Interest rates projections

Fed´s Powell made announcement which corrected Monday’s up move, when in NABE economic policy conference admitted bigger increase in interest rates if necessary, to fight inflation. Based on Bloomberg, Powell said :

“The risk is rising that an extended period of high inflation could push longer-term expectations uncomfortably higher, which underscores the need for the committee to move expeditiously as I have described,” he said, adding that this “underscores the need for the Committee to move expeditiously.”

Gold has corrected previous, almost 1%, up move earlier this day, as the reaction to NABE’s press conference.

We have analysed gold in: Commodities surged after Fed

Impact on gold

Yellow metal has no interest. So, in the case of high interest rates, or rising interest rates policy from central bank, it negatively affects gold. Reason is that financial products with interest will adapt to main interest rate policy and will bring higher profitability than products with no interest. Good example is US treasuries yields, where just the talk about rates hike brings higher yield.

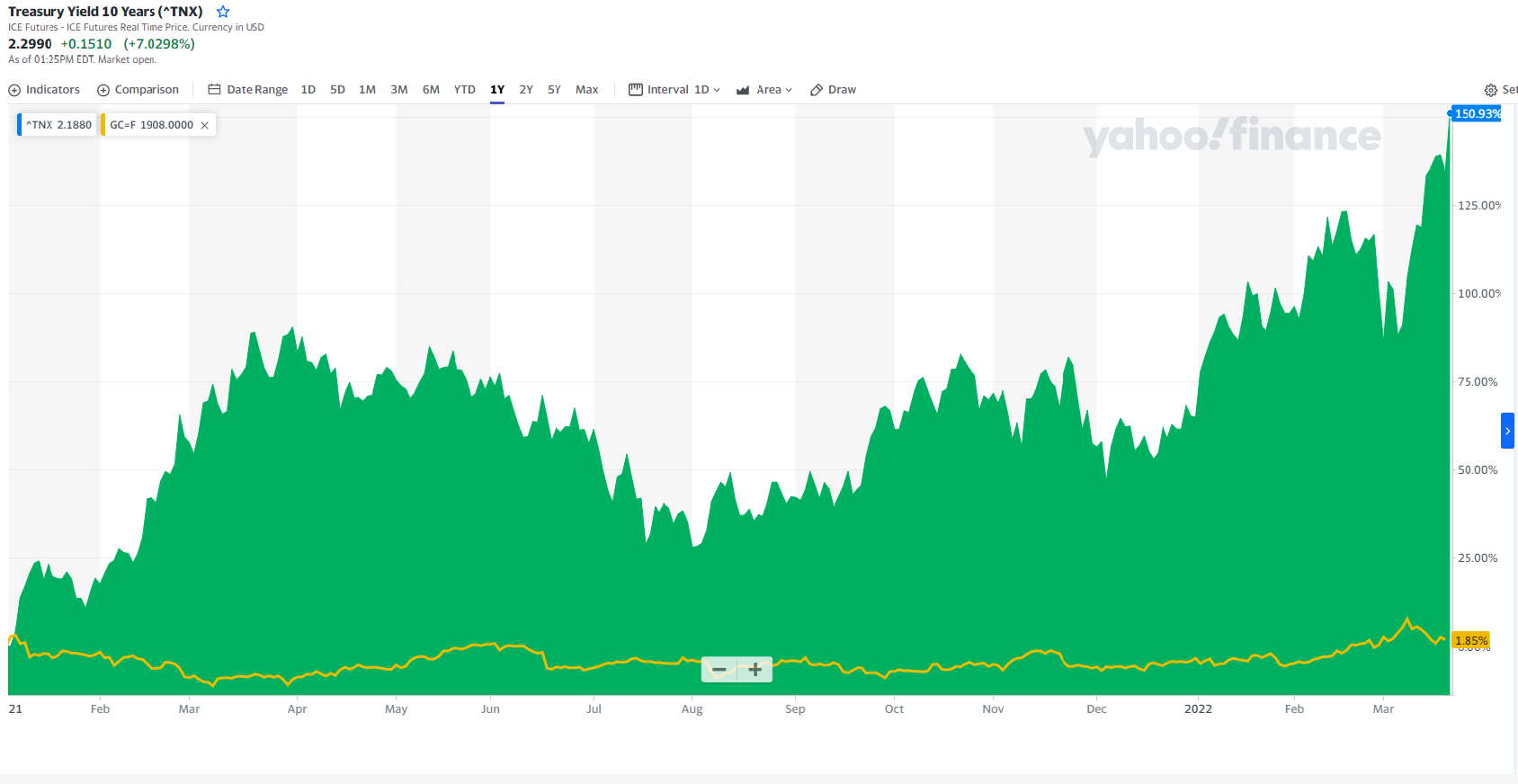

Comparison of TNX (green area) and GC (yellow line) from 2021-present, Source: finance.yahoo.com

This chart shows that from the beginning of the year 2021, 10 year Treasury Yield has appreciated more than 150%, and Gold has moved +1.85%. Gold gained big volatility in these two years and from trading side it was very lucrative, but despite this, inflation risk works better for products with interest.

You may be also interested in: USD/JPY holds 6-year highs

Inflation

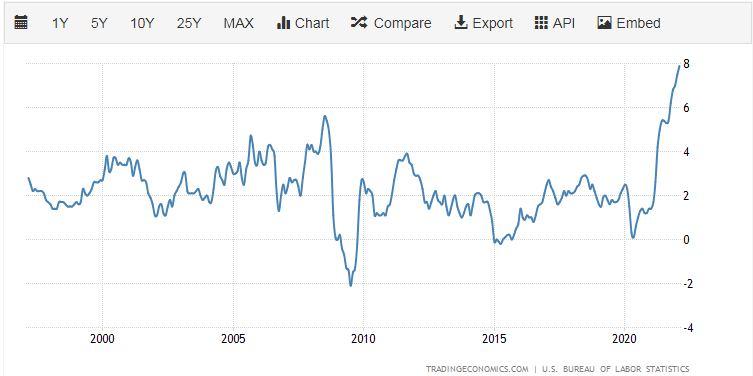

Powell’s comments makes sense, because the latest inflation data in US reached 7.9%, and in the 1st chart below, is obvious that this trend is continuous. Rising interest rates are considered as one of the main tools of monetary policy to fight inflation. Fed has lifted interest rates this month by 0.25% to actual 0.5%. But the inflation is 7.9% and rising. On the other hand, as it is seen in 2nd chart below, this tool has much more room to operate with.

United States inflation rate, Source: tradingeconomics.com

United States Fed interest rate, Source: tradingeconomics.com

Alert

It should be inevitable for Fed to change policy earlier than expect based on these data. There are projections of next steps in hiking rates, but actual situation is changing, and projections can change every week. Therefore, there is very high alert about long-term predictions, and need to evaluate that central bank must do something to fight biggest inflation from last 30 years. War between Ukraine and Russia persists and brings uncertainty and big risk to financial markets, therefore gold could continue in north way, but it is very important to think about another and very strong affection from the Fed’s next steps.

Comments