The world of decentralized finance (DeFi) experienced a massive increase in popularity and usability in 2020 and 2021. Due to community support, dozens of new and exciting projects have been added to DeFi, many of them coming to the forefront.

One of the most important categories in the world of DeFi is decentralized exchanges (DEX), which aim to create better trading options for cryptocurrency investors. The largest, most popular, and also most used DEX exchange is Uniswap, which we will discuss in this article.

History

The founder of Uniswap is Hayden Adams, who published the whitepaper of Uniswap on his Twitter account on November 2, 2018. This exchange is unique mainly because it was able to get among the top projects without ICO or any other form of fundraising. Financial support did not come until 2019, when Paradigm Capital invested $1 million in the project.

Then in August 2020, private investors led by Andreessen Horowitz joined with approximately $11 million. Meanwhile, on May 18, 2020, a new version of Uniswap was released, an upgrade to Uniswap v2, which brought more robust security and solutions to problems with oracle and flash loan hacks, which caused significant losses in the DeFi world.

Related article: What is Decentralized Finance (DeFi)?

The functionality and simplicity of the user interface of the entire platform have also been improved. There are two other significant events in the history of the Uniswap exchange. One of them happened at the beginning of September 2020, when after a very successful year in terms of the increase in Total Value Locked (TVL), this Uniswap statistic suddenly began to decline.

The reason was simple. The fork of the Uniswap exchange, called SushiSwap, was launched and used so-called “vampire tactics” to profit from the popularity of the Uniswap exchange. In short, the DeFi exchange SushiSwap, created only at the end of August 2020, copied almost everything from the Uniswap exchange and thus represented an automated market maker exchange.

SushiSwap vs Uniswap, source: link

However, it added to this system a governance token, SUSHI, which suddenly represented a financial reward for those who moved their liquidity from the Uniswap exchange to SushiSwap. Sushiswap simply changed its user interface, adding financial incentives for users to move their liquidity from Uniswap to Sushiswap. It brought the TVL of that exchange from zero to $1.42 billion in less than a week.

By contrast, Uniswap lost most of its liquidity in this move, with TVL falling from $1.82 billion to about $400 million. If the Uniswap exchange did not want to lose all of its liquidity, it had to take a major step. Therefore, Uniswap launched a governance token, UNI, which levelled the scales with projects such as SushiSwap, and added a financial incentive for users to return liquidity to Uniswap, which again increased TVL and pool liquidity.

How Uniswap works

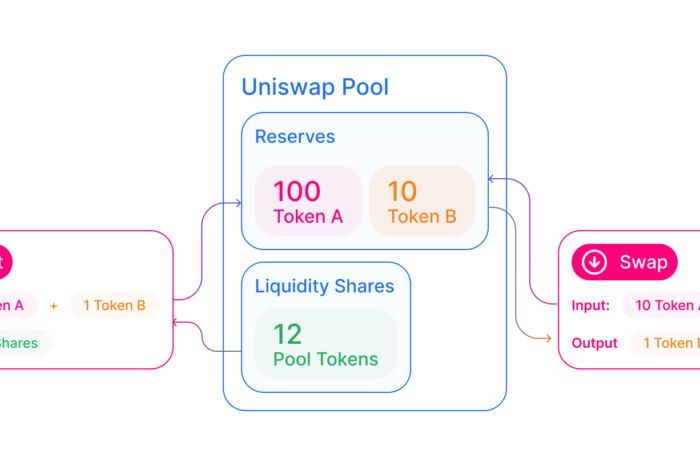

Uniswap is a decentralized, automated market making exchange built on Ethereum that provides liquidity through so-called liquidity pools (LPs), in which users can exchange their ERC-20 tokens between two different assets. These can be converted to a given exchange via a Web 3 wallet such as MetaMask, Coinbase Wallet, Formatic, Portis or Wallet Connect.

At the same time, Uniswap works entirely differently from traditional centralized exchanges. The main reason is the removal of order books, which the Constant product market maker model replaced. It allows the use of liquidity in the selected pool (representing a trading pair) and adjusts the price either up or down based on the relative size of the pool.

Read more: Crypto adoption increases – investors need to stay vigilant

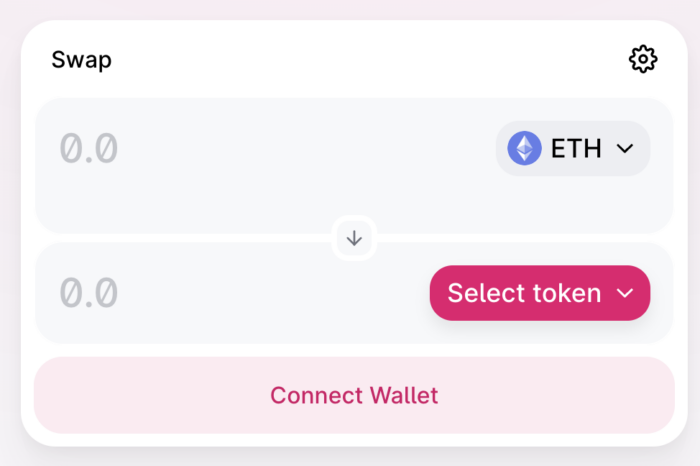

In this way, it is also guaranteed that the pool will never lose its liquidity. Simply put, when trading on Uniswap, you just choose the cryptocurrency you want to exchange (e.g., sell ETH) for the cryptocurrency you want to get (e.g., buy USDT), and Uniswap will do it for you at market value. Of course, it will also show in advance the expected number of tokens you will receive.

At this point, it must be said that this is only an estimated number because there can be a slippage (difference in the amount between entering the trade and executing the trade), price impact, and, of course, deducting the fee, all of which can expect the amount you entered. Therefore, before each trade/exchange on Uniswap, it is necessary to look at the following orders (according to the example).

How Uniswap works, source: link

Minimum received (2,203 USDT): a guarantee of the smallest number of tokens you will receive if the price of the token you selected moves against you at the time of your trade. Suppose you are not willing to accept the lowest number of tokens you will receive for a given trade. In that case, you should not proceed, because even though the possibility of receiving the minimum amount of your chosen token is small, it may occur due to slippage.

Liquidity provider fee (0.000021 ETH): approximately 0.25% to 0.3% of the transaction.

Price Impact (<0.01%): in the case of small pool liquidity, your trade may “move the price” of the token you have to receive, which means that its price will move up, so you may get fewer tokens as originally estimated. Price impact depends on the amount you enter but also on the amount of liquidity of the pool.

It is also true that the more significant the price impact of your trade, the greater the chance of obtaining a lower number of tokens. For example, a price impact of <0.01% is very small, so a price impact should not occur.

Slippage tolerance (0.5%): protects you from receiving too few tokens of your choice. In the case of a small slippage tolerance, it can cause the transaction to be cancelled.

Transaction deadline (20 minutes): is responsible for ensuring that the transaction is completed within the time limit. If this does not happen, it will be rejected, and you will get back the cryptocurrency you used.

Providing liquidity through LP

Exchanging ERC-20 tokens is not the only functionality that Uniswap offers. The second way to use Uniswap is to provide liquidity to one of the pools, for which the liquidity provider can obtain fees from the given pools. When providing liquidity to a pool, it is essential that the dollar value of the two tokens provided – for example, ETH and PAX – is the same.

Once a person provides liquidity, he receives so-called “Liquidity tokens,” which they can exchange back at any time for his original tokens. “Liquidity tokens” only serve as a confirmation of the provision of liquidity while also allowing the liquidity provider to see any increase or decrease in the value of the assets, but no loss should be made in dollar value (therefore, the same value should be entered in both assets at the beginning).

Liquidity pools also provide an exciting opportunity to make money through various liquidity strategies. For example, if you believe that a specific trading pair has the potential to be more traded in the future, you can provide liquidity to it. If your estimate comes true, a higher number of transactions means a higher number of transaction fees, which means higher fees that are redistributed among liquidity providers.

However, you should also be aware that the higher the liquidity, the smaller the share of the given LP you own and the smaller the share of transaction fees you will receive. The logic behind the model that Uniswap uses is simple.

The higher the liquidity, the smaller the slippage, and the price of pair of tokens is fairer, the higher the interest in this currency pair should be, means a larger number of trades and thus an increase in the total trading fees of the pair, and that causes higher earnings for liquidity providers, who will be motivated to provide it in other LPs as well. In this way, Uniswap seeks to encourage the provision of liquidity.

Advantages of Uniswap exchange

First mover advantage: Uniswap is the largest and most well-known name in the DEX world, with daily transaction volumes comparable to leading CEX exchanges. Compared to other DEX exchanges, it is one step ahead, with Curve Finance and Sushiswap keeping pace with this exchange as much as possible.

Noncustodial: Unlike centralized exchanges, Uniswap and DeFi are based on the fact that ownership and responsibility for tokens lie solely with their holders. This prevents the trader’s funds from being frozen or lost through a hack. However, in the case of Uniswap, you are still solely responsible for your keys.

No KYC: know-your-customer often encounters resistance in the cryptocurrency world, which is why Uniswap is also for those who do not want to verify themselves on exchanges and try to maintain privacy. No passport, ID, or other identity document verification is needed.

It also eliminates the possibility of stealing or disclosing details about you, which happened in mid-December 2020, when the Ledger hack led to the disclosure of 270,000 home addresses and 1 million email addresses to Ledger’s clients. This is not the case with Uniswap.

Easy access to new cryptocurrencies: because Uniswap is decentralized, there is no approval or selection process to decide which crypto will be listed. New cryptocurrencies are therefore included here relatively quickly, which makes Uniswap interesting due to its offer, especially of smaller low cap tokens.

Low fees: Uniswap also has lower fees, as is the case with centralized exchanges. Here, of course, it mainly depends on which stock exchanges and in which volumes you trade, but with fees of approximately 0.3% of the trade, Uniswap is one of the cheaper ones.

Very simple UI: unlike its predecessor, such as EtherDelta, Uniswap is one of the market’s simplest and most transparent exchanges in terms of a visual interface. No order books, complicated shop settings and the like. Just a simple and clear entry of two tokens you want to exchange or provide liquidity to the LP you desire.

Disadvantages of Uniswap exchange

Lots of scams: easy access to new cryptocurrencies is one of the advantages, but it can also be seen from a negative point of view. Since theoretically any ERC-20 token can get to Uniswap, a lot of scams and fake cryptocurrencies can get there too.

That is why when buying cryptocurrencies, which are only on Uniswap, it is necessary to look for more about them and make your investment obligation in a thorough review of the project.

Transaction failure: This is also one of the problems that can occur on Uniswap. These can occur, for example, with a low gas fee, which was not profitable for the miner, and thus the transaction was not processed.

Moreover, a problem could occur with a lack of liquidity in LPs, which would again lead to non-processed transactions. However, this is primarily a problem with tiny tokens with low liquidity and is relatively unlikely to happen with a larger pair.

Regulators: a disadvantage for the future may also be regulators who may try to outlaw the use of Uniswap, as the user or trader does not need to go through KYC. The US authorities have problems with this, but no one can rule out the possibility that regulators will not exert greater pressure on the KYC from Europe or Asia.

Even if that happened, Uniswap and the use of any token governance would have to be completely outlawed, as banning a decentralized exchange would be more than difficult.

Conclusion

The Uniswap exchange, with its UNI token, is one of the flagships of DeFi. This DEX has helped boost DeFi, helped with its security and functionality, and has built up great community support in the process. Although it has a few disadvantages, if the DeFi world grows, it is very likely that the use and popularity of the Uniswap exchange will also grow.

Comments

Post has no comment yet.