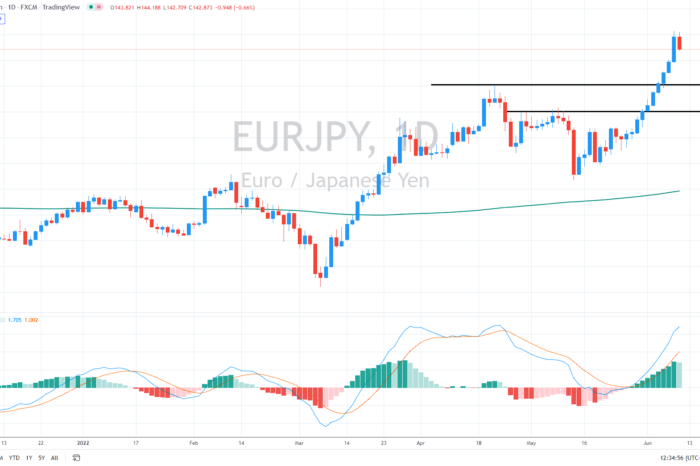

The euro continued to strengthen against the Japanese yen, bolstered mainly by the bleeding JPY, pushing the EUR/JPY cross above 143 for the first time since January 2015.

All eyes on ECB

With the emphasis on the ECB’s monetary policy meeting later in the afternoon, the euro traded cautiously and was flat against the USD, and slightly lower against the JPY. The central bank is generally anticipated to declare the end of large-scale asset purchases soon, clearing the way for the first interest rate hike in almost a decade next month to tackle rising inflation.

Last month, ECB President Christine Lagarde announced a plan to end the central bank’s ultra-accommodative monetary policy, saying that the minus 0.5% deposit rate would begin to rise in July and could be at zero or “slightly above” by the end of September, before rising further “towards the neutral rate.”

Therefore, investors do not expect any rate hikes today, but clear signaling that the central bank will start hiking rates very soon. At what pace, remains a mystery.

“President Lagarde is unlikely to explicitly indicate 50 bps is coming but will Lagarde be in a position to explicitly exclude it? We doubt it and if that is the case, the rates market may well move to fully price 50 bps. That implies further upside scope for market rates and the euro.” analysts at MUFG said today.

Markets are pricing in a total tightening of 130 basis points by the end of the year, implying a 50 basis point rise at one of the four remaining meetings – after the June one.

“While we cannot exclude a hawkish surprise, we see a greater risk that President Lagarde will stick to her recently outlined plan for 25 bp hikes in July and September, ultimately raising the risk of some dovish repricing across the EUR swap curve, implying further euro weakness” analysts at ING brought a different view ahead of the ECB decision.

The divergence between ECB and BoJ will likely continue in the following months, although the difference is much lighter than between the Fed and BoJ. Nevertheless, the uptrend in EUR/JPY might continue, thanks to the inactivity of the BoJ.

You may also read: India could allow exports of stranded wheat

Outlook remains bullish

The medium-term outlook still seems bullish, however, overbought conditions could lead to some profit-taking, similar to late April. Nevertheless, as long as the euro trades above 140, bulls are in charge, trying to push the cross above 145.

Alternatively, if the price declines below 140, we might see a more significant drop, most likely toward 138.

Comments

Post has no comment yet.