There was a lot of sweat in the crypto industry throughout 2022 and early 2023. With Bitcoin below $20,000, many mining companies found it difficult to produce adequate cash flows to pay their debts. For example, Core Scientific had already declared bankruptcy.

Bitcoin‘s ever-erratic price chose to go on a bull run in the first quarter of 2023, providing public miners with some much-needed breathing room as they faced the prospect of insolvency.

Bitcoin miners are back

Most Bitcoin mining stocks have seen huge increases as the rise has instilled confidence in the sector. As one of the worst-performing industries in 2022, Bitcoin mining stocks fell by an average of 80%-90%.

Related article: MicroStrategy’s $4 billion Bitcoin investment turns profitable

However, mining stock investors who had been licking their wounds from large losses saw their investments surge with the arrival of 2023. Bitcoin’s price increase by more than 80% so far this year explains why mining stocks are skyrocketing.

These equities have a high correlation to Bitcoin’s volatility but are far more volatile overall. This is because the stocks might have a market cap of $100 million or $500 million, but Bitcoin’s market cap is currently around $565 billion, thus less prone to volatility. Investors are taking advantage of this by utilizing these equities as leveraged, high-beta wagers on the price of Bitcoin.

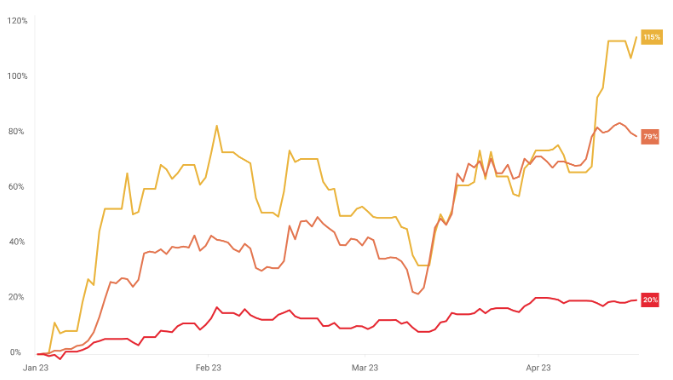

HI crypto mining index, performance YTD, source: hashrateindex.com

While Bitcoin is up about 80%, the index that tracks the performance of mining stocks returned around 115%. At the same time, Nasdaq is up 20%, well below the performance of the crypto industry.

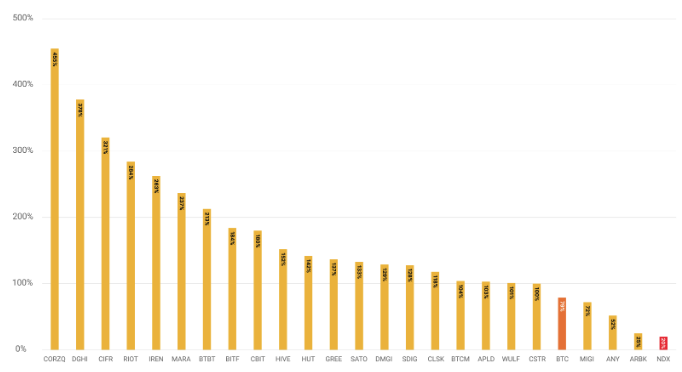

While the Bitcoin mining industry as a whole has had a fantastic year so far, individual stocks have varied greatly in their success. All of these increases are greater than the one on the Nasdaq. Contrarily, twenty of the twenty-three mining stocks beat Bitcoin. Look at the top performances and see who stands out.

Bitcoin mining stocks, performance YTD, source: hashrateindex.com

With a 455% increase, Core Scientific is the best-performing stock thus far this year. This is despite the fact it has officially declared bankruptcy. Its enormous debt load has boosted its equity throughout the 2023 bull market.

Read more: TOP 10 Bitcoin podcasts for beginners – who should you listen to?

Cipher, Riot, Digihost, and Iris Energy have also shown quite impressive results. Unlike Core Scientific, most of these businesses are substantially less financially leveraged due to their lower debt-to-equity ratios.

Final thoughts

The past performance of Bitcoin mining stocks has been positive, but future performance depends on several factors such as market sentiment, halving, and overall economic situation. Bitcoin miners will do well as long as the uptrend continues, but the risk still prevails as Bitcoin is still far below the all-time high level.

The halving event in one year could help Bitcoin to get back its strong bullish momentum and rise to $100,000 or even more. Moreover, a green signal would also be when central banks finally start to lower interest rates.

Bitcoin weekly chart, source: tradingview.com

Comments

Post has no comment yet.