Free fall

On Monday, gold erased 33.7$, representing -1.74% and ended at 1900 level, but the volatility was bigger and low was under important level 1900$ at 1891.8$. In previous article about gold we pointed out resistance area around 1953, which has not been broken, moreover we added that fundaments like presidential vote in France could affect Monday’s price movement. During the weekend, Emmanuel Macron won the vote and has become the president of France for next electoral term. This cooled markets down, and nervousness eased.

We wrote about this topic: Gold erased previous week’s gains

30 minutes chart of GC (gold futures), Open/close range. Source: tradingview.com

Awaiting Fed’s move

Vote in France was not the only aspect of gold decreasing, because markets await Fed’s decision on interest rates. The next meeting is planned on the 3rd and 4th of May, based on official site of Fed. This has been very important topic for last months and will be definitely for next months, if not years. We wrote many times about how big of an impact on markets (gold included) Fed decision has. Consensus for next interest rates is ‘raise by 50 basis point’. This could spark shock and possible big sell-off across markets. Despite this, any hawkish decision could have positive impact on US dollar, which means another possible downtrend for gold .

Related: SP500 falls toward March lows

Technical analysis

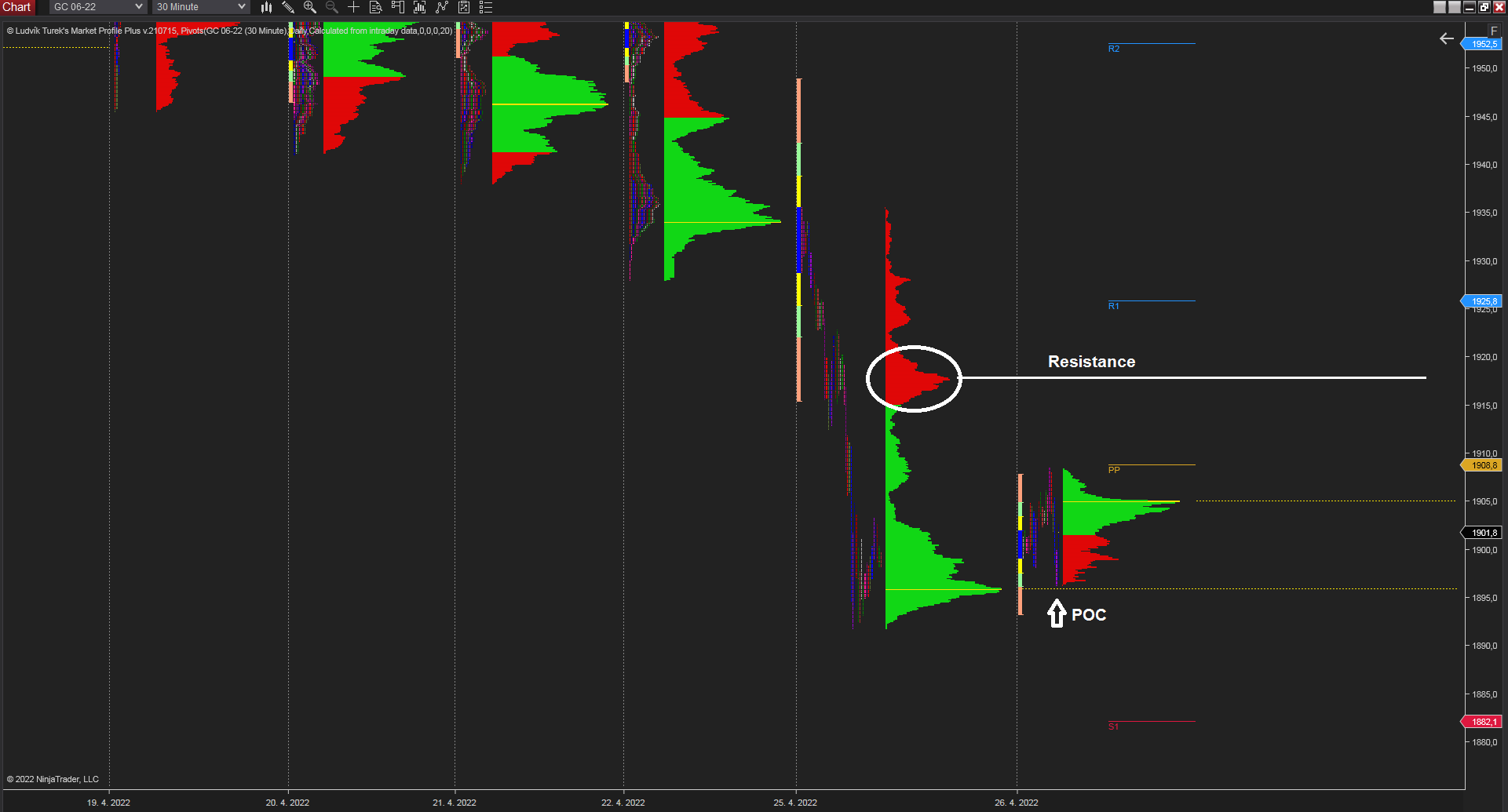

Market profile shows that the biggest volume of the Monday is at low, where the POC of the day resides as well. This point of control level has made support for today, where any break under this level could possibly lead the price more south and continue in trend. On the other hand, next resistance is at 1917.6$, represents 2nd biggest volume of day.

30 minutes chart of GC, Daily Market Profile. Source: Author’s analysis

Monthly VWAP shows that price has stopped at the 2nd standard deviation of volume weighted average.

DivDelta

What is equally interesting in analysis is divergence of delta between bids and asks. On the chart below we can see quite big positive delta, meaning ask volume is bigger than bid one. The third chart at the picture below shows cumulative delta, and we can see this cumulative delta is raising.

We can not say if this means rebound of prices or continue in downfall, but shows that big volume is coming in as positions are setting up. Maybe getting ready for next week’s Fed?

Comments

Post has no comment yet.