The most traded currency pair in the world continued in its short-term downtrend today, falling toward the 1.07 threshold.

Meanwhile, industrial production in Germany declined 3.1% monthly in December, a decline from the 0.2% gain reported in the previous month. Additionally, Germany reported a decrease in December Factory Orders of 10.1% yearly, which was far worse than projected.

You may also read: What is S&P 500 Index?

Moreover, retail sales in the Euro Zone dropped 2.7% month-over-month and 2.8% year-over-year in January. The results weakened the Euro on Monday.

Hawkish Powell again?

So far today, major currency pairs were subdued in preparation for Powell’s speech at the Economic Club of Washington DC, scheduled for later in the day. After stronger-than-expected nonfarm payrolls figures lifted the dollar and Treasury rates last week, all eyes will be on the Fed Chair’s comments on inflation and monetary policy.

“Since last Friday, (when) the U.S. reported a stronger than expected jobs number, this has reversed expectations that the Fed would pivot in its monetary policy,” said Tina Teng, market analyst at CMC Markets.

There are currently limited reasons for the Fed to alter its existing policy. Therefore, central bank governor Jay Powell is anticipated to sound more hawkish during today’s Economic Club of Washington speech, which might provide more support for the dollar.

“As the market is maintaining its rate cut expectations for the Fed and as the ECB is also likely to sound hawkish, the scope for lower levels in EUR/USD is limited – unless, of course, there are further (positive) economic surprises,” economists at Commerzbank maintained their bullish stance.

In the US macro calendar, the Balance of Trade results for December is planned, followed by the Consumer Credit Change and M. Barr’s speech.

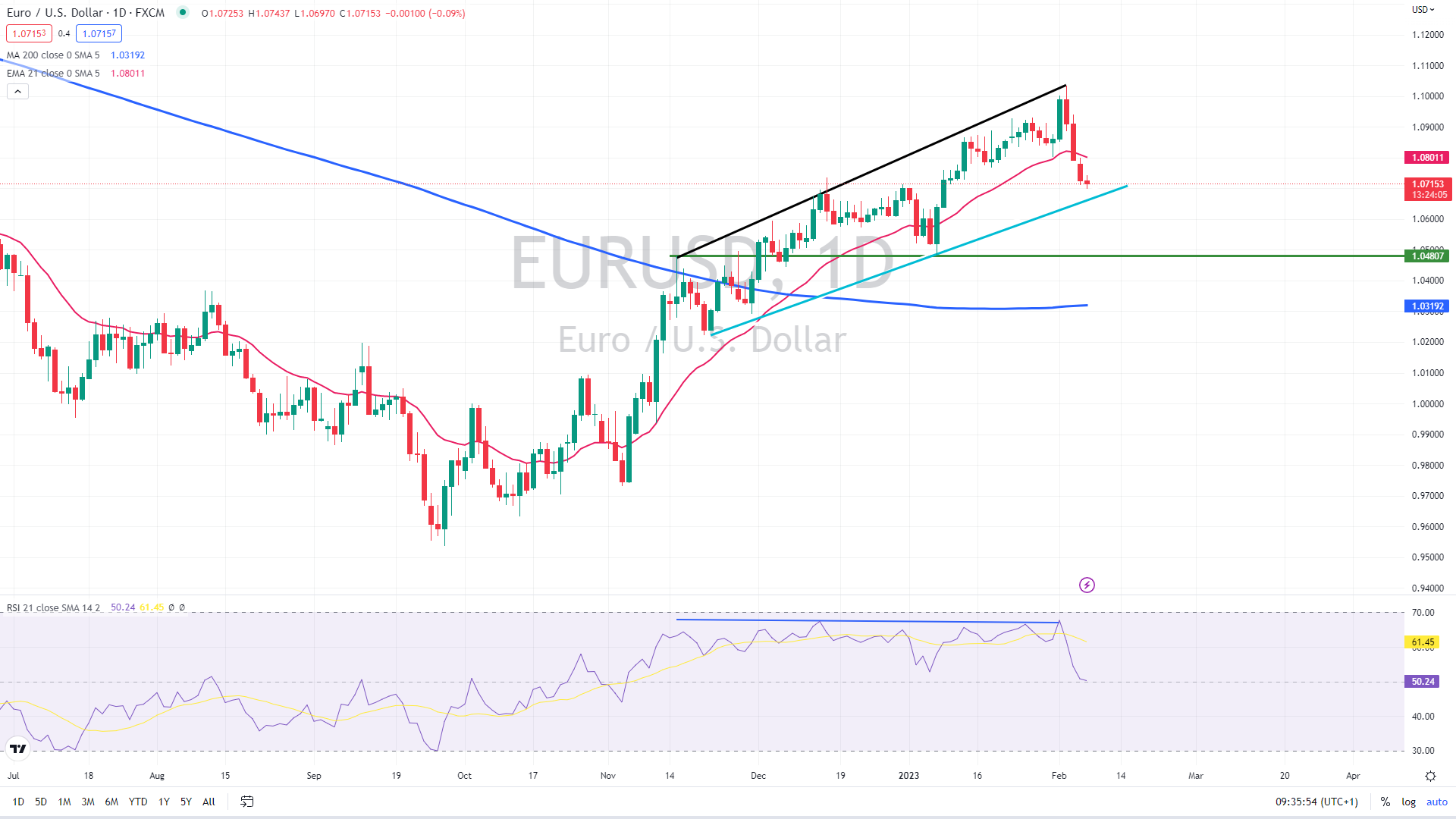

Bearish divergence kicks in

Technically speaking, the euro is down for the fourth consecutive day, dropping toward the 1.07 level. As previously mentioned, the negative divergence between the price and the RSI indicator finally stopped the bullish momentum and led to a correction.

The following support is expected at the uptrend line near 1.067. If not held, the euro could decline toward 1.06. On the upside, the resistance will be at 1.08. As long as the pair trades below it, the immediate outlook seems bearish.

EUR/USD daily chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.