The FTSE 100 index traded half a percent weaker amid the recent Bank of England monetary policy decision. Still, volatility has been rather low today.

Following the lead of the Federal Reserve, the Bank of England has hiked interest rates by the anticipated 50 basis points, marking the ninth consecutive increase to a 14-year high of 3.5%, pursuing attempts to manage sky-high inflation even as the United Kingdom formally enters recession.

Very divided MPC

Interestingly, the Monetary Policy Committee was even more divided than in its previous decision, with a three-way split: two votes for no change (rate rises completed/pause), one vote for 75bps, and six votes for 50bps.

You may also read: EUR/USD slows ahead of ECB decision

Particularly, Tenreyro and Dhingra voted for unchanged, stating that the current setting of the Bank Rate was more than adequate to bring inflation back to the objective before falling below target in the medium term; on the other end of the spectrum, Mann voted for +75bps, stating that although there was some proof of a turning point in CPI inflation, there was a greater indication that price and wage forces would continue to be strong for longer than had been estimated in the November Report.

“The majority of the committee judged that, should the economy evolve broadly in line with the November Monetary Policy Report Projections, further increases in bank rate may be required,” Bailey wrote in a letter to Chancellor of the Exchequer Jeremy Hunt.

Inflation may have already reached its pinnacle, according to Bailey. Still, the risks associated with this forecast are to the “upside,” and the price increases will stay quite rapid in the coming months.

The majority stated in the meeting minutes that “the labor market remained tight, and there were indications that inflationary pressures in domestic prices and wages may imply increased persistence, thereby justifying a more robust monetary policy response.” The meeting minutes were issued on Thursday.

Estimates are rough

Importantly, BOE experts think that the United Kingdom has slipped into a recession, despite the fact that the economy is somewhat stronger than projected in November. The BOE forecasts that the gross domestic product will likely decline 0.1% in the fourth quarter, following a 0.5% drop in the third quarter.

The BOE also stated that the fiscal package released by the government last month would boost the economy next year but reduce output in three years. According to the central bank’s projections, the GDP will be 0.4% higher at the end of 2023 than previously anticipated, but it will be 0.5% lower at the end of 2025.

Also read: Fed rate hike slows down and dominates US market

The actions taken by the Treasury will have little effect on inflation. However, a 3,000-pound ceiling on energy bills beginning in April will reduce headline inflation by 0.75% in the second quarter, according to the BOE.

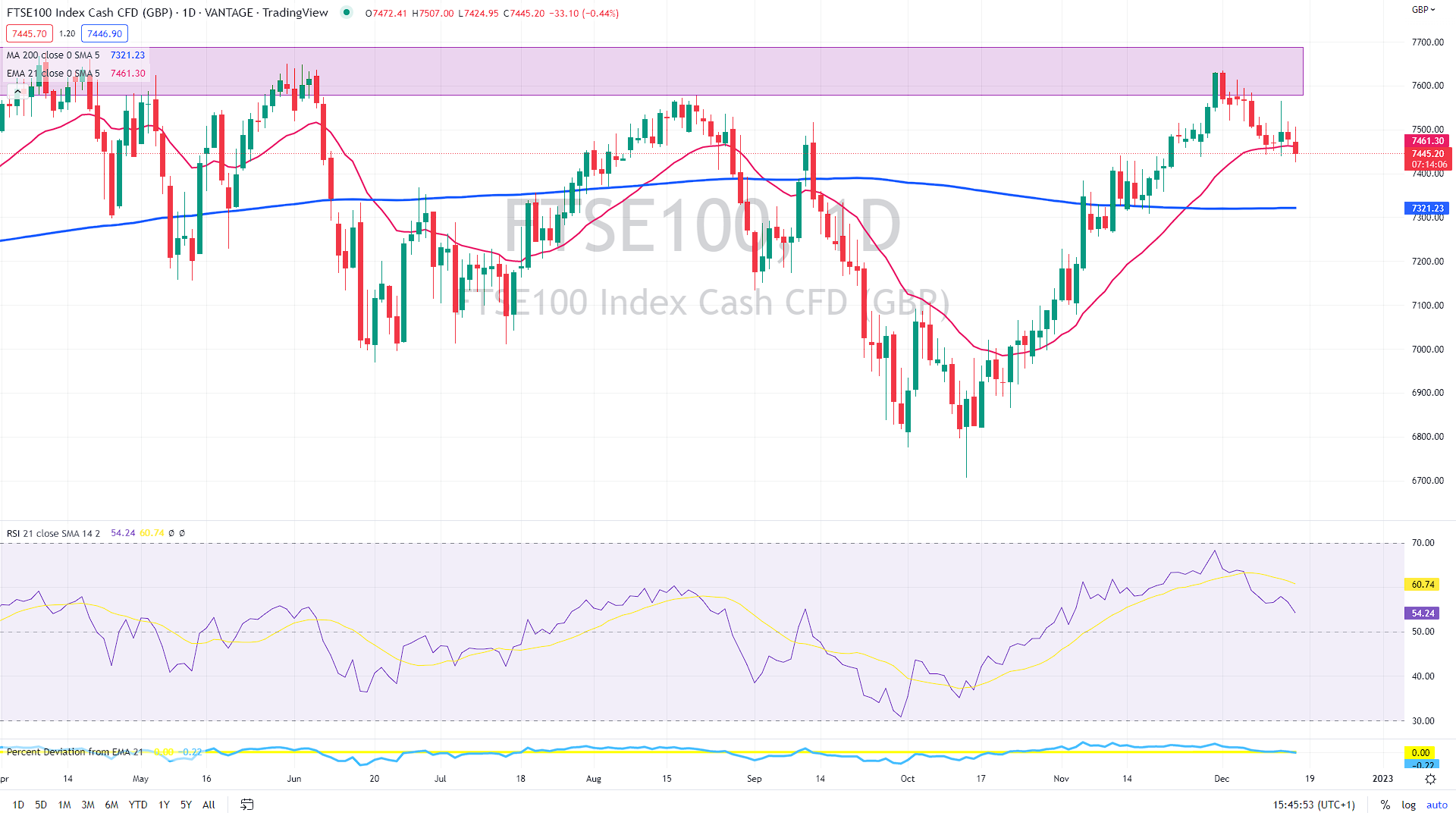

As long as the FTSE100 index trades below the key resistance zone of £7,600, the outlook seems bearish, targeting the 200-day moving average (the blue line) near £7,300.

FTSE100 daily chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.