Traders decided to sell the recent rally in the US dollar, dragging the dollar index down by half a percent on Thursday as the medium-term trend remains negative for the US currency.

Meanwhile, the dollar’s price movement continues to reflect the ongoing disagreement between the Fed’s policymakers’ persistently hawkish narrative and the markets’ forecasts of an end in the present tightening cycle.

Fed’s rhetoric remains hawkish

John Williams, president of the New York Fed, stated at a Wall Street Journal event that moving to a federal funds rate between 5.00% and 5.25% “appears to be a pretty plausible perspective of what we’ll have to do this year to reduce supply and demand imbalances.”

Williams’s remarks followed Chair Jerome Powell’s reiteration of the term “disinflation” on Tuesday when he repeated his interest rate outlook.

The Fed increased the fed funds target range by 0,25% to 4.50-4.75% range last Wednesday. Furthermore, the Fed funds rate is expected to peak slightly above 5.1% in July and then decline to 4.8% by the end of the year, according to the interest rates derivatives market.

“We think markets may feel relatively comfortable with the current pricing for a 5.15% peak rate for now, even though risks are skewed towards another 10bp of tightening being added into the curve,” analysts at ING said in a note.

This suggests that the dollar’s upward correction may have more room to run, but it is unlikely that this will transform into a sustainable USD rally at this time.

You may also like: Alphabet experiences second largest daily market cap loss ever

The US economic calendar will include the regular weekly Initial Jobless Claims data, while investors will remain focused on the central bank’s governor speeches.

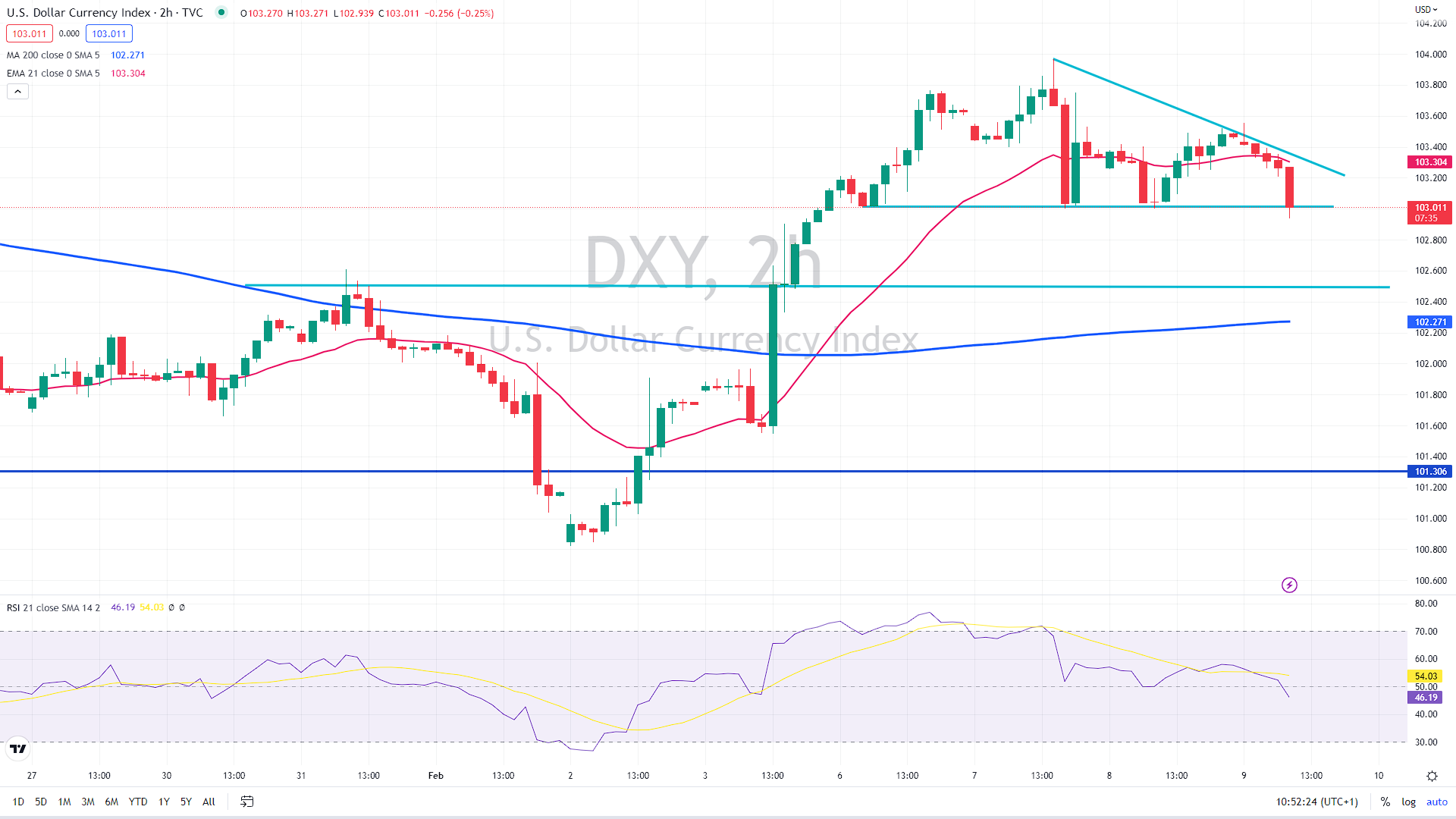

Support to be taken out

The dollar index is testing its strong support line of previous lows near 103, and it looks like the selling pressure will drag the index below that level. In that scenario, stop losses of long positions will be triggered, likely sending the DXY to another support zone near 102.45.

On the upside, the resistance will be at the short-term downtrend line, currently near 103.20, and if the index accelerates higher, it might jump toward the previous swing highs in the 103.70 area.

Dollar index 2h chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.