It is appropriate to say that sentiment for the markets is unpleasant. And not just for stocks or crypto. Commodities evaporated gains in June at a quick pace. Last month was hard throughout all of commodities. The pressure of deepening fear of the economic slowdown and recession is high and is seen in the charts.

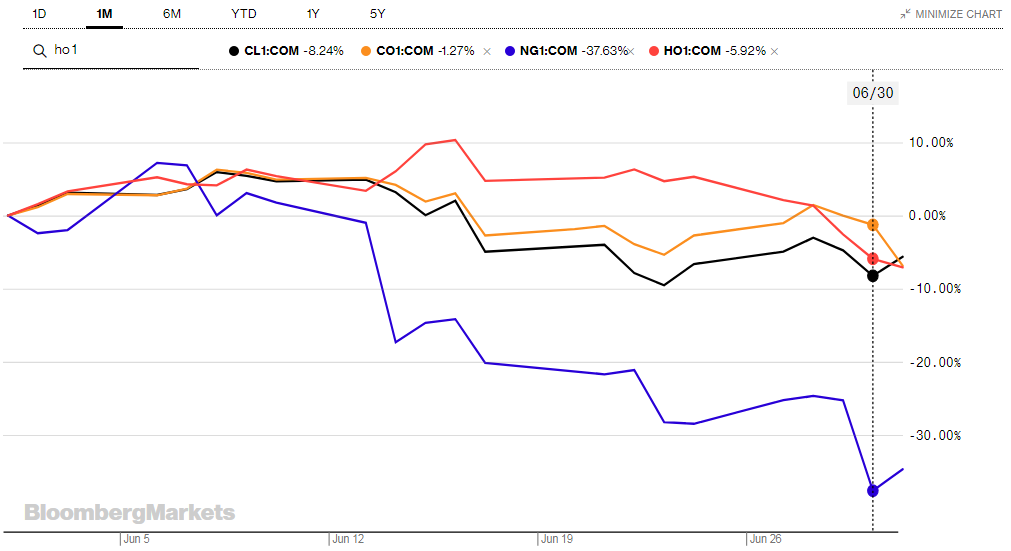

Energy sector with losses

The energy sector brings, surprisingly, a decline. CL1 (WTI futures) erased -8.24% and CO1 (Brent crude futures) -1.27%, but the most mentioned Natural gas erased -37.63%. Heating oil futures HO1 was down -5.92%. These numbers can not be seen as good. And the question “what is going on here” is in the right place. For example, crude oil futures are not as straight-lined as they might be.

The Organization of Petroleum Exporting Countries can not achieve an agreement for an oil production increase with its allies. The highest pressure is from the side of the USA, since the president Biden will travel to the Middle East to urge an increase in supply. Turbulence is from other allies and members as well, which want to raise their production or even start to sell the products. These were tapped during the Covid pandemic and waiting for the better shape of the global economy.

We have informed about this topic: OPEC+ will not change oil production policy

The performance of the energy sector in June. Source: bloomberg.com

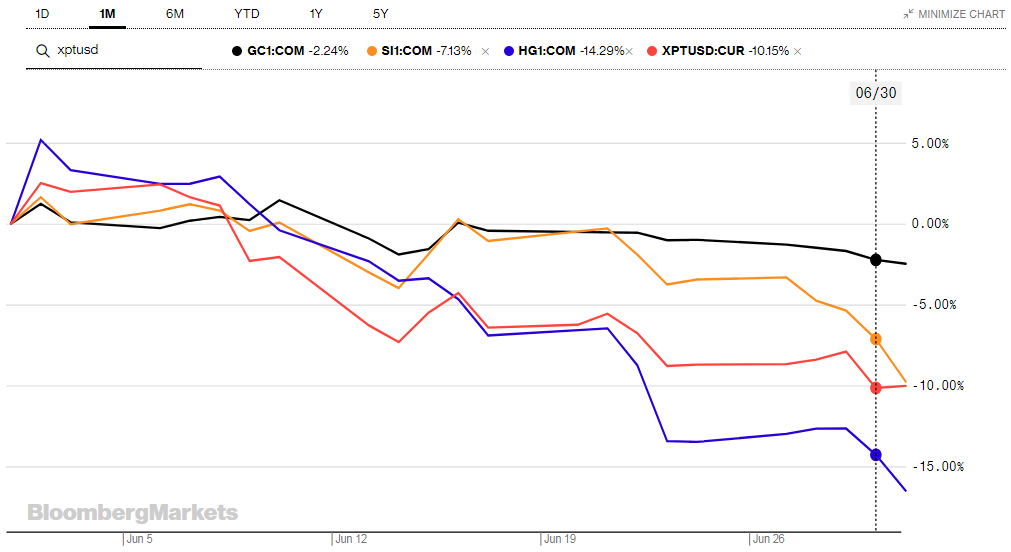

Precious and industrial metals not doing any better

Metals ended last month in red as well. Gold futures GC1 erased -2.24%, but today is another -0.72% down. The sentiment of higher inflation is not favourable for the yellow metal, because it is a not an interest-bearing financial asset. This means financial assets with interest are more competitive to fight inflation. Silver has been more aggressive and was -7.13% for June. Moreover, today it is another -3.89% down.

The biggest decline was seen with Copper by -14.29%, and today it is another -3.45% lower. Copper is very closely attached to the global economy and sentiment for the last two years is not kind to this industrial metal. Moreover, analysis shows that copper will face, an approximately 10% surplus in the next two years. This means that economic slowdown and recession are not what the copper industry wants.

We analysed also: Gazprom shares fall after dividend cancellation

The performance of the Precious and Industrial Metals. Source: bloomberg.com

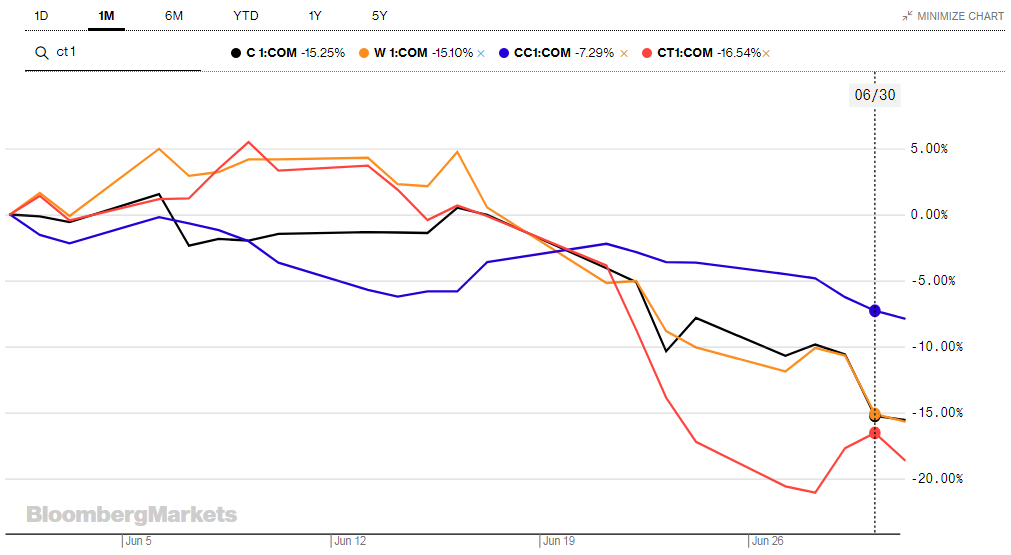

Can agriculture deliver?

Corn, wheat, cotton, and cocoa settled in red numbers as well. Surprisingly, wheat erased -15.10%, even after Russia blocked Ukrainian docks and stole the Ukrainian harvest of grain. Let’s not forget that the performance of wheat from the beginning of the year is above +15%. But the top was around +67.89%. Corn was -15.25%, Cocoa -7.29%, and Cotton -16.54%. Despite the fact of war, the fear of recession and economic slowdown affects grain as well.

The performance of the Agriculture sector. Source: bloomberg.com

Comments

Post has no comment yet.