The nuclear deal raises the pressure

The price of crude oil has been declining since the beginning of June. From the month’s top, the price fell 30.56%. A possible deal with Iran and west countries could allow the country to raise the supply of crude oil. A more extensive supply of oil could have a negative impact on the price of the commodity. For the last few days, the price went under 90$/barrel.

Read more: Germany’s dependence on China has increased

Crude oil’s volume levels of interest

The monthly VWAP indicator confirms the level of $90.48 as strong resistance. Support could be seen at the level of $87.74, which represents the 1st standard deviation, and lower at $85.66, the 2nd standard deviation.

30 minutes chart of CL (Crude Oil Futures), Monthly VWAP. Source: Author’s analysis

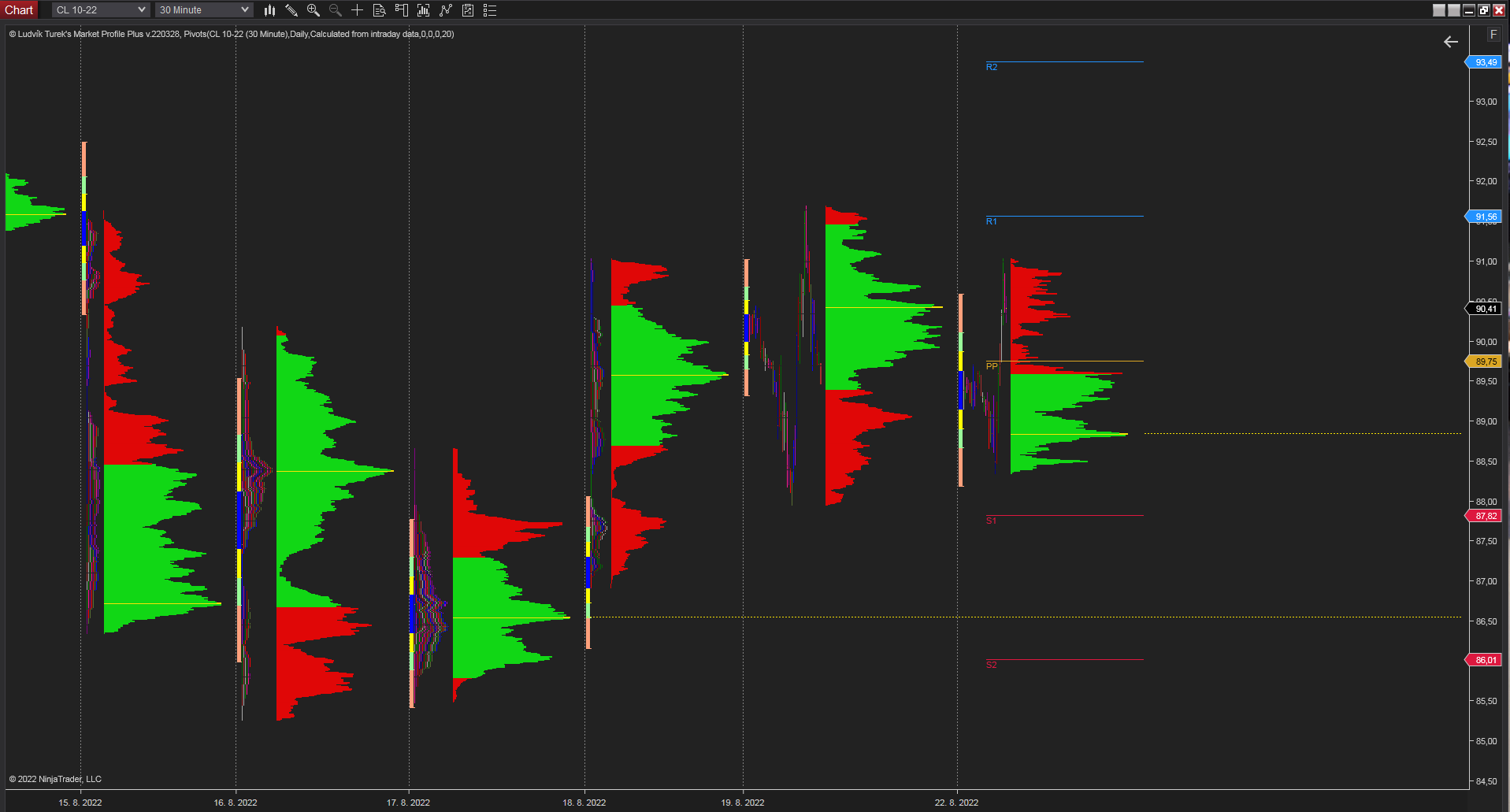

The daily Market profile shows the level $90.43 as the resistance level, which was fulfilled around mid-day. After the test of the level, the price is slightly down, and waiting for news from the industry. Support could be set by an untested POC (Point of Control) level from 17.08.2022 at the price $86.55.

30 minutes chart of CL, Daily Market Profile. Source: Author’s analysis

Biden, Europe, and Iran

Ongoing negotiations about a nuclear agreement could seem like a neverending story, but the market’s reaction keeps volatile. Every small step in this negotiation sparks a significant activity. It is essential to know that Iran is one of the top producers of crude oil in the world, and opening the taps could rapidly raise the supply in the world.

Therefore calling to “strengthen support for partners in the Middle East region” from Biden and European politicians signals willingness to make this deal happen.

Comments

Post has no comment yet.