The Euro has rallied recently, pushing the EUR/USD pair above the 1.13 resistance, completely erasing all the losses suffered after the hawkish FOMC decision.

EU inflation still hot

The EU CPI came in above expectations, further supporting the view that inflation will not be transitory. Year-on-year inflation ticked higher to 5.1% in January, up from 4.8% in December, but above expectations of a decline to 4.4%. The core indicator eased slightly to 2.3% from 2.5%. The 5%+ reading in CPI is the highest level ever recorded during the euro area.

The single currency rose after the data, jumping some 0.35% during the EU session.

Later in the day, the US ADP employment report is due. According to this methodology, the US economy is seen creating only 207,000 new jobs in January, down sharply from 807,000 in December. So that could be another bearish impetus for the greenback.

The whole labor market data are due on Friday, with the non-farm payrolls numbers expected to come out at 150,000, less than 199,000 in December. As a result, the unemployment rate will likely stay at 3.9%.

Dollar seems overbought

Although the divergence in monetary policies between the Fed and ECB is massive, it looks like we could have seen the top in both the US yields and dollar, possibly leading to a short squeeze rally in the EUR/USD pair.

The ECB meets tomorrow, and the official consensus is for no changes in monetary policy, still repeating the exact phrase that inflation is temporary.

On the other hand, the fundamental situation still vastly favors the USD over the euro. The ING presented the same analysis.

“We see mostly downside risks for the pair as the hawkish bar has been set higher after the strong German CPI numbers on Monday, and we expect President Lagarde to keep showing patience on inflation and tightening.” economists at ING said on Wednesday.

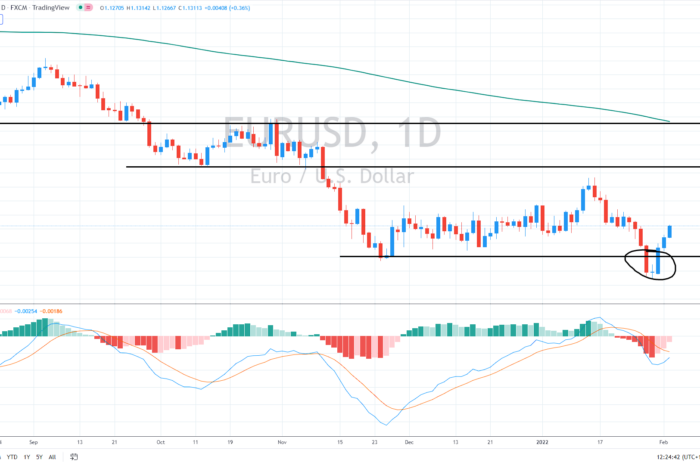

Daily chart looks bullish

The recent drop below the critical support of 1.12 destroyed all the stop-losses. However, it was followed by a strong surge above that level, thus resulting in a bearish trap. That is usually a bullish reversal formation.

The short-term outlook seems bullish since the euro has already climbed above the resistance level at 1.13, likely targeting the 1.1380 selling area.

Alternatively, should the pair drop back below 1.1280, we might see a decline toward 1.12.

Comments