Stuck around the $80 level

Crude oil fluctuates in a close range of $78-$83. US inventories rose less than expected and pointed to 533,000 barrels against the expected 3 million. Inventories data made some price move up and tested the closest resistance. On the other hand, this move was no big deal, the price went back down to $80.

Read more: Will oil stay above $80?

In the last 7 days, price volatility has been approximately 6.4%, but to the side. Uptrend from the beginning of the year stops and black gold is waiting for the next impulse. The fear of economic recession, especially in China where the demand for crude oil is enormous and has a big impact on its price development.

Where are the levels of interest?

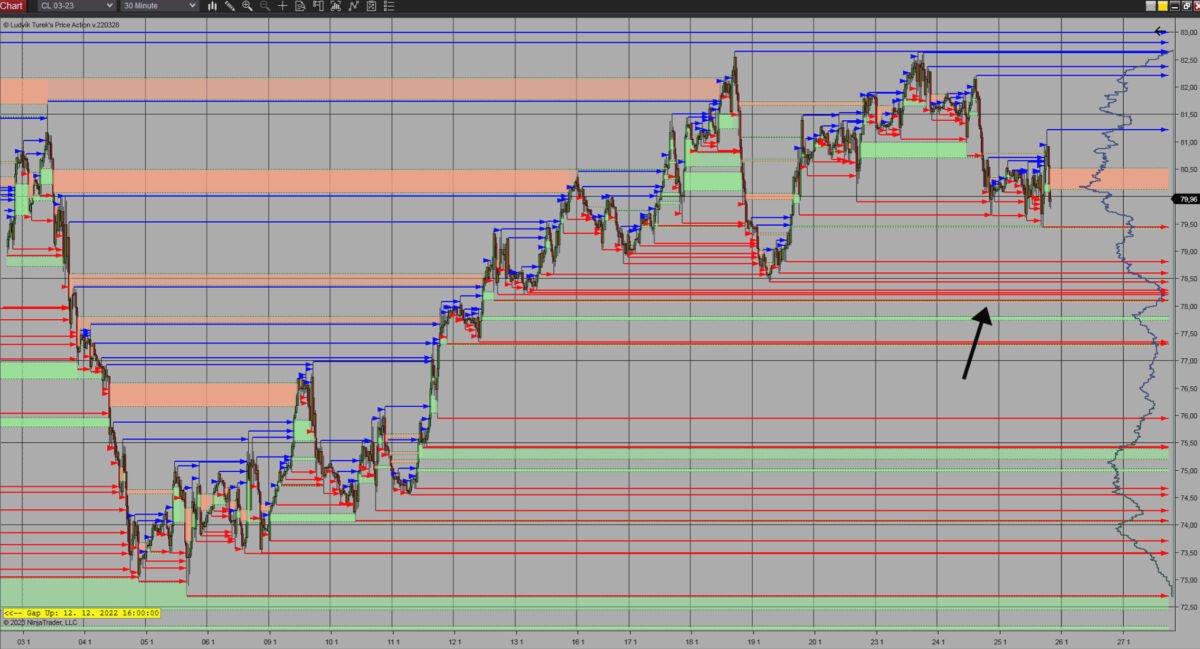

The crude oil is stuck around the level of $80. The development of the commodity’s price cooperates with VWAP (Volume Weighted Average Price) for the whole month. Especially in the last two weeks, the 1st standard deviation (orange developing line) of monthly VWAP has been reacted as support.

30 minutes chart of CL (Crude Oil Futures), Monthly Developing VWAP, source: author’s analysis

But with the side move from the last days, the price got under this level, and support changed to the resistance. The volume and price action point to a similar level of interest.

We also analyzed: Oil stays up as China celebrates a week of the Lunar New Year

This level of interest is set by monthly developing VWAP (yellow developing line – white arrow) which is on the price of $78.26 and price action activity where pivot lows cumulated in the close area of $78.10-$78.60. The cumulation of pivot lows is on the chart below market by red lines.

30 minutes chart of CL (Crude Oil Futures), Price action and pivot lows source: Aathor’s analysis

Fed rate decision

The question is, will oil stay above $80? Fundamental signals are mixed, but big macro data will come next week. The Fed rate decision will be announced at a scheduled meeting on the 1st of February. But there is still no specific answer if the Fed will stay hawkish or change to dovishness.

Higher rates or talking about another rate hike – hawkish rhetoric – can be mirrored into a stronger dollar and vice versa.

Comments

Post has no comment yet.