Gold bounced from $1700

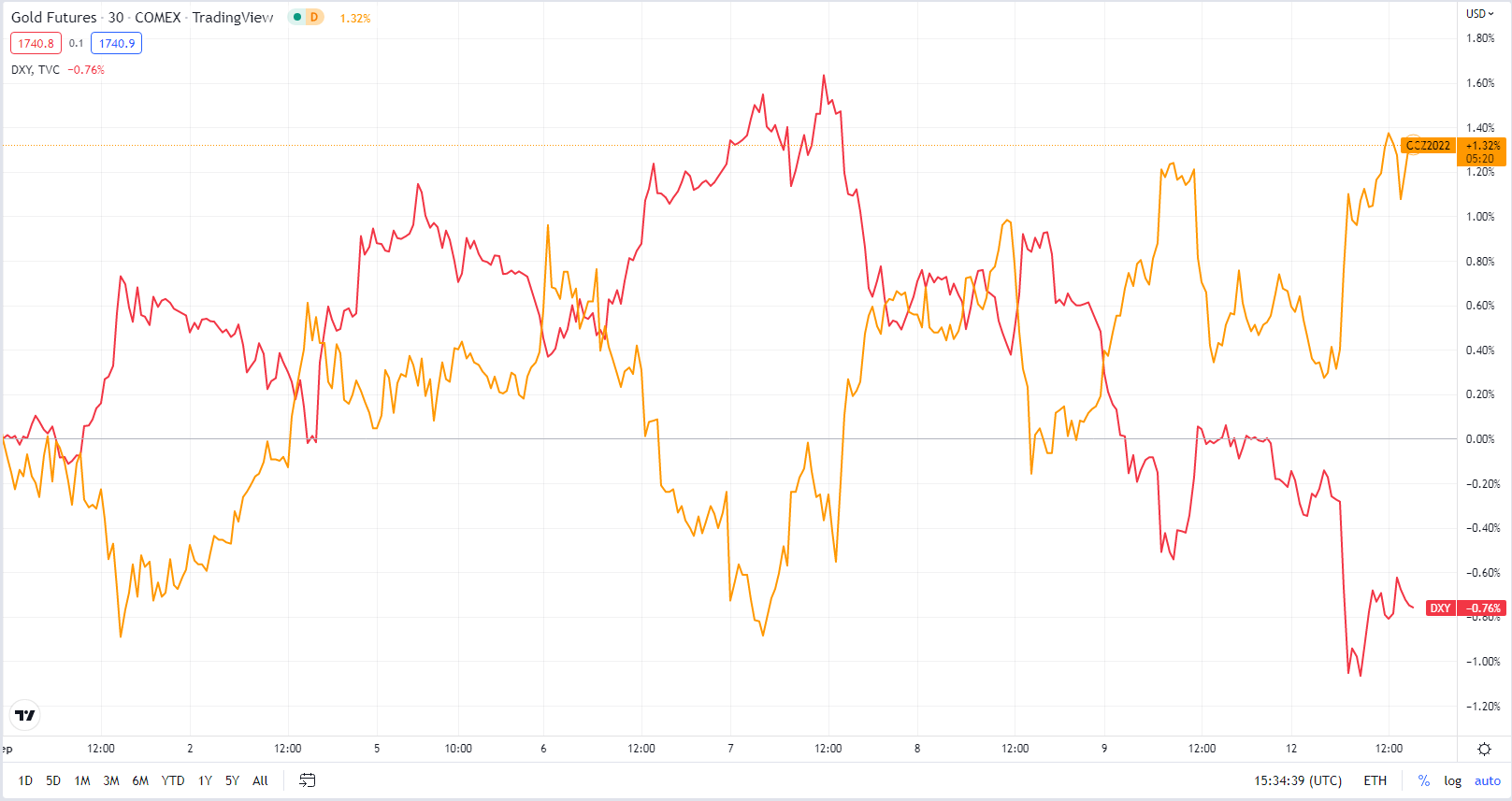

The strong psychological level of $1700 worked well as a support. Gold tested this level twice, right at the beginning of the month. Moreover, the weaker US Dollar helps bullion to elevate at the price. The picture shows the development of Gold futures (GC) and the US Dollar Index (DXY) in this month. In 12 days, gold has gained +1.32% while DXY has declined by 0.76%. A highly negative correlation is clearly visible.

You may be also interested in: ECB hikes rates, DAX falls 1.5%

The comparison in development between GC (Gold Futures) and DXY (The US Dollar Index). Source: tradingview.com

Fed decision as a strong market mover

Fed interest rates decision is set on the 21st of September with an expectation of 3.25%, which means a hike by 75bps from the current 2.5%. A decision is commonly known as a strong market mover. The last press conference held by Jerome Powell, the chair of the Fed, at the Jackson Hole Symposium showed a solid hawkishness in monetary policy. Gold fell to a psychological level of $1700, but despite this, gold corrected the decline and is attacking $1750. This area could be set as the closest resistance, which was set up by the monthly VWAP level from last month and 1st standard deviation in monthly VWAP in the current month (white arrows show where the price reacted).

30 minutes chart of GC (Gold Futures), Price reaction on Monthly VWAP. Source: Author’s analysis

The US inflation ahead

Tomorrow will bring new data from the US inflation. The consensus of year-to-year change is 8.1%, and month-to-month -0.1%. Inflation data are very closely watched by investors because inflation can bring more insight to the next monetary policy meeting. Higher inflation can spark sales in the markets, on the other hand, better than expected numbers can bring more optimism. Investors can await a highly volatile rest of the month.

Comments

Post has no comment yet.