Commodity currency

Firstly, every commodity has its denomination currency. The most common currency used as counterpart is USD, but the list of other currencies is long. Despite the fact in which currency is commodity traded, development of specific currency is also important. For example, oil is predominantly affected by fundaments from energy industry, but if FED dramatically appreciates US dollar by monetary decision, oil goes down.

Therefore, it is more than appropriate to make analysis of both of counterparts, in our example, CL and USD. It could be quite a problem in case that there is open trade on oil, because you believe in up move, but you forgot that in the evening is Fed monetary decision, which poses big risk for this open trade.

Secondly, there exist “commodity currencies” or currencies with strongly positive correlation with specific commodities. Good example is Canadian dollar.

Read more about this topic: Gold/Silver correlation remains very positive

Canadian dollar

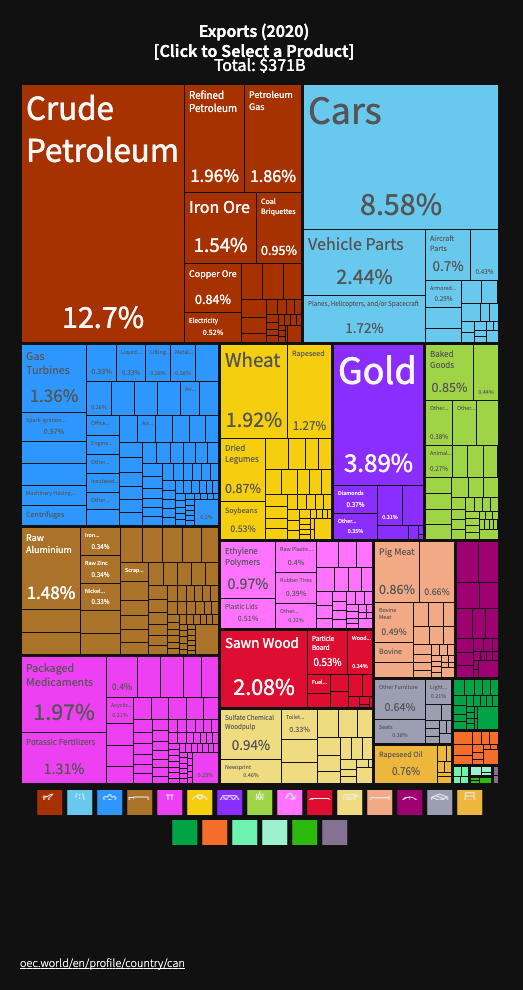

The Observatory of economic complexity stated that, in 2020, Canada exported a total of $371B, making it the number 12 exporter in the world. Canada’s export in 2020 was led by crude oil, representing 12.7%. This should be an important message for forex traders, because fundaments connected with crude oil (as the biggest exported asset of the country) affect Canadian dollar. The same applies to commodity traders, who need to check fundaments of denominated currency, when trading specific country and its currency.

Canada’s 2020 export in %. Source: oec.world

Correlation between CAD and Crude oil

In the charts below you can see correlation between main forex pair USD/CAD and other cross pairs vs. West Texas Oil (WTI). For all the time frames, ranging from 1 month to 1 year, correlation in all forex pairs remains very strong, therefore the move of Canadian dollar is statistically very similar to the move of crude oil’s price.

USD/CAD vs. WTI correlation. Source: oanda.com

CAD crosses vs. WTI correlation. Source: oanda.com

In the case of USD/CAD negative numbers, CAD is second in the pair, so if Canadian dollar evaluates, the pair goes south. On the other hand, other pairs in the chart have CAD at the first place, which means evaluation of currency brings up move.

Read also: China will cut reserve requirements for banks

In summary

In summary, the correlation between CAD and oil is highly positive in the longer time range, so if oil evaluates its price, data shows, there is approximately 80% probability that CAD could evaluate as well.

Comments

Post has no comment yet.