After the electronics retailer reported better-than-expected quarterly earnings, increased its sales estimate, and resumed its share repurchase program, Best Buy (BBY) is today’s best-performing stock in the S&P 500 index.

As of writing, the stock was trading more than 12% higher during the US session on Tuesday.

Better-than-expected, but still very weak earnings

Best Buy announced third quarter fiscal 2023 earnings per share (EPS) of $1.38 on $10.59 billion in revenue. Both exceeded experts’ predictions. According to FactSet’s survey of analysts, expectations were for EPS at $1.03 per share on sales of $10.31 billion. Best Buy’s profits fell 34% year over year while its revenues fell 11%.

On an annual basis, it was Best Buy’s fourth consecutive quarter of decreasing sales and profitability.

Related article: Tesla falls to 2-year lows amid more software issues

In the third quarter, all categories of Best Buy’s sales decreased. Home theater and computer equipment saw the most significant decreases.

Comparable store sales decreased by 10.5%, which was less than expected.

Despite “obviously being in a hard situation for our sector,” CEO Corie Barry claimed Best Buy excelled. She stated that despite consumers being squeezed by inflation, the business noticed “pretty constant behavior from our purchasing clients.”

According to Barry, Best Buy has “strategically and efficiently controlled our inventory flow” for the 2022 holiday season based on what it anticipates would be a more conventional buying pattern with solid demand on Black Friday, Cyber Monday, and the two weeks before Christmas.

Upgraded outlook

Due to its third-quarter performance, Best Buy has revised its full-year comparable sales projection to a 10% decrease, up from its previous guidance of an 11% decline. It has also increased its operating income rate forecast from 4% to 5%.

The business also said it had started buying back shares of stock again in November after stopping them in the second quarter. This year, it anticipates spending around $1 billion on share repurchases.

Citi reiterates its bearish view

On the other hand, following the release of the company’s earnings report on Tuesday morning, Citi analyst Steven Zaccone stated in a note to investors that “Near-term Best Buy’s same-store sales are still some of the worst in retail with Christmas volume a huge uncertainty.”

Thus, he remains bearish on the stock, saying investors should fade today’s rally (i.e., take profit from long positions or initiate new short positions).

Zaccone, who kept a Sell recommendation on Best Buy’s shares, believes that given the cautious nature of consumer spending in 2023, there is still an overlooked risk.

“Looking to next year, we still struggle with the EBIT [earnings before interest and taxes] margin trajectory as the top-line faces incremental pressure from a slowing consumer spending environment,” he wrote.

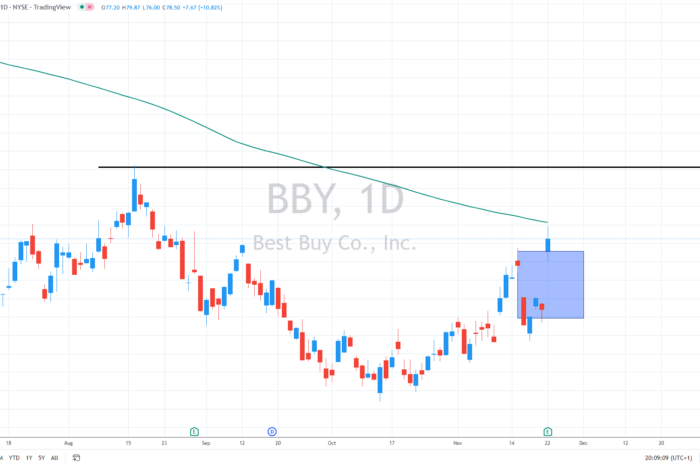

Approaching 200DMA

The stock price is quickly approaching the 200-day moving average, currently near $80. If it jumps above that level, we might see another leg higher, likely targeting August highs of $86 in the initial reaction.

Read more: Crypto outlook: Ethereum and Cardano heading south?

On the other hand, failure to break above that level might spur some profit-taking, possibly dragging the price to close the massive bullish gap, i.e. eyeing the $72 level.

Comments

Post has no comment yet.