After severe losses in February, American stocks saw weekly gains. After a favorable month in February, the rebound in market confidence led to the dollar’s first weekly drop in a month.

Next week will be full of data

It might be a calm start to a week that will be filled with new data, interest rate decisions, and updated advice from central banks. The Reserve Bank of Australia will meet on Tuesday (a 25 basis point rate rise is anticipated) and the Bank of Canada will meet on Wednesday.

Fed chair Jerome Powell will speak to Congress on Tuesday and Wednesday. China will release its trade data on Tuesday, and inflation data on Thursday. The most important day will be Friday, when the Nonfarm payrolls report is released.

You may also like: Silvergate tanks almost 50% amid bankruptcy concerns

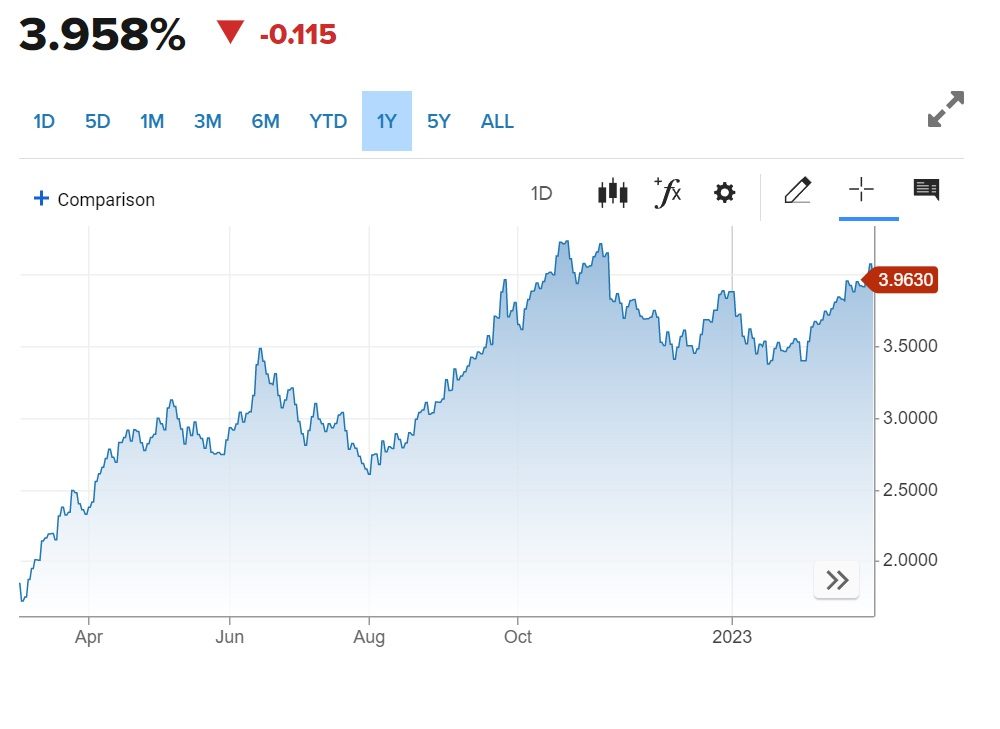

Bond rates retreated from decade-high levels. After recently reaching its top point since 2010, the 10-year Treasury yield fell down below the critical 4% mark.

US Treasury 10-year bond yield chart, source: CNBC.com

The S&P 500 rose 1.5%, while the Dow Jones rose 1.04% and the Nasdaq gained 1.9%. Tesla rose 3.6% Apple rallied 3.5% and after Meta announced it will cut prices of its VR headsets, it shot up more than 6%.

Dollar buyers retreat to take more risks

The US dollar index declined 0.4% allowing EUR/USD to achieve a slight, 0.38%, weekly increase. This was sufficient to mark its greatest result since January.

GBP/USD remains range-bound, supported around 1.1900, unable to reclaim 1.2000. Around 137.00, USD/JPY meets a formidable support, which seems to be unbreakable at the moment.

The weakening dollar and rising stocks helped the more risky assets like crude and natural gas. Also, with the help of the EIA’s revelation of record petroleum exports last week, crude prices increased about 2% on Friday, and more than 4% over the preceding week.

West Texas Intermediate ended at $79.68 a barrel in New York, up $1.52, or 1.9%, just slightly below the magical $80 mark. The weekly increase for the US crude benchmark was 4.4%.

Brent crude traded in London closed at $85.83, up $1.08, or 1.3%. The benchmark for global crude increased 3.7% for the week.

More to read: Gold aiming for the sky – will the rally last?

After a 2-and-a-half-month decline that sent prices below $2, natural gas futures increased by 23% this week to recover to the crucial $3 price level.

The April natural gas contract traded on the Henry Hub finished at $3.0090 per mmBtu, or metric million British thermal units. This is a increase of 24.4 cents, or 9%, on the day. It increased 55.8 cents during the week.

Comments

Post has no comment yet.