EU ban on Russian oil

Oil continues in price surge after EU ban on Russian oil, which are planned as part of sanctions toward this country. Crude oil opened this week at price 104$ with high at 111$ price tag. The news about possible EU ban on Russian oil until the end of this year shook the markets. Week’s volatility is about 11%. This fundament can not be considered as the only price influencing factor, but it is very important.

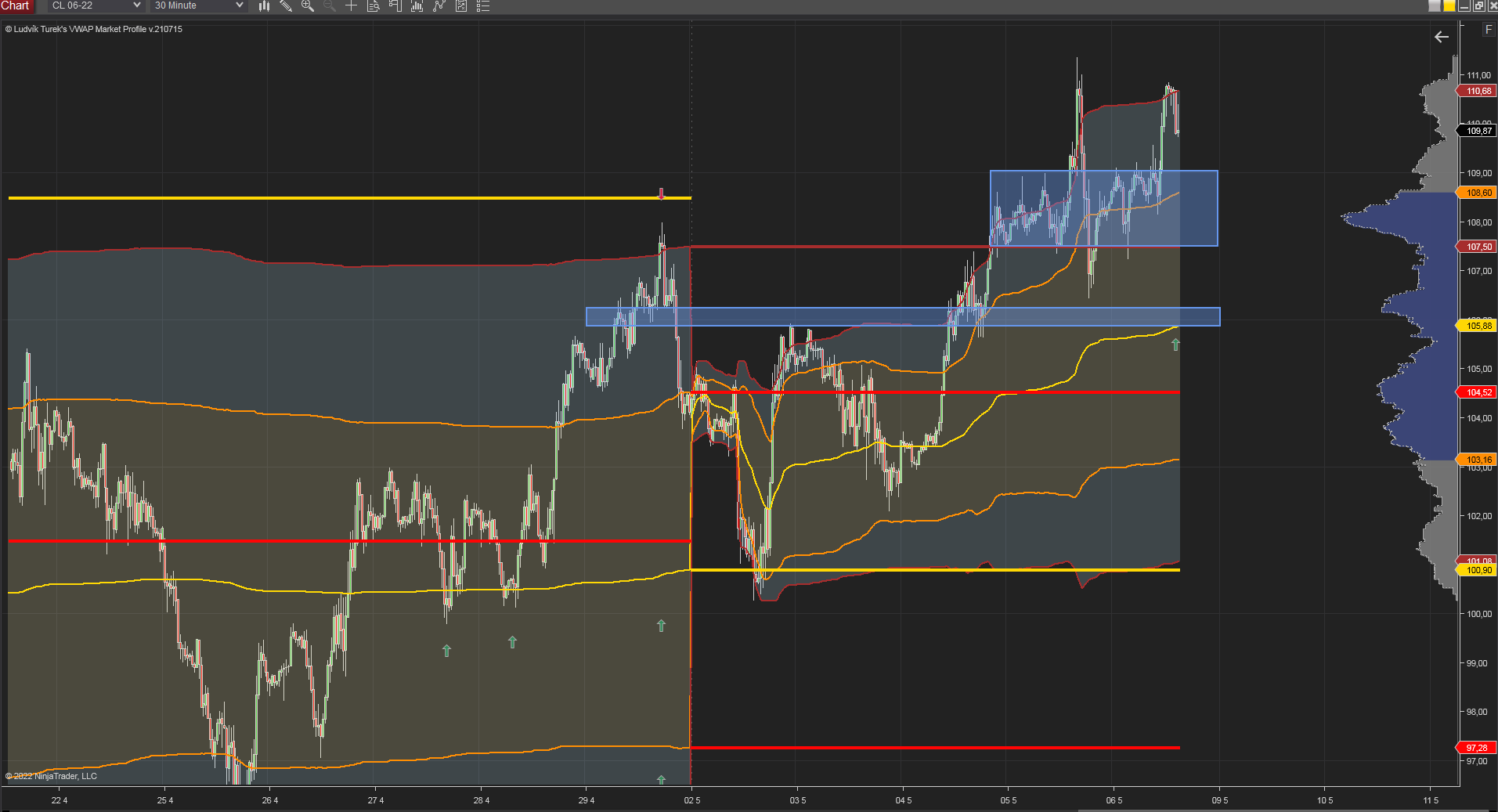

30 minutes chart of CL, Week’s volatility. Source: tradingview.com

Russia needs to find new market

It is important to understand that the ambition to cut off Russia from gaining finances as the part of the sanctions has other, darker side. Closing pipes for Russian oil could cause deficiency of this commodity in Europe, and markets evaluated this in the price of black gold. Eleven percent in a week shows enormous volatility, and we can not say where the price could go. But the scenario of higher prices are widely considered as possible.

We have informed about this topic: EU wants to ban Russian oil imports by the end of the year

Exceptions on the table

Exceptions are negotiated for countries of EU with high dependence on oil and gas from Russia, such as Hungary, Slovakia and Czech Republic. Based on Bloomberg, all of these countries asked for exemption from the ban, where year 2024 is considered. Moreover, Hungary asked for exemption for the next 5 years. Rest of the countries have to end their import until the end of this year. Moreover, Reuters wrote that Slovakia and Hungary received 96% respectively 58% of crude oil and oil products imports in 2021 from Druzhba pipeline.

You may be also interest in: USD/JPY recovers from FOMC induced losses

Volume chart

Chart analysis shows, predominantly, supports. Despite the volatility, resistance areas are very hard to determine. There are several levels we mentioned before as previous resistance around 108$, but during this week it has been broken toward 111$. Next support lays at 105.87$ as yellow line (developing monthly VWAP). Market profile shows 106.25$, so support area could be 105.87- 106.25.

30 minutes chart of CL, Monthly VWAP. Source: Author’s analysis

Comments

Post has no comment yet.