Fed fears have traders on the edge

The S&P 500 continued to decline on Friday, keeping it on track for perhaps the worst week of the year. The Fed’s favorite inflation gauge, the core PCE indicator, rose 4.7% year over year in January, above economic predictions of 4.2%.

Wall Street was red across the board, as inflation data fuelled worries that the Federal Reserve may become more aggressive. The S&P 500 decreased 0.93%, the Dow Jones lost 0.91%, or 273 points, and the Nasdaq closed 1.6% in the red.

More to read: TOP 10 dividend stocks

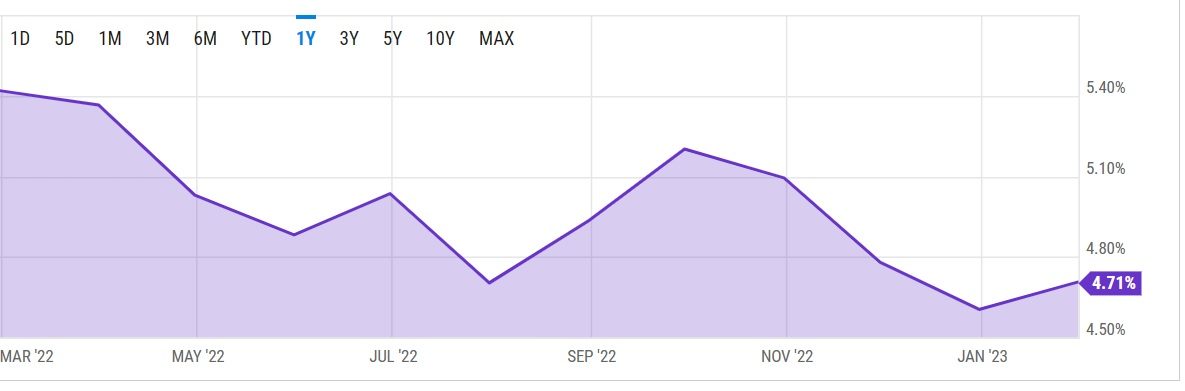

The scorching inflation reading is heightening anticipation that the Fed may have to raise rates by a greater amount than previously anticipated. Following the release of the data, Treasury rates extended their recent advances.

Core PCE YoY chart, source: ycharts.com

The 10-year Treasury return edging closer to the 4% threshold, triggering a sell-off in rate-sensitive industries such as technology. Alphabet, the parent company of Google, Microsoft, and Apple were down around 2%.

US dollar keeps getting stronger with hiking fears

After US data, EUR/USD came under strong negative pressure and plummeted to a new 2023 bottom below 1.0550. The US dollar index, which measures the greenbacks strength against 6 major rivals rose 0.61% to post a green week close at 105.18.

You may also like: How to invest in real estate

AUD/USD closed in the red 1.19% and USD/JPY 1.28% in the green. GBP/USD also closing down 0.58%, solidifying the US dollar as victorious among major pairs.

Crude ignores the fundaments

Oil bulls converted a negative week into a flat close by sticking to an unconfirmed claim about Russia’s planned production cutbacks. This drove oil prices higher for a second day, despite the US inflation statistics.

WTI, crude for April delivery rose 93 cents, or 1.2%, to $76.32 a barrel. After the reversal, however, the benchmark for US crude oil concluded the week only 2 cents down, virtually flat.

Also interesting: Nvidia skyrockets higher amid AI news, earnings and Biden’s plans

Brent futures for April delivery rose 95 cents, or 1.2%, to $83.16 per barrel. Brent fell $1.12 per barrel earlier in the day. The UK crude increased by 13 cents for the week, finishing practically even.

Finally, gold futures closed 0.48% in the red at $1818. Silver extended the loss below the $21 mark closing at $20.760.

Comments

Post has no comment yet.