Gold in 2022

The precious yellow metal ended the year 2022 at just -0.21% with the previous year’s open at $1830.1 and close at $1826.2. These data can deliver a neutral look-like year for gold. But reality can not be further from the truth. Markets were hit by the Russian war in Ukraine with the price exploding above the $2070 level with a year’s high at $2078.8 (+13.59%).

You may be interested in: Coal and gas lead the 2022 commodity market

Despite the enormously strong fundament, which war definitely is, the price of safe haven started to decline. The Fed started to fight inflation by significantly hiking interest rates from 0.25% in March to 4.5% at the end of the year. Higher interest rates had a positive impact on treasury yields. This means that financial assets with higher interest became more attractive than non-interest gold. Therefore, the commodity fell to the year’s low at $1618.3, which represents -22.15%.

The daily chart of GC (Gold Futures), Volatility in 2022. Source: tradingview.com

Strong finish

The last two months were in a green mood again, where gold appreciated to the year’s end at $1830.1 (+13.10%). This appreciation was caused especially by Fed. Again. The main reason was the change in the rhetoric of Fed officials. With the possible peak of inflation, which is closely watched by Fed officials, the monetary policy has changed a little bit. Another significant hike in interest rates is not on the program and hawkishness evaporates.

Levels of interest

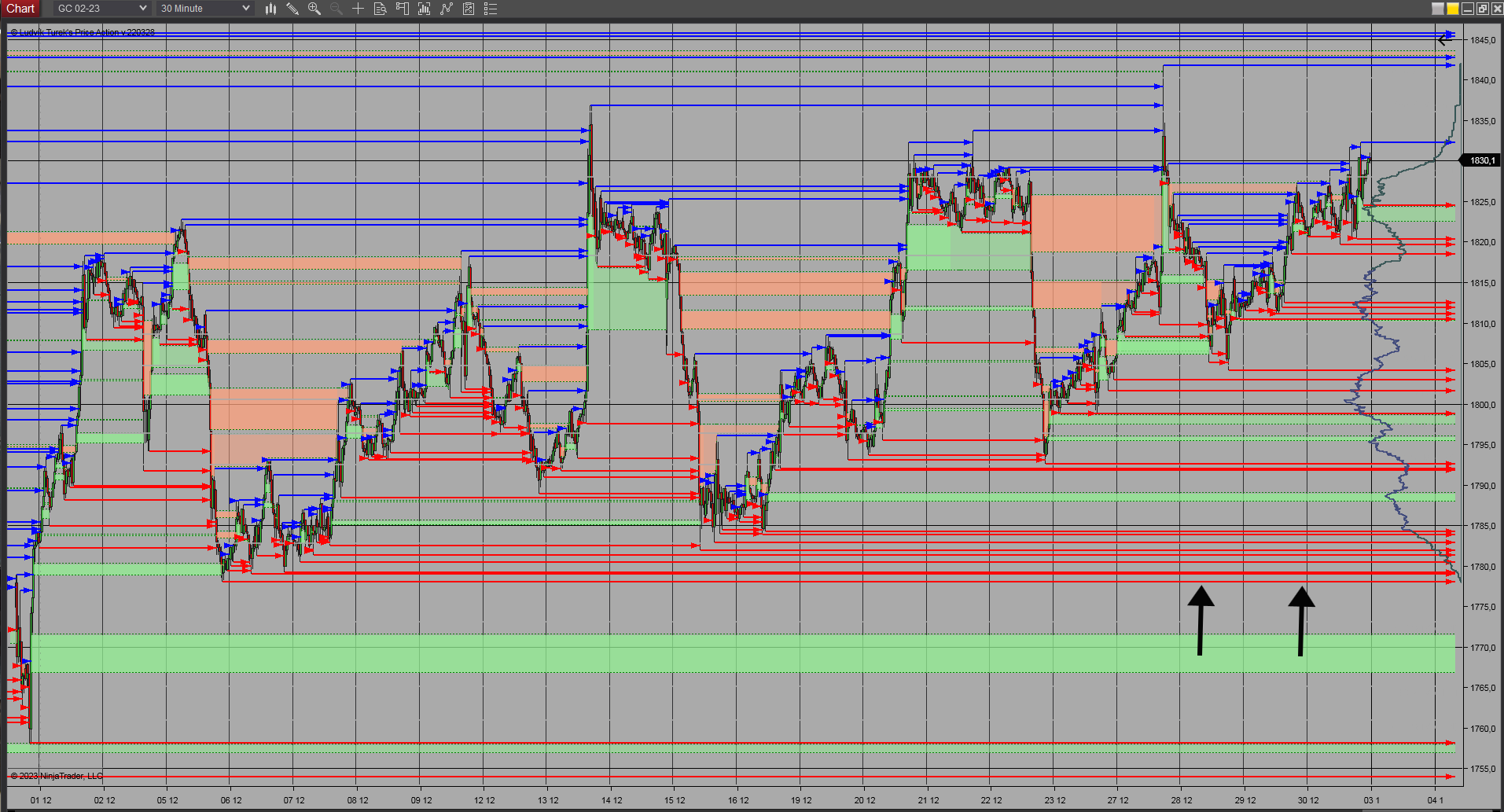

On daily basis, the volume profile shows untested POCs (Point of control) from the 28th and 29th of December at levels of $1811.1 and $1813.%. A development in December set several levels of interest. Monthly VWAP (Volume Weighted Average Price) set possible support at $1807.4 and lower support at around $1788.

The price action shows massive activity in the range of $1780-$1785, with cumulated pivot lows (red arrows) from the 6th, 7th, and 16th of December. To sum it up, the first range of interest is $1807.4 – $1813, and the second range is $1780 – $1788.

30 minutes chart of GC (Gold Futures), Cumulated pivot points. Source: Author’s analysis

Gold awaits fresh data to drive the price

Gold awaits new inflation data in the US which have an impact on Fed’s monetary policy and the next possible rate hikes. It is commonly known that higher rates have a negative impact on the price of gold because gold is a non-interest asset.

Therefore higher rates decrease the competitiveness of yellow precious metal. The development in Ukraine will be one of the biggest questions not just for the markets but for the whole planet. New outbreaks in the Covid pandemic confront China’s effort to boost economic activity.

Comments

Post has no comment yet.