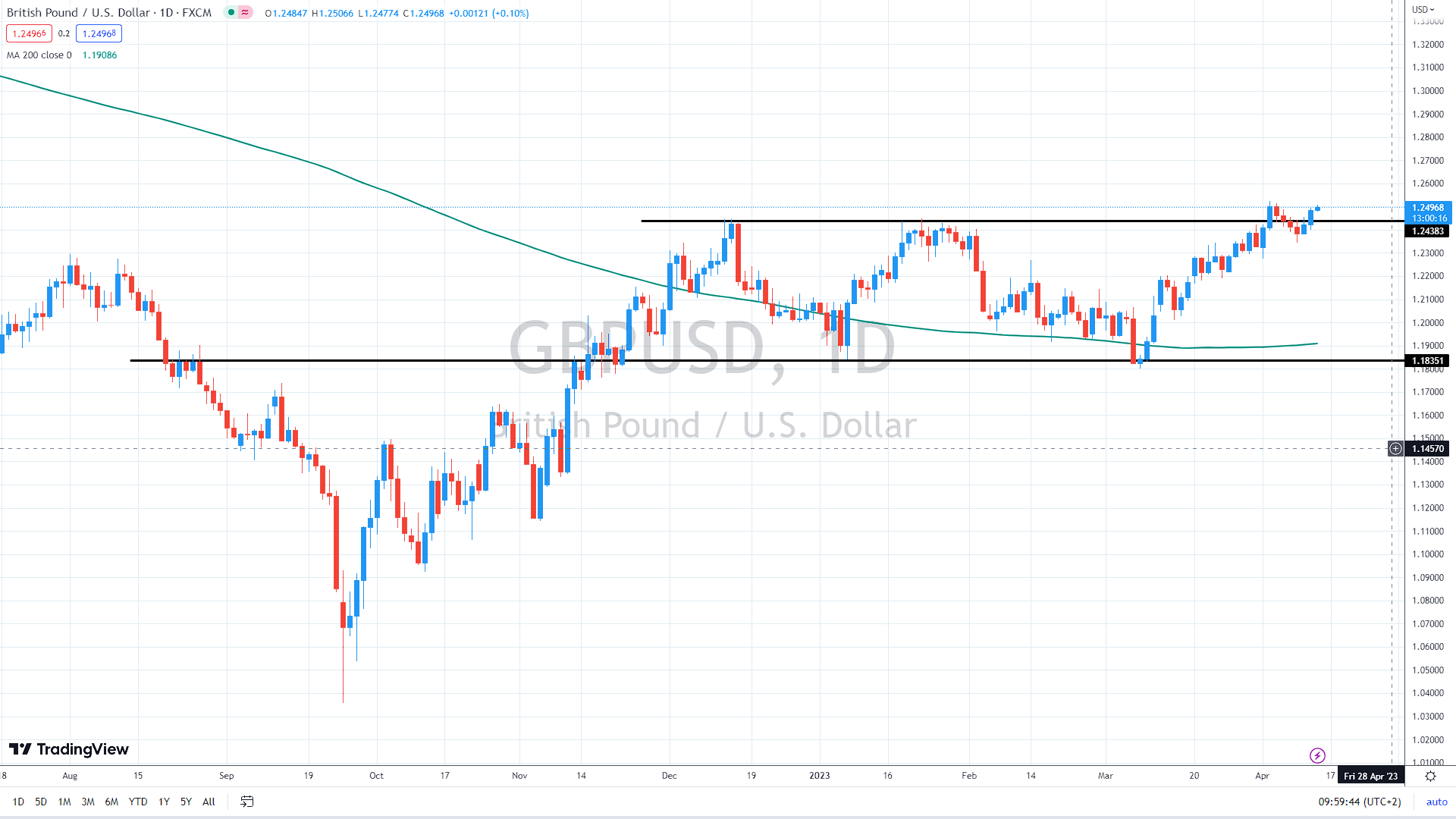

The Pound has recently jumped to multi-month highs, rising above 1.25 for the first time since June 2022. As long as the GBP/USD pair trades above this year’s highs of 1.2440, the bull market could continue, likely targeting the 1.30 level later this spring.

A batch of UK data released, including weaker GDP numbers

The monthly publication of the United Kingdom’s Gross Domestic Product (GDP) for February, released on Thursday, revealed that the British economy stagnated at 0% in February, compared to expectations of 0.1% and a prior reading of 0.3%.

In contrast, the Index of services (February) came in at 0.1% 3M/3M compared to the -0.2% forecast and 0% previous reading.

The industrial sector activity did not increase in February, according to the latest UK industrial and manufacturing production data released by the Office of National Statistics (ONS). In February, manufacturing output was 0% monthly versus 0.2% expected and -0.1% in January, while total industrial output was -0.2% month on month versus 0.2% expected and -0.5% in January.

You may also read: Warren Buffett strikes again – calls Bitcoin a “gambling token”

In February, annualized data for UK Manufacturing Production came in at -2.4%, exceeding expectations of -4.4%. However, in the second month of the year, total industrial output decreased by 3.1%, compared to the expected -3.7% decline and the previous reading of -3.2%.

Separately, the UK goods trade balance for February was reported as GBP-17.534 billion, compared to £-17.00 billion expected and £-16.093 billion the previous month. In February, the total trade balance (non-EU) was -£6.519 billion, compared to -£6.574 billion in January.

Commenting on the GDP figures for February, UK Finance Minister Jeremy Hunt stated that the economic outlook is brighter than anticipated.

“We are on track to avoid recession as a result of our actions,” Hunt continued.

UK home sales Increase

March home sales in the United Kingdom came near pre-Covid levels, propelled by demand for apartments and an upturn from the market downturn caused by the disastrous mini-budget of then-prime minister Liz Truss last September.

According to a survey by the property marketing platform Rightmove, the number of agreed transactions between sellers and purchasers was only 1% lower in April 2019 than in March.

Another interesting topic: USD/CAD remains bearish after BoC decision, US inflation data

The last decline in sales was attributed to market turmoil and the withdrawal of thousands of mortgage proposals by lenders as a result of Truss’ £44 billion plan for unfunded tax cuts. However, loan costs have since decreased, resulting in the present economic recovery.

US inflation slows but stays highly elevated

According to data released on Wednesday, US consumer prices inched 0.1% higher in March, which led to a yearly rise of 5.0%, the lowest 12-month growth since May 2021. The core CPI, which excludes volatile food and energy prices, rose 5.6% annually, up from 5.5% the month before. These numbers suggest that the Federal Reserve will likely increase interest rates again the following month.

Producer prices, expected to ease compared to last year’s, will be released on Thursday, along with weekly unemployment claims, projected to rise by a fractional amount.

GBP/USD daily chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.