The Pound declined notably Tuesday, falling below the crucial level of 1.20 as weak domestic data and a rebound in the greenback pushed GBP/USD lower.

Consumers remain under pressure

Investors digested UK economic figures indicating that retail sales growth in the United Kingdom slowed last month as the seasonal bounce vanished.

According to the most recent BRC-KPMG Retail Sales Monitor, overall sales increased 4.2% year-over-year and 3.9% on a like-for-like basis for January.

Another interesting topic: EUR/USD touches 2-week lows ahead of Powell’s speech

In January 2022, retail sales increased by 11.9% on a total and like-for-like basis, representing a notable decrease from the previous year. In December, overall sales grew by 6.9%, while underlying sales jumped by 6.5%.

The British Retail Consortium’s chief executive, Helen Dickinson, stated: “As the holiday spirit faded, merchants experienced January blues as sales growth slowed. As a result, many shops offered steep discounts to attract customer spending. While there were deals to be gained during the January sales, merchants continued to experience declining profitability and volume.

UK real estate sector stabilizes

In other news, following four months of declines, home prices stabilized in January, as per the latest poll from mortgage provider Halifax.

Following a 1.3% dip in December and a 2.4% drop in November, prices remained almost steady in February at £281,684. However, the rise in prices decreased to 1.9% annually from 2.1% in December and 4.6% in November.

The current average home price is around £12,500, or 4.2% less than its peak in August of last year, but approximately £5,000 higher than in January 2022.

Elsewhere, Reuters quoted Bank of England (BoE) Chief Economist Huw Pill as saying, “British central bank was willing to do more to get inflation back on track.” Additionally, the press reported that the BoE indicated last week that interest rates were nearing their top.

Lastly, Catherine Mann, a Bank of England (BoE) policymaker, stated at a scheduled appearance on Monday that the next move in the bank rate is more likely to be another rate increase.

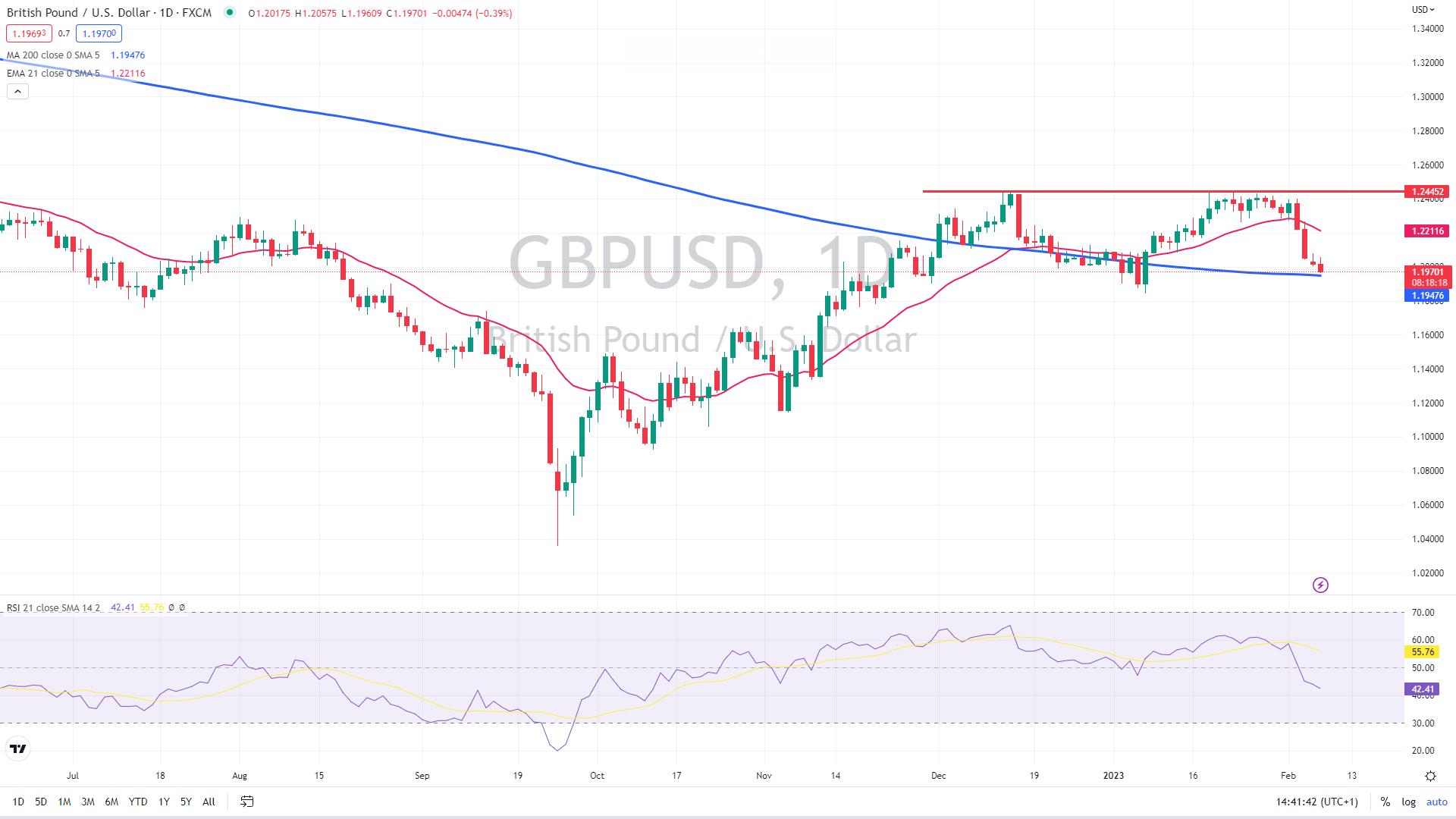

GBP/USD may have established a double top after failing to surpass 1.2450. Société Générale economists anticipate a decline to 1.1840, with a breach below this level opening the door to more losses.

You can also read: Norwegian Cruise: Stock dilution possible due to ruined balance sheet

Sterling failed on its second try to regain December’s peak of 1.2450, forming a double top formation, usually a bearish reversal pattern—implying weakening bullish momentum.

A short-term retreat cannot be ruled out; the formation’s neckline at 1.1840 provides critical support. A break below that level can lead to another leg lower toward 1.1640, with the pattern’s full potential at 1.1250.

GBP/USD daily chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.