Amid all craziness in markets, many projects started to fail. As Terra Luna failed and drew the whole crypto market with it, another project called Celsius Network is also on the brink of failure. Will it survive?

Celsius Network collapse explained

Recently, Bitcoin tumbled to $20,000, an all-time high from 2017. That caused many investors to dump their positions in altcoins, specifically Celsius. Amongst all the selloffs, Celsius, a crypto loan provider, has halted withdrawals for its customers, raising concerns about market contagion. Will Celsius and the whole market survive these dark times?

Related blog: What can happen if BTC holds USD 20k?

Many factors amplify the fall of the whole crypto market, including raging inflation, a falling stock market, a possible recession, etc. In the midst of all the chaos, Celsius created even more fear by pausing all client’s withdrawals. While all their clients wait until they can withdraw their funds, Bitcoin touched the $20,000 mark several times over the past few days and now even breached it lower. Celsius is definitely adding fuel to the fire at the moment.

Alex Mashinsky, the CEO of Celsius, said the following in his tweet on June 15:

“Celsius team is working non-stop. We’re focused on your concerns and thankful to have heard from so many. To see you come together is a clear sign our community is the strongest in the world. This is a difficult moment; your patience and support mean the world to us.”

Terra vs Celsius

This situation is definitely similar to the one of Terra Luna, however, there are several differentiating factors.

- The fall of Terra Luna took only few days until the cryptocurrency went down by 99.99%, basically all the way to zero. On the other hand, Celsius fell gradually with the whole crypto market over the last year by 97%, and they had the power to stop this sell-off by halting the withdrawals. Is this the right thing to do? While many investors think Celsius is a DeFi coin, this is a proof it is not a decentralized finance project. If a project is DeFi-oriented, no one can stop its withdrawals or influence it in similar ways.

- Terra Luna did not stop investors from selling their positions and traders from shorting the hell out of the token. However, Celsius did, and it helped the price of the token to stabilize although it’s currently down around 92% from its all-time high.

- Terra Luna is known for connecting its stablecoin (UST) to its Luna coin, building a hefty $50 billion Ponzi cryptocurrency. Celsius is a crypto lender, meaning it didn’t create a Ponzi scheme, but it was predestined to fail as it becomes more complicated to pay out profits to customers when the whole market turns upside down.

Important facts about Celsius

With over 1.7 million clients, Celsius advertises to its consumers that the platform may provide an 18% average yearly return. Celsius is where users deposit their cryptocurrency. After that, the crypto is leased to institutions and other investors. As a result of the revenue earned by Celsius, users receive a certain yield. Or at least that’s how it worked until now. Unfortunately, the current bear market is hurting Celsius and similar crypto companies more than ever before.

Coinbase suffers as well: Coinbase will lay off due to worse market situation

Three Arrows Capital deep in water

Three Arrows Capital, or 3AC, is a $5+ billion hedge fund, existing for more than 10 years. 3AC is actually one of the most significant funds in the cryptocurrency space. They held many high-risk crypto assets, mainly borrowed from almost every major crypto lender, including Celsius, Nexo, BlockFi, and others. This caused a domino-effect collapse that started with Bitcoin falling by only around 50%. When the problems arose, the cofounder tweeted:

We are in the process of communicating with relevant parties and fully committed to working this out

— 朱溯 🐂 (@zhusu) June 15, 2022

Fears of a potential collapse grew at the start of this week as there was no central bank to step in and supply liquidity as a lender of last resort—anathema to crypto supporters who value decentralization. This could further draw the prizes of all cryptocurrencies in a downwards spiral as bad news knows no end at the moment. If you’re a Celsius holder, check out their publicly available FAQ that should help you get the answers you need.

.@CelsiusNetwork is working around the clock to respond to customers' questions. Please find our FAQ here. https://t.co/cHZ6QxdMI2

— Celsius (@CelsiusNetwork) June 16, 2022

Conclusion

Crypto markets fall as hard as they rise. There has been an astonishing bull run for almost 2 years, and some coins saw 100x returns or even more. It is only natural that a 90% or 99% fall comes later on. However, the situation now is worse than ever before. No bearish cycle in the crypto market had to cope with rising inflation, interest rates, and such a bearish sentiment.

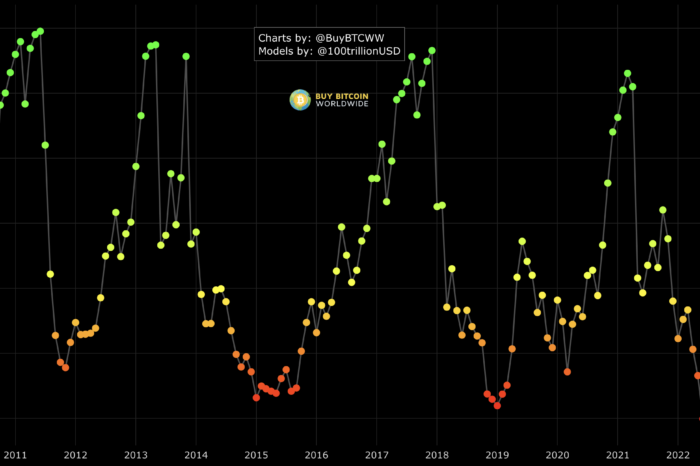

If Celsius fails, another domino fall will come, which will probably bring Bitcoin under 2017’s all-time high level, causing many other projects to fail. However, since that already happened, what can come next? In that case, markets should be ready to skyrocket in the upcoming months because it’s already the most oversold in history according to the relative strength index (RSI).

Comments

Post has no comment yet.