Technicals

This week, gold erased gains from previous week’s rally. As we can see on the chart, its volatility represents -3,24%, and it is not the end of the day yet. In addition, the drawdown has happened just on Monday and Tuesday, but for the rest of the week, price went sideways.

30 minutes chart of GC (Gold futures), Source: tradingview.com

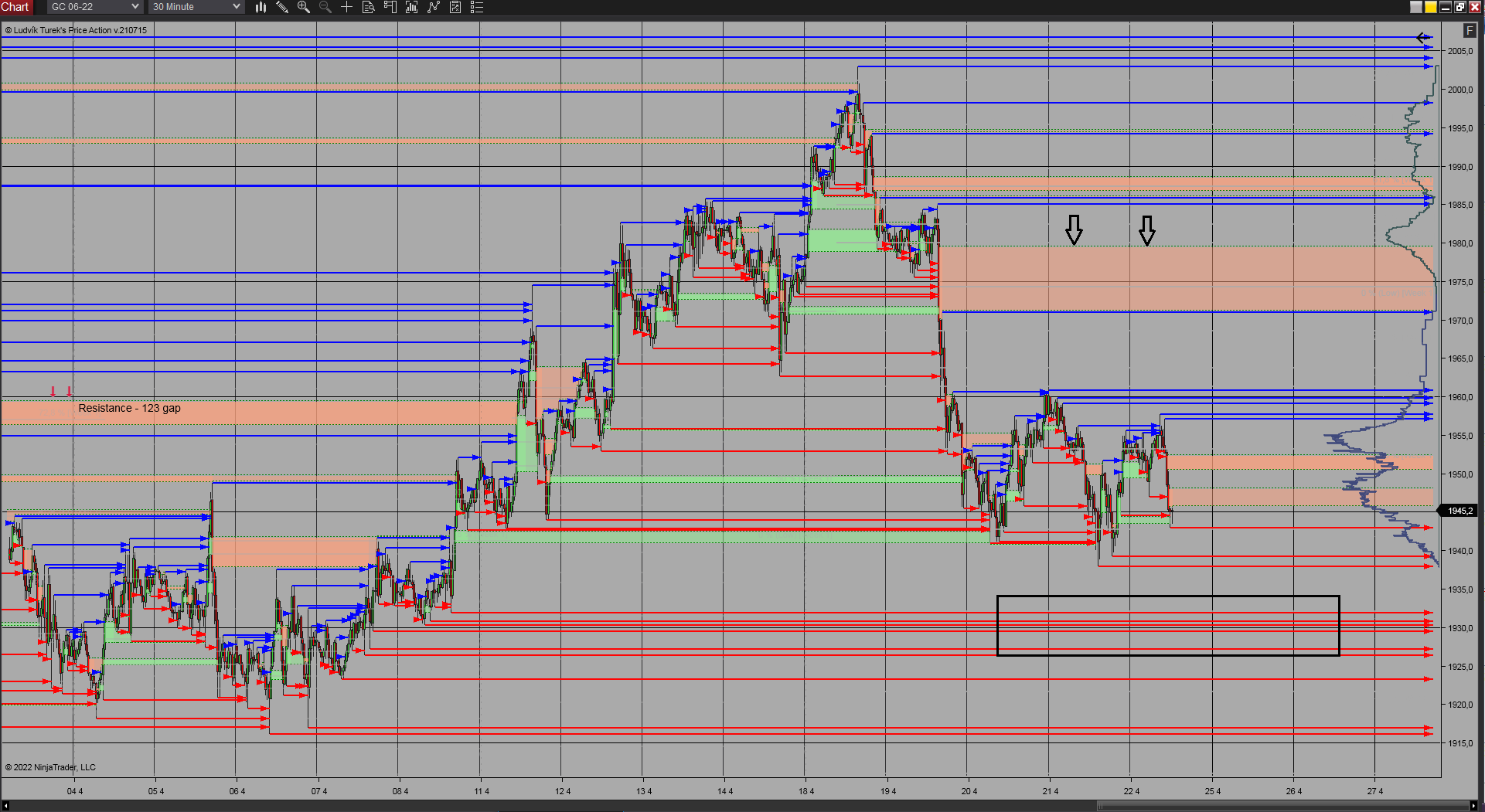

Support for this side-move represents level 1942$ which has been tested three times, but more significant support consists of pivot lows (red arrows) in area 1929-1932. On the other hand, 123 gap from 1971.3 – 1979.5 could be interesting resistance area.

30 minutes chart of GC (Gold futures), Price action. Source: Author´s analysis

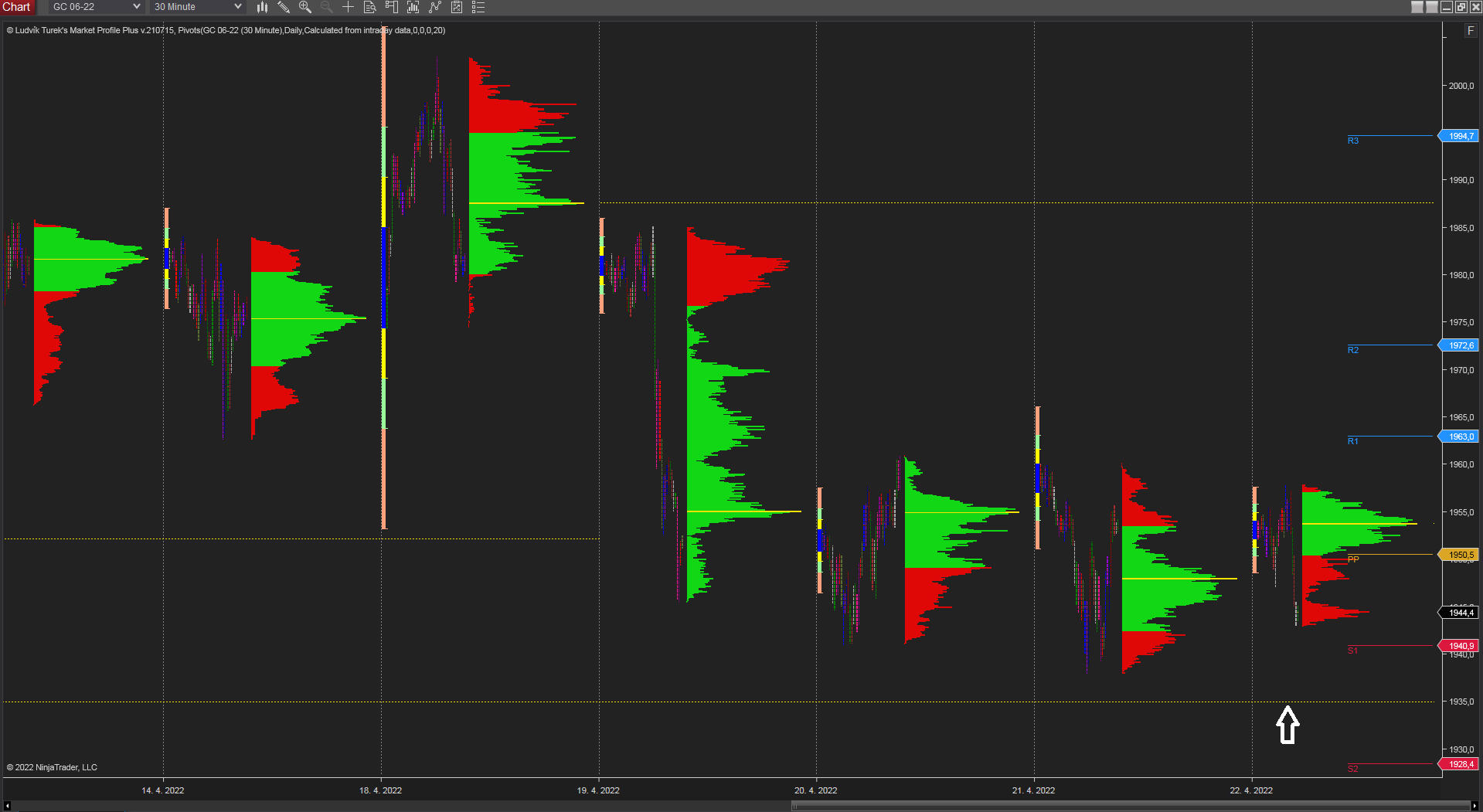

The above-mentioned support around 1932$ is confirmed by another indicator, specifically by daily market profile. This shows support by POC level (point of control – yellow dotted line) far from 8.4.2022 at 1934.9$.

Related: Technical analysis of gold

30 minutes chart of GC (Gold futures), Daily Market Profile. Source: Author´s analysis

Monthly VWAP shows resistance by developing VWAP, which has been tested this week 4 times, and successfully stopped gold’s up-move. This level lays at 1953.4$. Support could be set by 1st standard deviation at 1930.5$, which backs supports from indicators mentioned above.

You may be also interested in: Tesla beats all estimates in Q1

30 minutes chart of GC (Gold futures), Monthly VWAP. Source: Author´s analysis

Fundaments

Let’s not forget about fundaments, because during the weekend will be second round of French presidential vote, where Macron has majority in poles. It cools markets a little bit, but in case the French send Le Pen to presidential chair, a spark of nervousness could come to the markets and gold as well.

Moreover, Covid situation in China worsens and questions about economic stability of Asian country are slowly rising. Bloomberg stated that sentiment toward Chinese assets has soured as Covid lockdowns slow economic growth and policy stimulus falls short of investors’ expectations.

The third biggest possible influence can come from war conflict in Ukraine. Unpredictability of possible decisions in war always brings shock to markets. So, it is more than appropriate to be ready for Monday’s open.

Comments

Post has no comment yet.