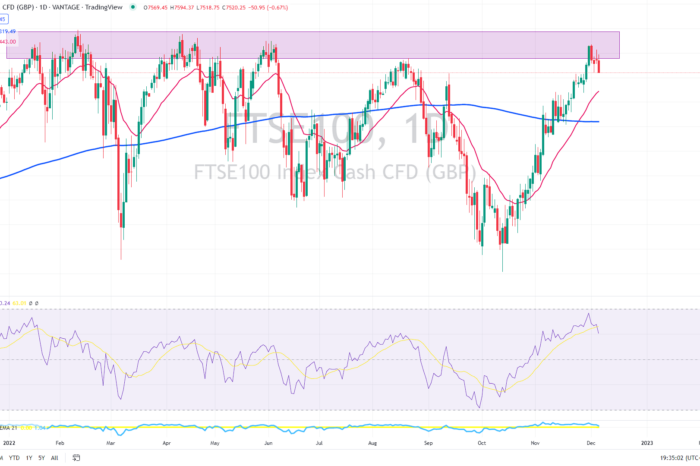

The British FTSE100 index has failed to break above the most significant resistance, falling nearly 1% Tuesday as sentiment deteriorated. It looks like the recent rally has run out of steam.

A lost decade in the UK

In its most recent economic prediction, the UK Confederation of British Industry (CBI) warned of a probable “lost decade” as stagflation puts the economy on track for a one-year recession in 2023.

According to the business organization, after a “stormy year, both politically and economically,” the United Kingdom certainly entered a recession in the third quarter, when GDP declined by 0.2%.

You may also read: Gold remains under extreme short-term pressure

As a result, it has reduced its GDP projections for 2023 from 1.0% to -0.4%, with the recession expected to continue until the end of the year.

Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, said: “Although their forecast is more optimistic than the Bank of England’s bleak prediction, it is the outlook for the decade ahead, which makes for difficult reading. The CBI warns that companies will face significant challenges through a long period of elevated inflation and stagnant growth.”

Deteriorating macro data

In addition, the most recent statistics from the UK services industry revealed that activity declined again in November, accompanied by the sharpest drop in new business orders since January 2021.

The S&P Global/CIPS purchasing managers’ index for the services sector remained at 48.8 in November compared to October. A value below 50 suggests contraction, while a value above 50 indicates expansion. In November, the composite PMI stayed at 48.2, slightly below the earlier estimate of 48.3.

Lastly, according to the most recent BRC-KPMG Retail Sales Monitor, sales in the four weeks leading up to November 26 grew 4.2%, compared to a growth of 5.0% during the same period last year.

Another interesting story: Billionaires with extreme differences on the state of crypto

In the three months leading up to November, food sales increased by 5.5% on a like-for-like basis, whilst non-food sales decreased by 0.4%.

The British Retail Consortium stated that because the sales data are not adjusted for inflation, the increase in revenues likely disguised a “far bigger” loss in volumes.

As previously mentioned, the critical resistance for the index is near £7,600. So far, every rally to this level has been met with significant selling. On the downside, the immediate support could be found at the 21-day moving average near £7,445 (the red line).

Comments

Post has no comment yet.