The dollar registered minor gains on Thursday with the release of data indicating that the US job market remained tight and confirming that the country’s economy returned in the third quarter at a faster-than-expected rate after declining in the first half of the year.

US data eyed

According to the latest readings of the Gross Domestic Product (GDP), the US economy increased at an annualized rate of 3.2% in the third quarter, compared to 2.9% in the prior estimate.

Another interesting topic: Holidays are coming – when are markets open?

In order to get inflation under control, it appears that the Federal Reserve will have to continue its vigorous monetary policy tightening for longer than originally anticipated.

“Americans have been through a tough few years, but I am optimistic about our country’s economic prospects,” US President Joe Biden reflects on the state of the economy in an op-ed for Yahoo News

Later today, the Federal Reserve’s favored inflation indicator, the US Core Personal Consumption Expenditure (PCE) – Price Index, will join the monthly Durable Goods Orders to deliver one final burst of market activity before the holiday-related lull.

Forecasts indicate that the US Core PCE Price Index will remain constant at 0.2% month-over-month. Nonetheless, the Annualized estimates indicate weaker values of 4.7% YoY compared to earlier readings of 5.0%. In addition, US Durable Goods Orders might decline by 0.6% in November compared to the prior gain of 1.1%.

Geopolitical problems remain

Elsewhere, investors continue to be concerned about the economic headwinds caused by the increase in COVID-19 cases in China. Aside from this, geopolitical uncertainties have been feeding recession fears, which might lead to some dollar inflows.

You can also read: FedEx defends gains after encouraging earnings report

In reality, Russia stated on Wednesday that there is no possibility of peace negotiations and that the continuation of Western countries’ weaponry supply to Ukraine will worsen the existing conflict.

In Europe, Vice-President of the European Central Bank (ECB) Luis de Guindos stated on Thursday that we should anticipate this rate of interest rate hikes to continue for some time, saying that increases of 50 basis points may become the new norm in the near term.

“If we do nothing, the situation will be worse because inflation is one of the factors behind the current recession. We have no choice but to act,” he added

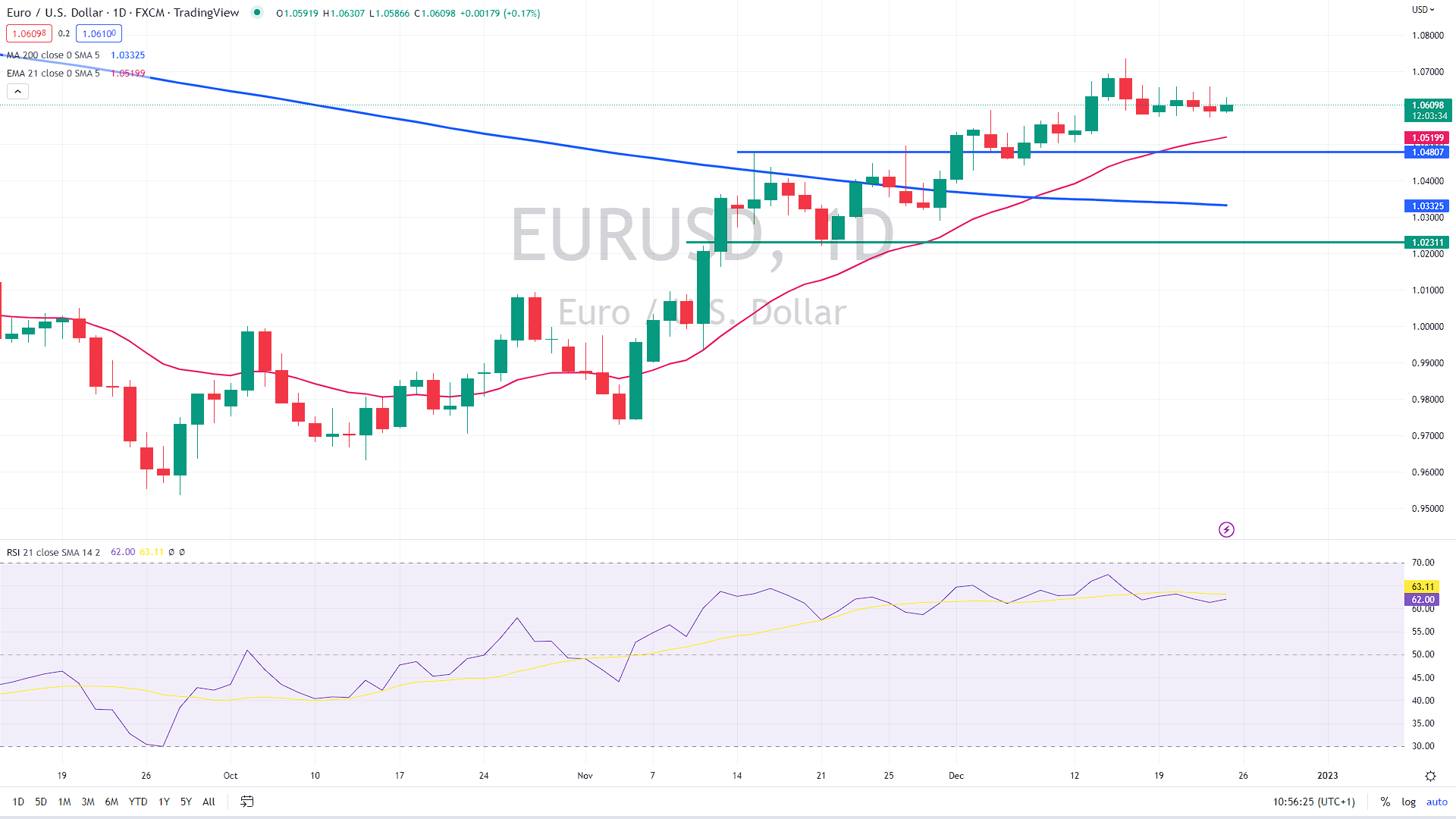

The medium-term uptrend remains intact as long as EUR/USD trades above previous highs of 1.0480. Other supports are spotted at 1.033 (the 200-day moving average) and near 1.023. On the upside, the resistance is expected at December highs of 1.0750 and above that at the 1.08 level.

EURUSD daily chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.