The Pound traded lower as investors paid attention to the worsening macro situation in the UK, while the Japanese Yen benefited from the deteriorating sentiment in the global markets.

Mixed inflation report

The Japanese March national CPI came in at 3.2%, higher than the 2.6% predicted by economists but still lower than the 3.3% reported in February.

As a result of falling oil prices on the global market, headline CPI has decreased somewhat from previous levels. On the other hand, instead of 3.4% and 3.5%, the core CPI, which excludes the effect of fluctuating oil and food prices, has surged to 3.8%. The continued ultra-loose monetary policy and stimulus for rising salaries likely contribute to this uptick in retail consumption.

Another interesting topic: Oil prices continue Wednesday’s decline

This suggests the Bank of Japan (BoJ) is on pace to meet its target of an annual inflation rate of above 2%. Kazuo Ueda, governor of the Bank of Japan, has previously stated that the country’s central bank projects maintaining consumer prices over 2% by 2025.

Japanese financial sector is unaffected by US bank failures

In other news, according to the Bank of Japan’s semiannual financial system report, issued on Friday, Japan’s financial system has been maintaining stability. Despite the worldwide tightening of financial conditions, Japanese banks have adequate capital bases to carry out financial intermediation activities adequately.

You may also read: Tesla sinks amid weak margins – is the bounce over?

The March bank collapses in the United States have increased anxiety about the financial sector in the United States and Europe, while Japan’s financial system has remained stable and secure.

UK retail sales came out weak

March retail sales in the UK came in at -0.9%, much below the -0.5% forecast and the 1.1% recorded in February. After excluding car motor fuel sales, Core retail sales fell 1.0% monthly, worse than the -0.7% decrease forecast and the 1.4% growth seen in the prior month.

Annually, core retail sales in the UK fell 3.2% in March, compared to a fall of -3.1% in the preceding month and a decline of 3.3% in the previous month. Moreover, retail sales were down 3.1% in March.

You can watch: #3: Organizing Bitcoin-only conference with Jordan Walker

More details showed that the sales volume of non-store merchants (mostly internet retailers) decreased by 0.8% in March 2023, following a 0.3% increase in February. Lastly, after dropping by 1.2% in February 2023, sales of automobiles increased by 0.2% in March 2023; nonetheless, they are still 8.5% below their pre-coronavirus (COVID-19) February 2020 levels.

Rising expectations of a further interest rate rise by the Bank of England (BoE) have mitigated the downside for the GBP/JPY cross for the time being. However, the persistently high British inflation could pressure the BoE to further hike interest rates, especially in light of higher wage growth figures from the UK revealed earlier this week.

On the other hand, the Bank of Japan stands determined to keep rates unchanged and continue with the ultra-lose monetary policy, weakening the Yen.

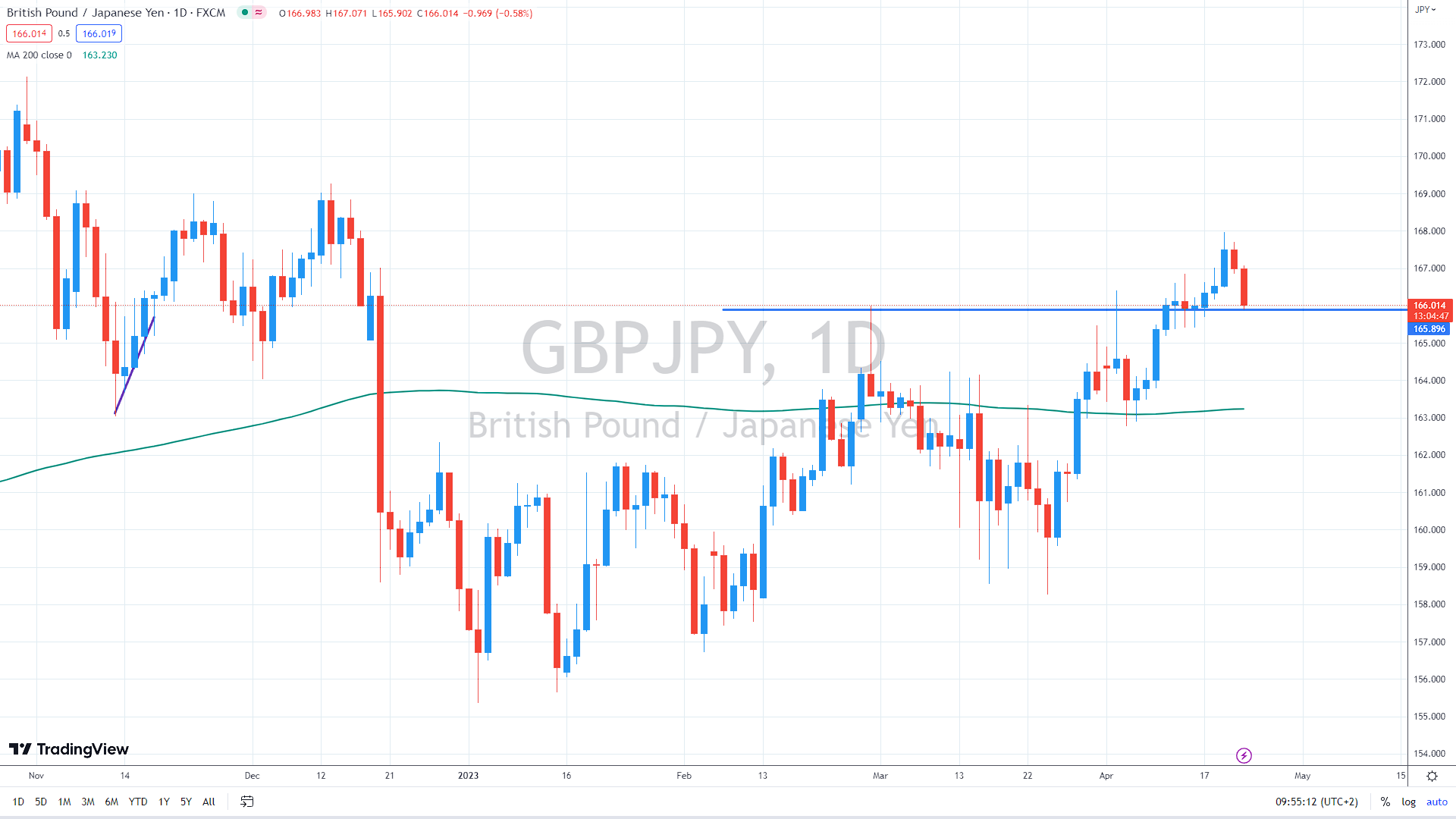

The immediate support seems to be at the previous swing highs near 166, and bulls must defend it for the short-term outlook to remain bullish. Alternatively, another demand zone is at the 200-day moving average, near 163.30. On the upside, the immediate resistance is at this week’s high of 168.

GBP/JPY daily chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.