Hindenburg Research has found another victim. After causing big trouble to the former third-richest man on the planet, Gautam Adani, Hindenburg is going after Jack Dorsey’s Block.

Hindenburg brought Adani Group down

Hindenburg Research is known for being a hardcore short seller, going after companies that they see as fraudulent. After diligent research, Hindenburg confirmed the opening of a short position on Adani Group’s stock in late January.

Related article: How to lose $60 billion in 5 days – the story of Gautam Adani

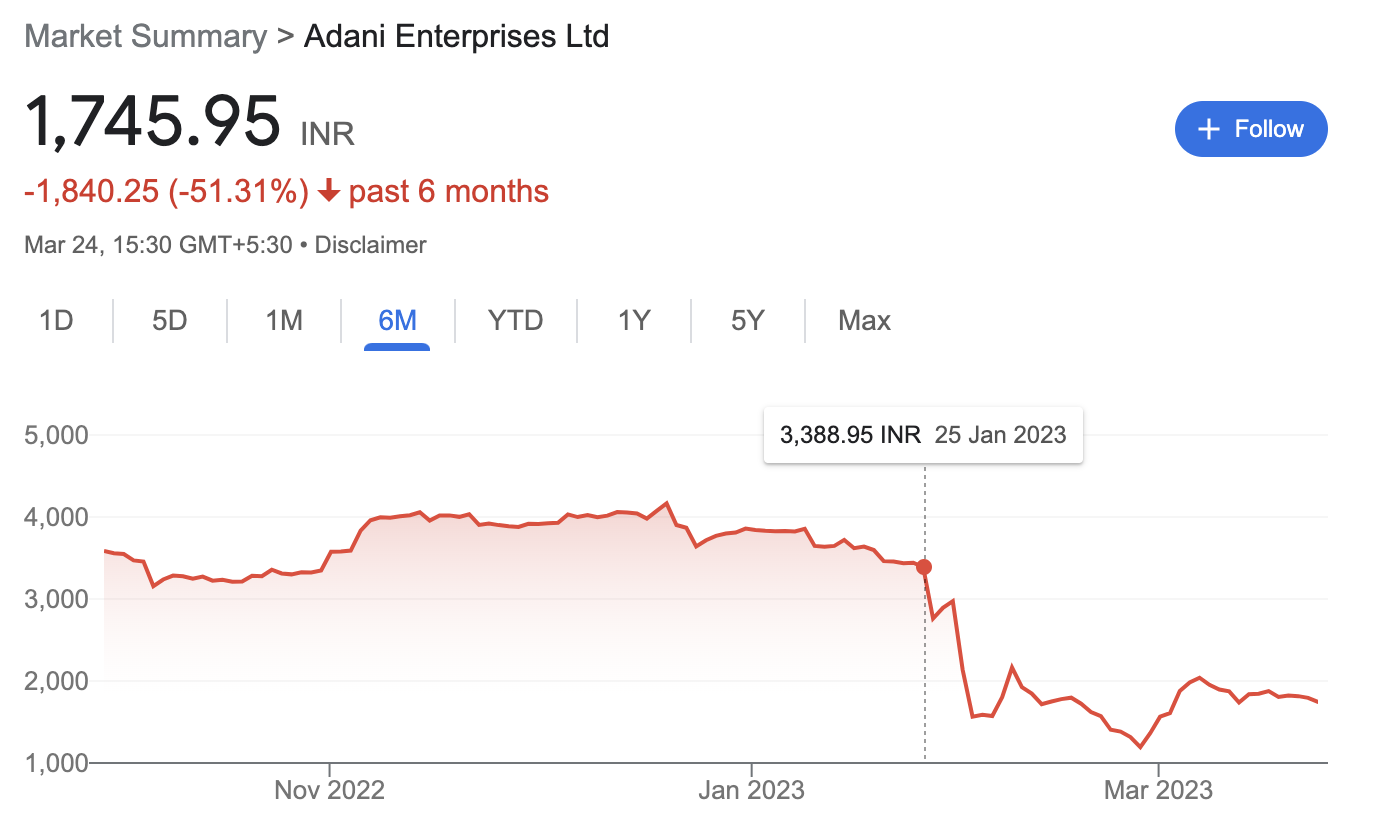

After the news got out, a huge selling pressure sent the stock down by more than 50% over the next couple of weeks. Hindenburg went against the formerly third-richest man on the planet and partially succeeded. The stock dropped from around 3,400 to 1,745 at the time of the writing. Is the same thing about to happen to Block?

Adani Group stock chart, source: google

Block as the next target

Block is an American company founded in 2009 by Jack Dorsey (Twitter founder) and Jim McKelvey. Block had a pretty successful run in the stock market, rising from approximately $10 in 2016 to $275 in August 2021, which was the company’s all-time high (ATH).

Since then, the stock had trouble finding a bullish momentum and Hindenburg is no help here. On Thursday morning, shares of Block, the company behind Cash App, dropped by 20% after short-seller Hindenburg released a scathing report.

Block stock chart, source: google

The report is accusing Jack Dorsey’s company of allowing fraudulent accounts that obscure criminals involved in illegal or illicit activities, such as the sex trafficking of minors. After two years of research, Hindenburg claims to have concluded that Block, the company behind Square, Weebly, Afterpay, and music streaming service Tidal, has deliberately taken advantage of the populations it claims to be aiding.

“Block enables fraud against customers and the government, escape regulation, dress up predatory loans and fees as a breakthrough technology, and mislead investors with inflated metrics,” claims the report.

According to the research, Block is governed like the “Wild West,” allowing criminals engaged in unlawful or immoral activities, including the sex trafficking of minors, to hide behind false accounts.

Read more: People made millions on Arbitrum airdrop – so why is ARB collapsing?

Block said the story was “factually false and deceptive” in a statement to CNN and that it plans to investigate legal options with the Securities and Exchange Commission (SEC) and take action against Hindenburg.

What’s next for Block?

If history repeats itself, Block could be looking at a 50% drop in its stock price. The sudden 20% price decrease started at $73 per stock, so it could easily plunge to approximately $36 in the next few weeks, which is the current low from a COVID crash that occurred three years ago.

Also read: US President’s Economic Report is wrong about crypto – here’s why

Hindenburg earned respect over time for doing very deep research on companies, which usually takes from one to three years. Now Block will have a lot of work to do to prove to its stockholders that this report is “deceptive.”

Block (SQ) stock chart, source: google.com

Comments

Post has no comment yet.