High prices

The shock to the commodity prices was significant, but those prices have not appreciated equally. There is a difference among sectors of commodities, like those which are literally affected by war, and those which are not. Good example is precious and industrial metals sector.

A rule of thumb about precious metals is that, in the time of uncertainty gold or silver prices rise. If we apply this rule to the latest circumstances, we can say that price rose, on the other hand, the comparison among other commodities or commodity index showed more interesting data.

Comparison among commodities

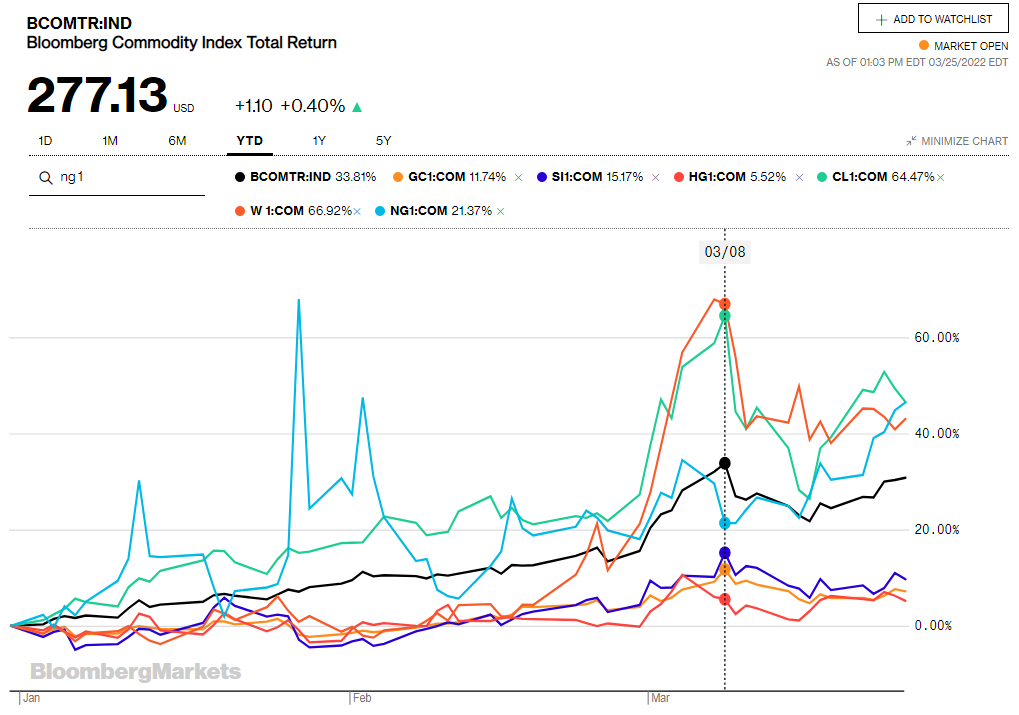

On the chart bellow are compared several commodities and Bloomberg commodity index, BCOMTR. Black line is “benchmark” BCOM index, second sector consists of precious and industrial metals as Gold (gold line), Silver (silver line), Copper (red line), energy sector has CL (WTI futures green line) and natural gas (blue line), and the last sector is agricultural represented by wheat (orange line).

Comparison of commodity prices and BCOM index, Source: Bloomberg.com

A year-to-date (YTD) appreciation we can see that precious and industrial metals are losers, even in the peak when the shock was imminent, they did not do any stronger up move. Gold has appreciated from YTD to the peak at the beginning of the March +11,73%, while Oil and Wheat gained +64,47% and +66,92%. In addition, BCOM index gained +33.81%.

So, the question is: “Can we play by precious metal´s rule-book these days?” Especially in the time, when the most influential central bank, Fed, wants to raise the interest rates?

More about Fed decision affection to gold: Gold affected by Fed´s Powell statement

Where is all the attention?

Energy sector hit the record prices, because of oil and gas pipelines, which are going from Russia to Western Europe. The old continent is dependent on the energy from Russia, therefore biggest danger for economic stability and the hardest negotiations and potential sanctions are around the energy sector. Additionally, Ukraine is one of the biggest global wheat producers and agricultural sector is seriously in danger thanks to the war. Therefore oil, wheat and gas gained the most.

We talked more about this topic: Tough time for farmers

Comments