The greenback fell notably on Wednesday, ending the current rally as investors took profits ahead of today’s massive macro event. When writing, the USD/CHF pair was down half a percent, changing hands at 0.9960.

Earlier today, Swiss PPI rose further in May, printing 6.9% yearly, up from 6.7% previously. However, the monthly gauge slowed from 1.3% to 0.9%, although way above 0.6% expected.

US retail sales data for May are due later in the session,.estimated to have increased by 0.2% month over month in May, after rising by 0.9% in April. Retail sales increased 8.2% year over year in April but are expected to slow to 7.1% in May.

You may also like: India faces record-high consumer price growth

Fed’s meeting eyed

A two-day Fed meeting concludes on Wednesday with an announcement at 2:00 p.m. ET and a news conference by Fed Chairman Jerome Powell. After Friday’s explosive CPI data showing inflation reaching a 40-year high of 8.6%, there was growing anticipation that the Fed would increase rates by 75 basis points on Wednesday rather than merely 50 basis points.

Additionally, markets now view a 75-basis-point rise as overwhelmingly likely after Fed insiders allegedly disclosed to The Wall Street Journal on Monday that a larger-than-50bps rate hike is being contemplated.

During their appearances with CNN and Bloomberg, respectively, White House (WH) Economic Adviser Brian Deese and National Economic Council Deputy Director Bharat Ramamurti were among the US diplomats who emphasized the inflation problems and showed determination to combat them.

However, economists at Commerzbank do not expect the world’s most powerful central bank decision to provide additional support to the USD.

“Fed Chair Jerome Powell will likely want to keep all options open for himself at tonight’s press conference and provide little in the way of news but will only give a well-worded ‘we will continue to hike at a rapid pace.’ That, in turn, would not constitute any additional fuel for the dollar bulls as market expectations have already gone a long way”, they said.

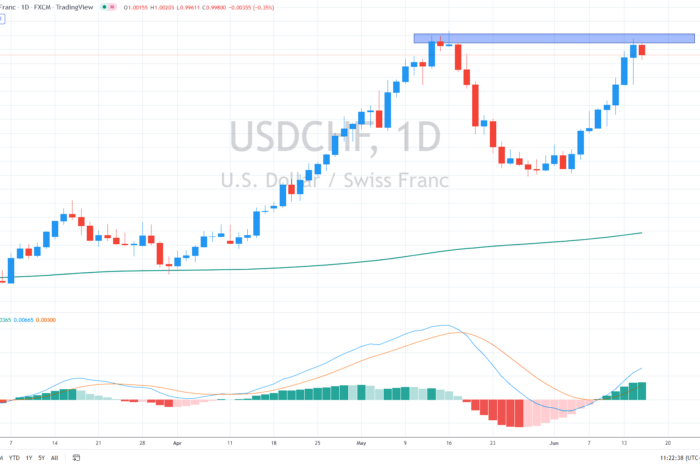

Double top pattern?

Another failure at the psychological level of 1.00 could be really bearish for the USD/CHF pair, especially as it looks like a double-top pattern. Thus, if today’s FOMC fails to boost the greenback, we might see a steeper sell-off.

The initial support could be at yesterday’s lows at 0.99, followed by another demand zone near 0.98.

Alternatively, in case of a bullish breakout above 1.00, the pair might rise further toward 1.05 in the medium term.

Comments

Post has no comment yet.