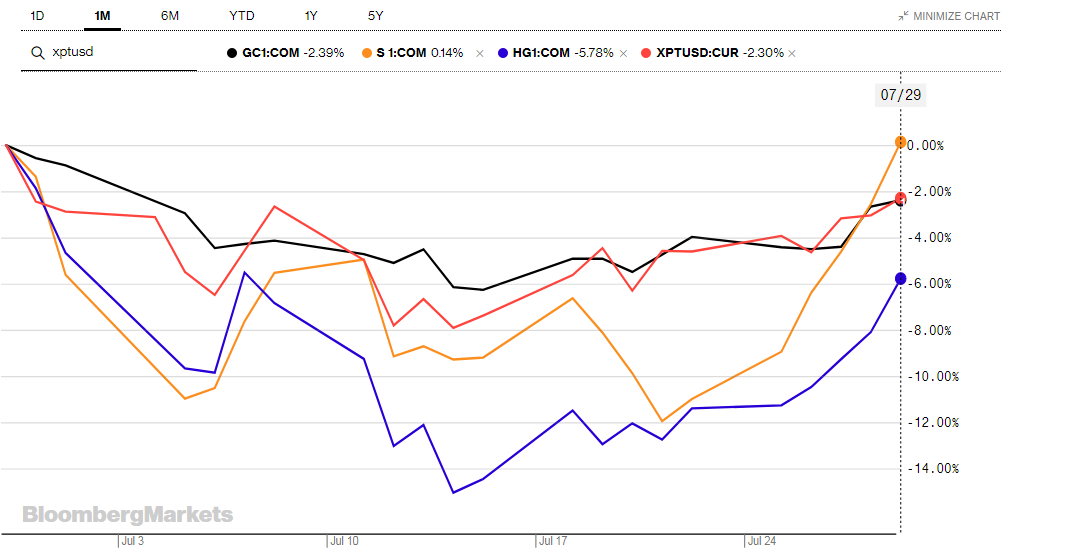

Precious and industrial metals

Metals have a very turbulent month on their shoulders. The first half of July was critical for precious and industrial metals. Gold erased -6.27%, Silver -12.12%, Copper -15.05% and Platinum -7.91%. The main driver for this sector was fear of inflation in the USA and the Fed rate decision. Scepticism and depression from the rising inflation rate were in place not just in the US but worldwide. Copper had the biggest dip in prices. It is very attached to the global economy and any stumble in the industry is seen in the metal’s price.

The performance of the Precious and Industrial Metals. Source: bloomberg.com

But the last few days of the month were kind to this sector and all watched metals gained. Despite the fact that the US GDP declined a second quarter in a row, which is technically a recession, Fed’s comments helped the situation. The mood was radically improved after Fed’s chair Powell commented at a press conference after the rate decision. He pointed out that the next rate hike does not have to be so radical as the last one. Depends on data from the next months. That pours optimism into the markets.

Related: Fed raises interest rates by 75 basis points

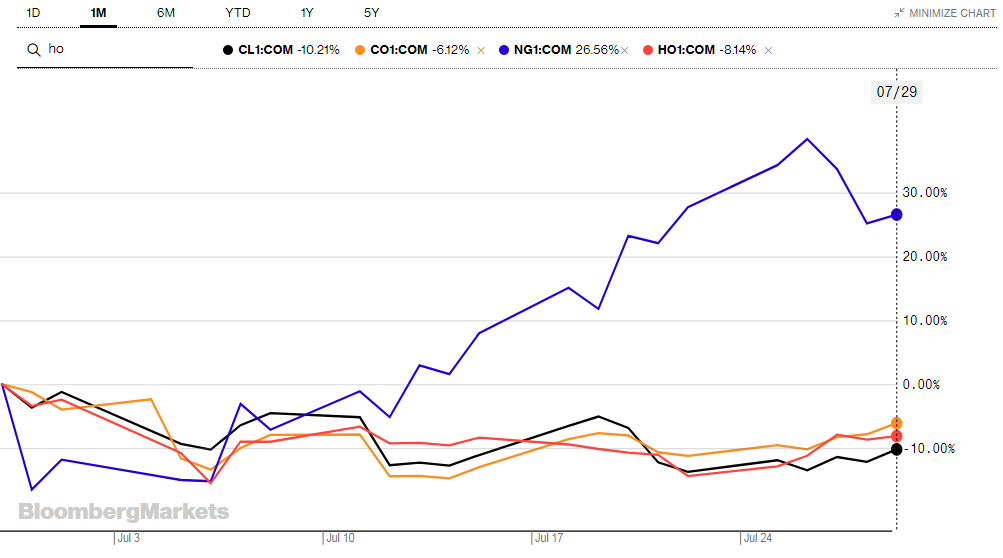

Energy sector

It is clearly seen that natural gas is the winner of the month in the energy sector. A war between Russia and Ukraine sparks the price moves. And natural gas is the main actor. This commodity is a key factor for Europe and Russia uses it as leverage. Europe needs to find other sources to fulfil its needs. All leads to the higher prices for gas. The end of the month shows +26.56% for futures NG1.

The performance of the energy sector in June. Source: bloomberg.com

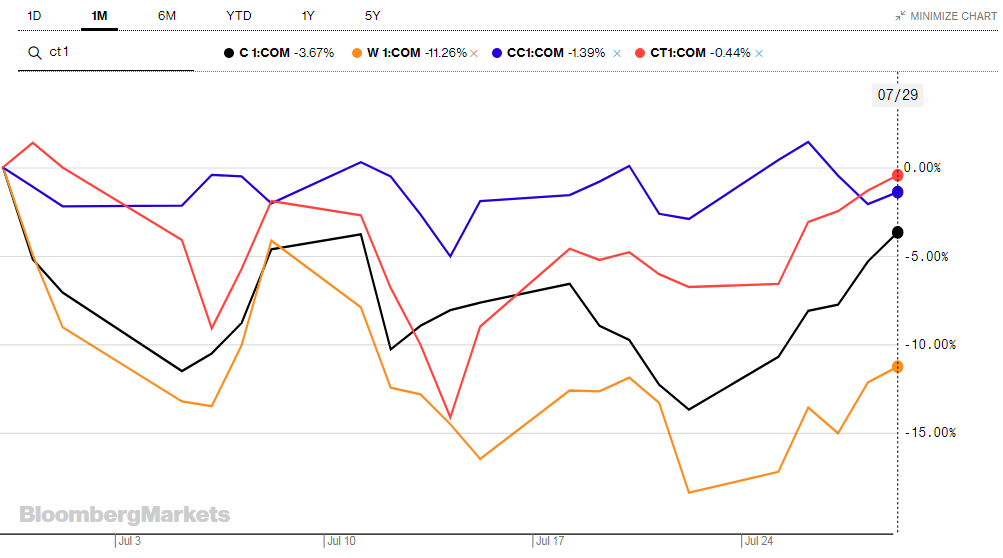

Agricultural sector

Corn (black line) started the month with a decline -13.69%, Cotton erased -14.13%, Wheat -18.39% and Cocoa -5.03%. All commodities except wheat, found support and went back up, close to zero percentual change. Which is a significant recovery, primarily for Cotton with -0.44% at the end of the month. Wheat is watched very closely, because of the exports from Ukraine. The country belongs to the main world exporters of wheat. Latest news show a possible break of lockdown on Ukraine’s docks, so the export of the commodity could start in several days or weeks. Now markets are waiting for any sign from this side of the world, and the price of wheat could interact immediately.

You may be also interested in: Gazprom will shut down another turbine at Nord Stream 1

The performance of the Agriculture sector. Source: bloomberg.com

Technical recession

A quarter to quarter GDP of the US has declined second time in a row. Technically, it is a recession. In the time of recession, central bank could change the monetary policy to help the economy out of it. Moreover, the comments of Powell and Yellen indicate an effort to elude from naming it. Despite this, it shows a possibility that the next rate hike could be less aggressive than the last one. This pours an optimism to the metals as non-interest financial assets. Gold gained +3.9% after the Fed decision.

Comments

Post has no comment yet.