The greenback kicked off the new year with massive gains, pushing the EUR/USD pair more than 1% lower on Tuesday, despite a rally in commodities and US equity indices.

Global outlook deteriorates

Investors remain concerned about the contradicting implications of China’s opening up and the return of COVID-19 cases, as well as the possible impact on Europe, given the significance of this export market to the region’s largest corporations.

The Chinese Caixin Manufacturing Purchasing Managers Index fell to 49.0 in December, according to data from a private poll issued earlier on Tuesday. This was the fifth consecutive month that Chinese manufacturing activity contracted.

You can also read: Gold awaits fresh data to move- where will inflation send it?

This is a decline from the previous month’s value of 49.4 and the fifth consecutive month that the manufacturing PMI has been in the contraction zone.

Meanwhile, Zhao Chenxin, Deputy Director of China’s National Development and Reform Commission (NDRC), stated earlier in the day, “China’s challenges in 2022 were worse than expected, but the economy will recover in 2023.”

Furthermore, IMF Managing Director Kristalina Georgieva stated on Sunday that the United States, Europe, and China, the primary engines of global development, were all declining at the same time, making 2023 a more difficult year for the world economy than 2022.

German inflation expected to ease

From other news, Germany’s Unemployment Rate decreased to 5.5% in December, while the Unemployment Change decreased by 13,000 compared to forecasts of +15,000. All eyes are now on the German inflation statistics as a source of new trade momentum, due later in the day.

North Rhine-Westphalia, the most populous and economically productive state in Germany, reported that annual inflation decreased to 8.7% in December from 10.4% in November and a peak of 11% in October.

Key US data ahead

From the US dollar perspective, the manufacturing PMI for December is likely to indicate that the sector remains in contractionary territory.

However, the majority of attention will be focused on the Federal Reserve’s minutes on Wednesday and US employment statistics later in the week to determine the initial outlook for interest rates in the new year.

Another interesting topic: How to become a better investor in 2023

The Federal Reserve hiked interest rates by 50 basis points last month, a smaller increase than the four straight 75 basis point raises before. However, the Fed has indicated that it may need to maintain rates up for a longer period of time to combat inflation.

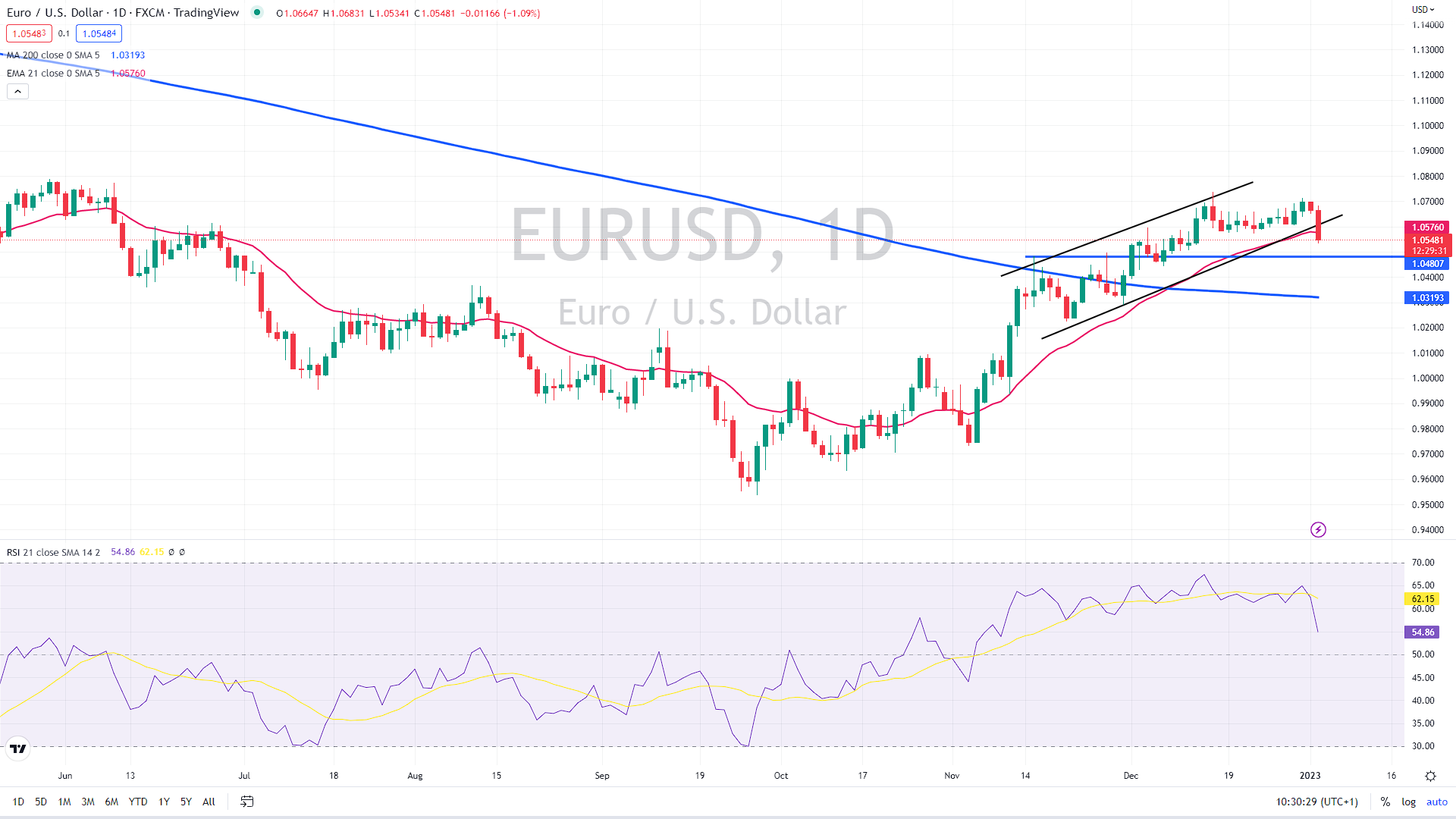

Technically speaking, the euro fell below the short-term uptrend line, ending the bullish outlook. The next support is expected at previous highs near 1.048, or possibly at the 200-day moving average (the blue line) at 1.0320.

EURUSD daily chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.