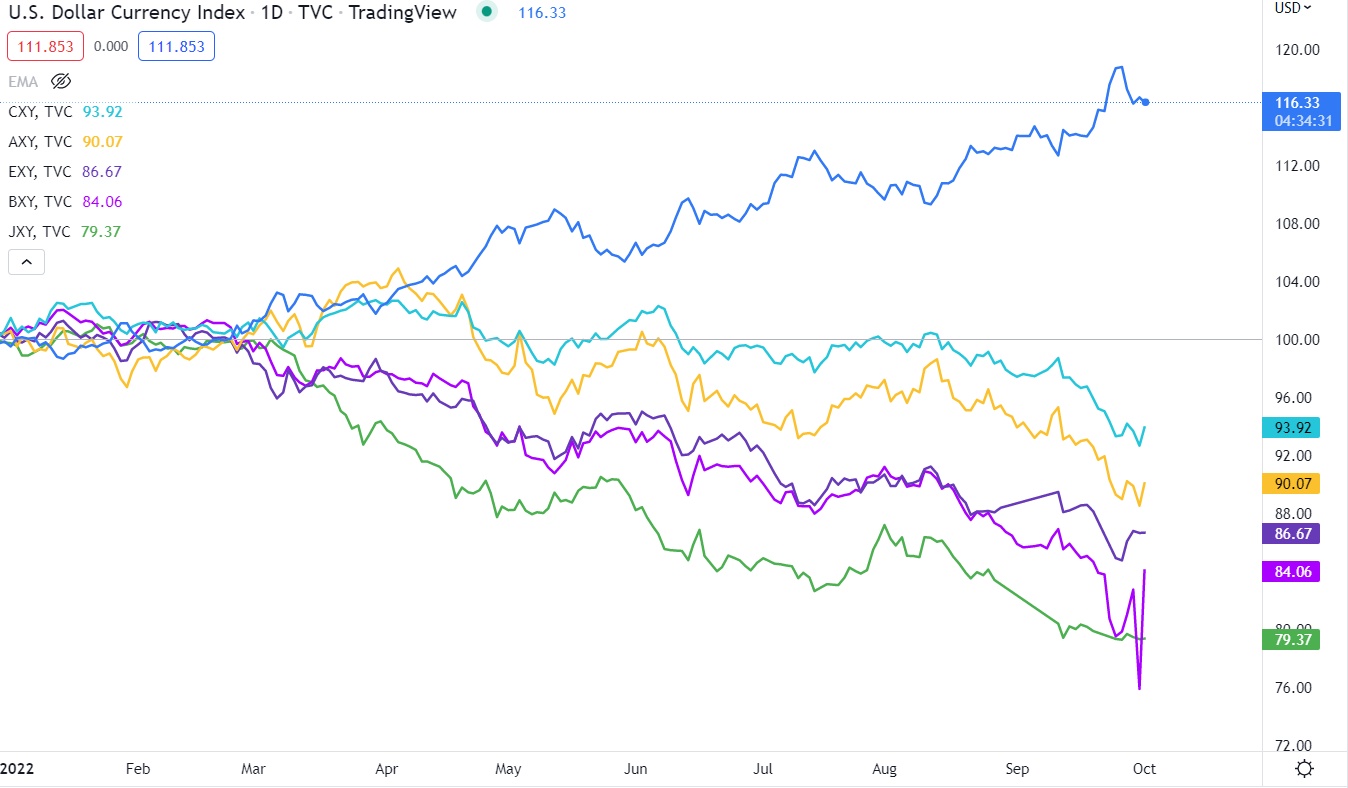

The ECB’s justified rate hikes pressures must be maintained in order to restore stability to the currency markets. Just look at how the Euro index and GBP index dropped. Almost every currency dropped in relation to the US Dollar. However, in the last few days, we spotted a reversal.

However, most of the inflation in Europe is caused by the supply side. But it is also true that supply-side inflation is too high and the outcome is also secondary inflation. Back to energy prices. Governments around the Euroarea try to bailout many companies as well as households with different schemes.

Currencies, Source: Investro analytics team via Tradingview

Once again, it could lead to higher deficits. And without additional liquidity by the ECB, there could be a lack of demand for private money. We believe that the risks of such an outcome from the ECB (similar to what we saw from the BoE) are very similar if the yield surge continues. It hasn’t been long since the ECB attempted to calm yields with a lengthy intervention about fragmentation risks. However, it is not a strategy to rely on the ECB’s capitulation; it is good to have it in mind. Furthermore, the BoE intervention put an end to the aggressive rise in yields in every major market-the US, the UK, and Europe. The market just needed the trigger.

Trading ideas with limited risk

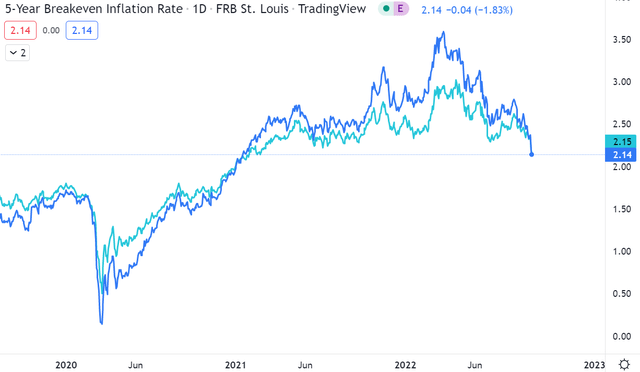

One of the reasons why we see great improvements in inflation projections is the change in the medium-term outlook for 5Y and 10Y breakeven inflation rates. This data is slightly delayed and based on the day-ago closing price. It will be slightly lifted today because the breakeven inflation rate is in some manner impacted by oil spot prices (20-30%), which surged today by 3-4%.

However, the thesis’s path is that, as a result of monetary tightening, medium and long-term inflation expectations are falling. It’s a key tool for the FOMC in the case of setting monetary policy. So the big point here is that we saw a big improvement in the change of market expectations in medium-term inflation from early 2022.

5Y and 10Y Breakeven Inflation Rate, Source: Investro analytics team via Tradingview

The Fed wants to get under control of short-term expectations and core inflation. But the risk here is that the FOMC can overshoot monetary policy if it is too tight. Despite further hiking, the market is currently pricing in a strong tightening cycle from the Fed. Additional hikes (ones which the market currently does not expect) would probably impact the short end of the yield curve.

It’s because, in our opinion, it would cause even greater medium-term damage, which would increase the odds of recession even more, and thus the market would price in slower economic growth. And that is a great mana for bonds with medium and long-term maturities (mainly).

However, we mixed US and European macros because they are partially linked in the event of rates peak, despite the fact that the eurozone has higher inflation pressures, which are primarily driven by supply-side factors. In both scenarios, we consider inflation-protected bonds (accumulating coupons) a very good opportunity with limited risk. As in the US case (ticker IDTP), the duration is more significant and the bonds are more volatile, which is why we saw a strong selloff in this section.

However, European inflation-linked government bonds – ticker IBCI – seem a little bit safer, as there are no such big duration risks. The coupon is affected by inflation and accumulates in price in both cases. If the yields in Europe and the USA continue the trend of reversal, we would see a solid upward move in both bond ETFs. At the chart we can see the indexed results from 2007. The long-term trend is clear because the price includes coupon payments that have already been made. When yields go down in Europe and the US, the prices of both bond ETFs will go up even more.

IBCE and IDTP – inflation protected bonds, Source: Investro analytics team via Tradingview

Although we published a bullish view on the S&P 500 previous week, we include another table that discusses seasonality when we look at tech stocks. Bear in mind that October is one of the most bullish months for stocks and that September is one of the most negative.

QQQ seasonality, Source: @gurgavin via Bloomberg

Comments

Post has no comment yet.