Suspicious volatility of bullion

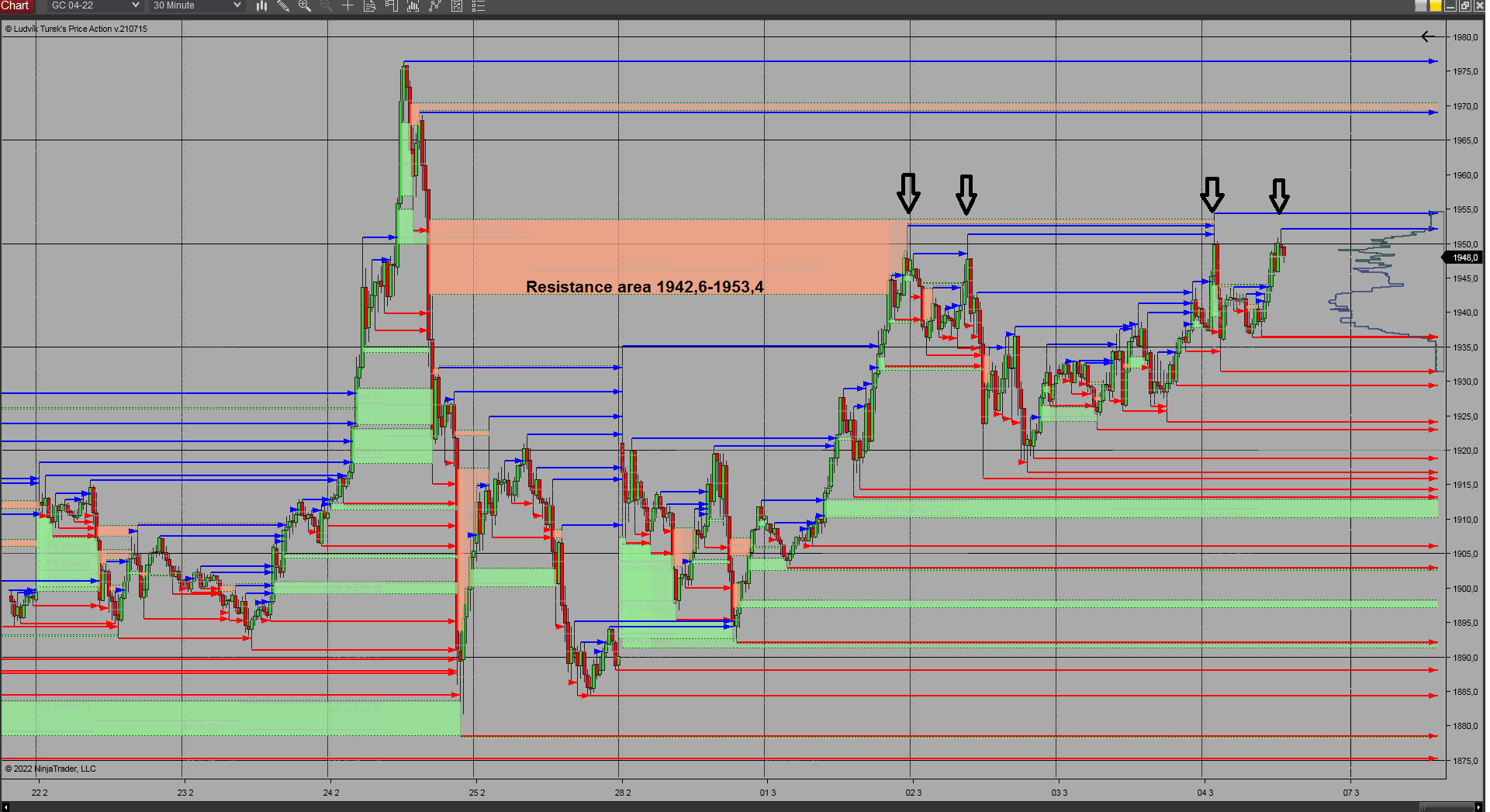

It is convenient to start with the chart exploration. In the previous article Gold, War and FED we added technical analysis of gold, where resistance area 1942.6 – 1953.4 is highlighted.

Upper level of resistance area worked for whole week. Despite the bigger escalation in conflict every time price hit the level, gold reverted and fell down. According to Citigroup Inc.:

“From the Falkland Islands War in 1982 to the Sept. 11 attacks, price spikes in gold resulting from crises that include military action or terrorist strikes tend to be temporary.”

This means that it really depends how long this crisis will last. The question is, what factor can affect the price of bullion against trading sentiment?

Common sense

Formula is that crisis sparks safe havens, ergo the price of gold should go up. Well, in some point this formula works. It is seen on long term charts, where the appreciation of gold is considerable. But on 24th of February price elevated 3,4%, and within 24 hours consolidated to pre-elevated levels. This week displays the price around 1950 as strong resistance. Chart below shows level has been tested 4 times. Even today, when Russian forces attacked biggest Ukrainian nuclear power plant the price consolidated within 60 minutes. Why?

30 minutes chart of GC (Gold futures), Price action. Source: Author´s analysis

FED decision

One of the reasons could be waiting for Fed rate decision. The Fed chairman, Jerome Powell, had a testimony before Senate Banking Committee. He has not an easy goal to balance between home monetary policy and Ukraine crisis. But the next awaited move is interest rate hike. Rising of interest rate could negatively affect the price of gold, because precious metal has no interest. Means, in the time of high inflation and high treasury yields, the gold depreciates. And this move is considered a possible game changer. Fed rate decision is set on March 16.

Trader sentiment

Based on the IG Trader sentiment, indicator shows 70% of its clients are in long positions. This can provide a little insight in retail thinking. Based on the current situation, it is absolutely logical to be in long positions for gold. On the other hand, Citigroup Inc., mentioned above in the article, has 30% of its positions in long. Apparently “the big guys” have different opinion. Technically, level around 1950 seems to be strong resistance, and any move above makes it support. Strong one.

Weekend is here, and any further escalation in the conflict can bring another price elevation to the 2000$ mark. On the contrary, possible de-escalation of the conflict or higher than expected rate hike of Fed monetary policy can start short trend in gold.

Comments