The fear of higher inflation

Last week gold went under $1880 on its futures contract pricing. Today, on Monday 13th, gold continues in depreciation and is losing more than 0.7% at currently $1866. Despite the fact that Fed’s dovish press conference, the precious yellow metal lost the ground under its feet. As the central bank members stated, the development of macro data in the U.S. can be a beneficial insight into the following monetary policy. And the highest importance seems to have inflation data.

Read more: Should gold be in your investment portfolio?

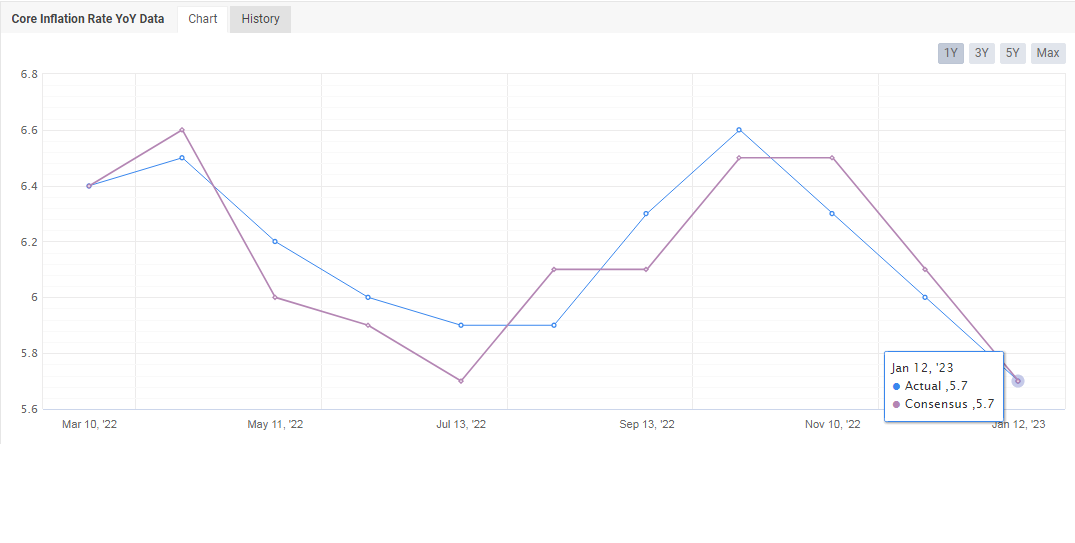

Last Fed’s meeting changed the predictions in the development of interest rates for the end of 2023 and the beginning of 2024. But the current situation is, that this optimistic projection has no strong base among investors and traders. The fear of higher inflation exists and it is seen in the development of the U.S. dollar. Consumer price index and core inflation rates are awaited on Tuesday with a consensus of 5.5%, which is a little down from the previous month with 5.7%.

US Core Inflation Rate YoY development, source: myfxbook.com

Volume accumulated under the support level

After the steep fall of the price from the beginning of the month, gold is in the side move for about 6 days. Technically is under the support, now resistance, the 1st standard deviation calculated from monthly VWAP. This level is $1882 (the red solid line). But the volume is accumulated and waiting for the next data from CPI. In this tight situation, any technical level could be anytime broken, because fundaments have a stronger impact than “lines”. Higher resistance could be above $1900. Lower support could be around $1853.

30 minutes chart of GC (Gold Futures) volume accumulation, monthly VWAP, source: author’s analysis

Higher inflation = higher rates

The common knowledge is that higher inflation = higher interest rates. Higher interest rates are a monetary tool to fight higher inflation and cool down the overheated economy. Fed members stated many times that inflation data from the U.S. have a significant impact on monetary policy. Therefore, CPI needs to be watched with high alert.

You may be interested in: Is natural gas ready to rally soon?

The interest rates projections from the latest bank meeting pointed to a willingness to lower rates at the end of the year 2023 or the Q1 of 2024. But only in the case of lowering the trend of inflation. If this requirement will not be met with the predictions, the possibility of more rate hikes could be on the table again. That is the reason why the fear of higher inflation has a positive impact on the US dollar, and a negative for gold, because of the USD denomination.

Comments

Post has no comment yet.