Crude oil gains

War is here. Russia invaded Ukraine and volatility in the markets is increasing. Right after the beginning of invasion of Russian troops to Ukraine, price of crude oil ascended to the new highs. Futures of WTI topped 100.55 USD per barrel. Ascending price is nothing new, we could see it for past weeks and months, but during the few hours of conflict, price jumped 8.69%.

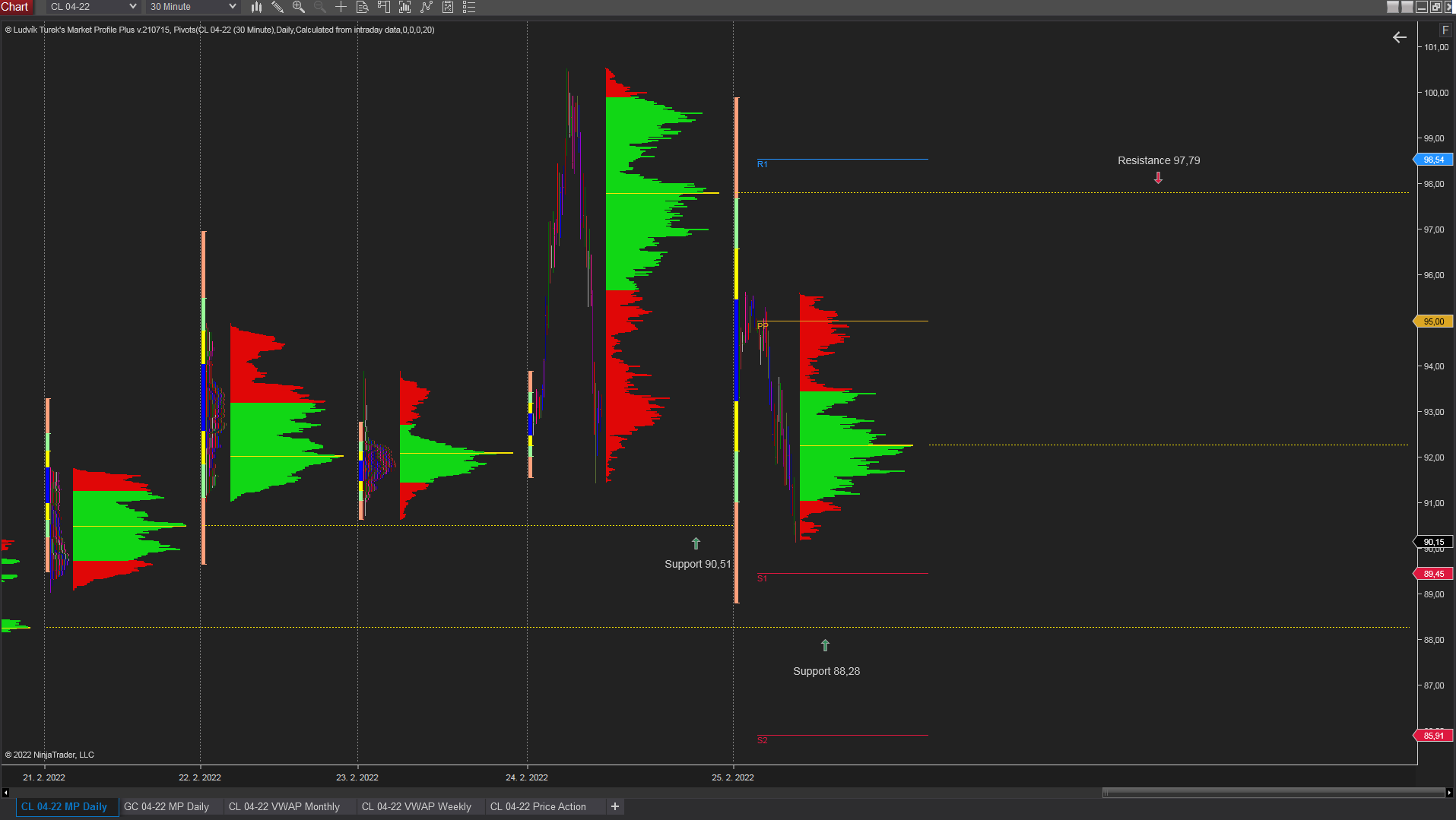

30 minutes chart of CL futures (WTI futures), Source: Author`s analysis, Tradingview.com

There is a but

One would say that this is not the end of all gains. But, despite all theories about commodity appreciation, crude oil is decreasing. And rapidly. During the same day the war started, and commodity hit the top, price plummeted, and gave up all the gains.

Thursday, after the initial price gain, ended just slightly in green numbers. Friday brought another decline. In the time of writing this article, around 17:00 (GMT+1), price of crude oil is -1.83% . Sum it all up, WTI plummeted 9.71% from the top.

30 minutes chart of CL (WTI futures), Source: Author`s analysis, Tradingview.com

NATO stays on borders

European leaders and U.S. hit Russia with sanctions. Measures are coming, but this is probably not the reason of price fall. NATO members made it clear, that they will not operate in Ukraine with any military units. In translation, there will be no more escalation from other countries in this war conflict. And traders, vividly, made easy equation. No bigger conflict means no higher price.

Technical analysis

Technical analysis in condition of high volatility is not always quite accurate. Predominantly in these days. Despite this, daily market profile shows support levels on 90.51 USD and 88.28 USD per barrel. But initial balance at the open of the last day of the week is enormous. Which means, that price course is uncertain. Moreover, monthly VWAP line (yellow) confirms support level on 90.62 USD. That means support area could be 90.62-90.51. Next support at 88.28 USD. On the other hand, resistance level is at 93.40 and 97.79 USD.

30 minutes chart of CL (WTI futures) Daily market profile, Source: Author`s analysis

30 minutes chart of CL (WTI futures) Daily market profile, Source: Author`s analysis

Weekend is coming

Do not forget, weekend is coming. Markets will be closed, and any action in war conflict could affect the price of any commodities, FX pairs or stocks. Data shows extreme volatility. As we can see on WTI development mentioned above, rulebook of how markets should work, does not work at all. Especially in the time of open war conflict in Europe.

Comments