The Pound has managed to score some gains during the EU session, but more significant movements are expected after today’s US CPI figures.

UK labor market helps the Pound

According to the most recent statistics issued by the Office for National Statistics (ONS) on Tuesday, the United Kingdom’s ILO Unemployment Rate stayed steady at 3.7% in December compared to the 3.7% that was estimated. Still, the claimant count change showed a decrease in the given month.

The number of individuals receiving unemployment benefits decreased by 12.9K in January, compared to -3.2K in December.

The UK’s average weekly earnings, excluding bonuses, reached 6.7% 3Mo/YoY in December, compared to 6.5% the previous month and 6.5% forecasted, while earnings including bonuses reached 5.9% 3Mo/YoY in December, compared to 6.5% the previous month and 6.2% forecasted.

US inflation is going to cause volatility today

Today’s inflation data for January is projected to indicate that consumer prices climbed at an annual rate of 6.2% in January, down from 6.5% in December and far below June’s four-decade high of 9.1%.

Nevertheless, investors are mindful of any potential larger-than-anticipated shocks in core inflation, which eliminates volatile energy and food costs, since the labor market remains robust.

The US CPI report will play a significant part in determining the Fed’s rate-hike path, which should increase or decrease the USD demand and offer fresh direction to the GBP/USD pair.

On the other hand, speculation that the Bank of England (BoE) is nearing the peak of its current policy-tightening cycle might prevent bulls from putting new wagers on the British pound. This may contribute further to restricting gains for the GBP/USD pair.

You may also like: What is a trading journal?

Moreover, the United Kingdom is the only G7 nation whose output is below its pre-pandemic level. As a result, in the following months, economists at Rabobank estimate the British Pound to stay under negative pressure, targeting the 1.20 level.

“Currently, the UK is the only G7 economy not to have recovered its pre-pandemic levels. In addition to weak growth, its fundamentals are characterized by high inflation, low productivity, weak investment growth, post-Brexit trade frictions, and a current account deficit,” they added.

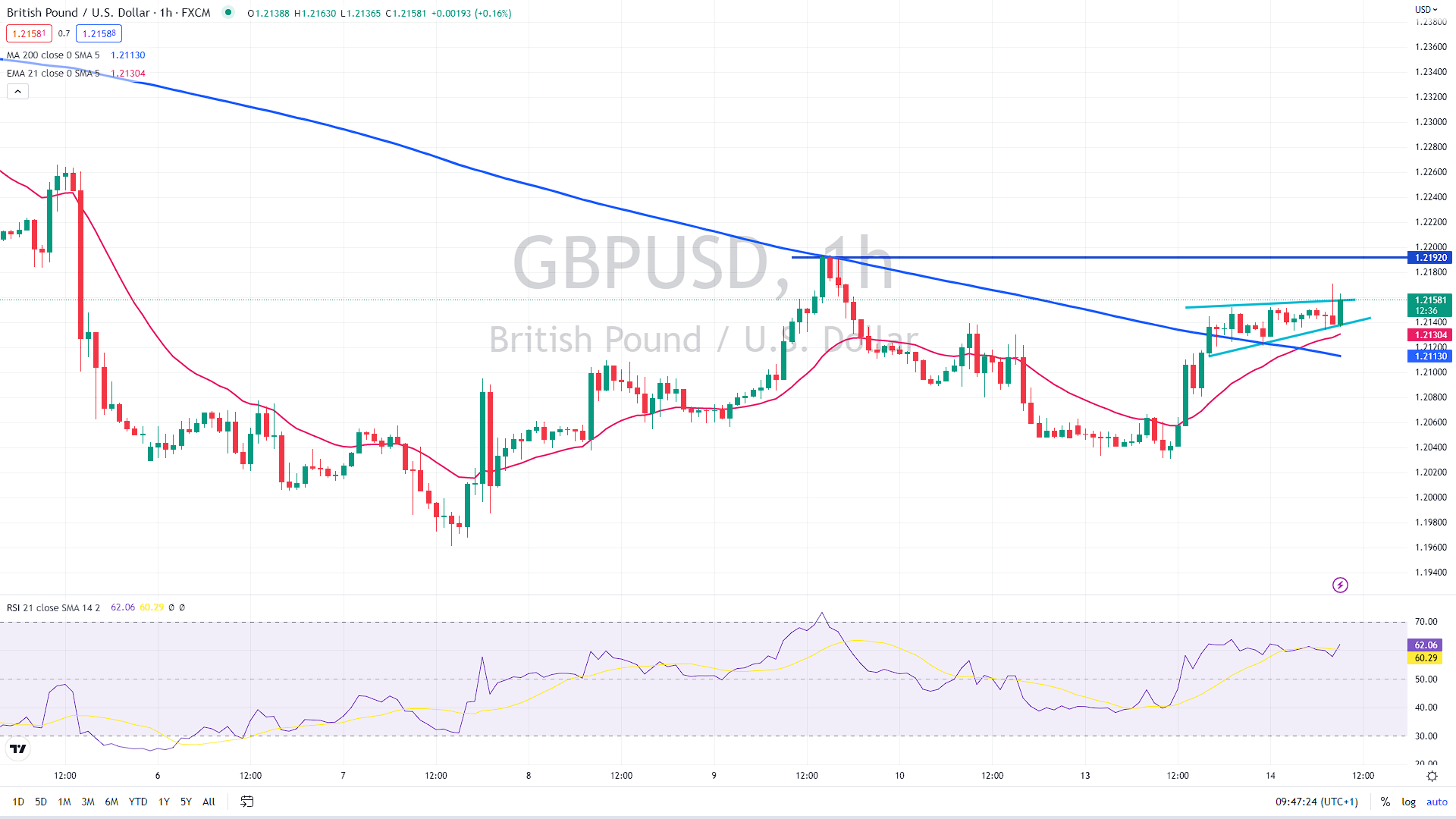

Sterling seems to be breaking above the short-term flag pattern, which could be interpreted as a bullish signal, likely targeting previous highs near 1.22.

On the downside, the support is at the lower line of the flag pattern, at around 1.2140. If not held, the GBP/USD pair might decline below 1.21 quickly.

GBP/USD 1 hour chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.